Baron Funds, an investment management company, released its “Baron Focused Growth Fund” fourth quarter 2022 investor letter. A copy of the same can be downloaded here. In the fourth quarter, the fund (Institutional Shares) decreased by 4.52%, compared to a 4.72% rise for the Russell 2500 Growth Index and a 7.56% increase for the S&P 500 Index. For the full year, the fund trailed the primary benchmark the Russell 2500 Growth index and declined 28.14%. In addition, please check the fund’s top five holdings to know its best picks in 2022.

Baron Focused Growth Fund highlighted stocks like ANSYS, Inc. (NASDAQ:ANSS) in the Q4 2022 investor letter. Headquartered in Canonsburg, Pennsylvania, ANSYS, Inc. (NASDAQ:ANSS) is an engineering simulation software developer. On March 3, 2023, ANSYS, Inc. (NASDAQ:ANSS) stock closed at $310.37 per share. One-month return of ANSYS, Inc. (NASDAQ:ANSS) was 13.93%, and its shares gained 1.47% of their value over the last 52 weeks. ANSYS, Inc. (NASDAQ:ANSS) has a market capitalization of $27.029 billion.

Baron Focused Growth Fund made the following comment about ANSYS, Inc. (NASDAQ:ANSS) in its Q4 2022 investor letter:

“In the fourth quarter, we added new positions in ANSYS, Inc. (NASDAQ:ANSS), the market leader in simulation driven product development. ANSYS is the leader in the simulation industry that its clients use for new product development. New technologies are creating goods and services that are significantly more complex. These companies need ANSYS’s software for product testing that they cannot do themselves. Accordingly, ANSYS generates strong recurring revenue through contracts that last three to five years and retention rates at 95% or higher. ANSYS has a $20 billion addressable market that is underpenetrated today. ANSYS’ stock declined 40% last year. We also believe its current valuation and growth prospects are attractive.”

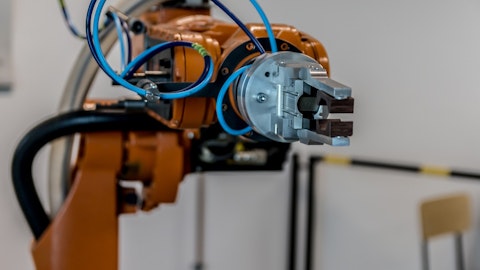

Photo by ThisisEngineering RAEng on Unsplash

ANSYS, Inc. (NASDAQ:ANSS) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 37 hedge fund portfolios held ANSYS, Inc. (NASDAQ:ANSS) at the end of the fourth quarter which was 44 in the previous quarter.

We discussed ANSYS, Inc. (NASDAQ:ANSS) in another article and shared the list of best AI stocks to buy. In addition, please check out our hedge fund investor letters Q4 2022 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 25 Largest Energy Companies by Market Cap

- 25 Most Profitable Companies in the World

- 10 Best Stocks to Buy for Good Returns

Disclosure: None. This article is originally published at Insider Monkey.