Insider Monkey has processed numerous 13F filings of hedge funds and successful investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the first quarter. You can find write-ups about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves and analyze what the smart money thinks of AquaVenture Holdings Limited (NYSE:WAAS) based on that data.

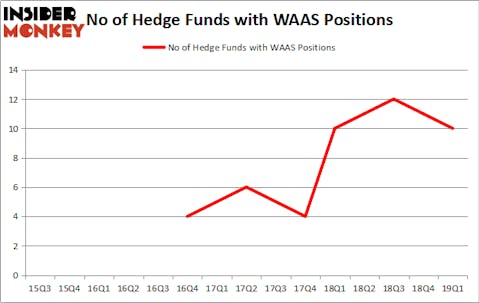

AquaVenture Holdings Limited (NYSE:WAAS) was in 10 hedge funds’ portfolios at the end of March. WAAS has experienced a decrease in hedge fund sentiment of late. There were 11 hedge funds in our database with WAAS positions at the end of the previous quarter. Our calculations also showed that WAAS isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Let’s analyze the key hedge fund action encompassing AquaVenture Holdings Limited (NYSE:WAAS).

What does smart money think about AquaVenture Holdings Limited (NYSE:WAAS)?

Heading into the second quarter of 2019, a total of 10 of the hedge funds tracked by Insider Monkey were long this stock, a change of -9% from the previous quarter. By comparison, 10 hedge funds held shares or bullish call options in WAAS a year ago. With hedge funds’ capital changing hands, there exists a select group of notable hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

More specifically, Renaissance Technologies was the largest shareholder of AquaVenture Holdings Limited (NYSE:WAAS), with a stake worth $8.6 million reported as of the end of March. Trailing Renaissance Technologies was Ardsley Partners, which amassed a stake valued at $6.2 million. Driehaus Capital, Private Capital Management, and Royce & Associates were also very fond of the stock, giving the stock large weights in their portfolios.

Due to the fact that AquaVenture Holdings Limited (NYSE:WAAS) has faced bearish sentiment from hedge fund managers, we can see that there exists a select few hedge funds that elected to cut their positions entirely by the end of the third quarter. Interestingly, Daniel Arbess’s Perella Weinberg Partners dumped the biggest position of all the hedgies tracked by Insider Monkey, worth about $2.1 million in stock, and Paul Marshall and Ian Wace’s Marshall Wace LLP was right behind this move, as the fund dumped about $0.3 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest was cut by 1 funds by the end of the third quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as AquaVenture Holdings Limited (NYSE:WAAS) but similarly valued. We will take a look at Kimball International Inc (NASDAQ:KBAL), Zymeworks Inc. (NYSE:ZYME), Rosetta Stone Inc (NYSE:RST), and e.l.f. Beauty, Inc. (NYSE:ELF). All of these stocks’ market caps are closest to WAAS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KBAL | 12 | 88420 | 2 |

| ZYME | 14 | 120820 | 3 |

| RST | 19 | 126725 | 7 |

| ELF | 18 | 117892 | 1 |

| Average | 15.75 | 113464 | 3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.75 hedge funds with bullish positions and the average amount invested in these stocks was $113 million. That figure was $21 million in WAAS’s case. Rosetta Stone Inc (NYSE:RST) is the most popular stock in this table. On the other hand Kimball International Inc (NASDAQ:KBAL) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks AquaVenture Holdings Limited (NYSE:WAAS) is even less popular than KBAL. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on WAAS, though not to the same extent, as the stock returned 4% during the same time frame and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.