It seems that the masses and most of the financial media hate hedge funds and what they do, but why is this hatred of hedge funds so prominent? At the end of the day, these asset management firms do not gamble the hard-earned money of the people who are on the edge of poverty. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. The S&P 500 Index gained 7.6% in the 12 month-period that ended November 21, while less than 49% of its stocks beat the benchmark. In contrast, the 30 most popular mid-cap stocks among the top hedge fund investors tracked by the Insider Monkey team returned 18% over the same period, which provides evidence that these money managers do have great stock picking abilities. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like American Assets Trust, Inc (NYSE:AAT).

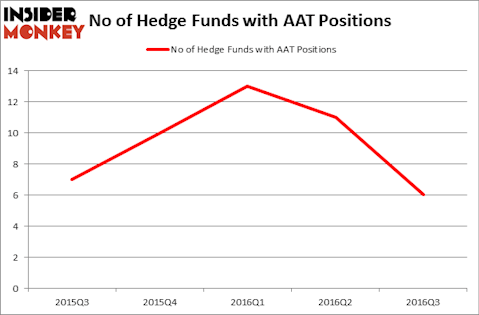

American Assets Trust, Inc (NYSE:AAT) has seen a decrease in support from the world’s most successful money managers lately. There were six hedge funds in our database with AAT holdings at the end of the previous quarter. At the end of this article we will also compare AAT to other stocks including Pattern Energy Group Inc (NASDAQ:PEGI), Rice Midstream Partners LP(NYSE:RMP), and Cott Corporation (USA) (NYSE:COT) to get a better sense of its popularity.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

g0d4ather / shutterstock.com

With all of this in mind, we’re going to check out the key action regarding American Assets Trust, Inc (NYSE:AAT).

How are hedge funds trading American Assets Trust, Inc (NYSE:AAT)?

At the end of the third quarter, a total of six of the hedge funds tracked by Insider Monkey were bullish on this stock, down by five over the quarter. By comparison, 10 funds held shares or bullish call options in AAT heading into this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Jeffrey Furber’s AEW Capital Management holds the most valuable position in American Assets Trust, Inc (NYSE:AAT). AEW Capital Management has a $102.3 million position in the stock, comprising 2.1% of its 13F portfolio. The second largest stake is held by Millennium Management, one of the 10 largest hedge funds in the world; with a $27.5 million position. Other hedge funds and institutional investors with similar optimism contain J. Alan Reid, Jr.’s Forward Management, D. E. Shaw’s D E Shaw, and Cliff Asness’ AQR Capital Management. We should note that Forward Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

We already know that not all hedge funds are bullish on the stock and some hedge funds actually sold off their positions entirely. At the top of the heap, Ken Griffin’s Citadel Investment Group sold off the biggest investment of all the hedgies studied by Insider Monkey, totaling about $2 million in stock, and Jim Simons’ Renaissance Technologies was right behind this move, as the fund dropped about $1.3 million worth of shares.

Let’s check out hedge fund activity in other stocks similar to American Assets Trust, Inc (NYSE:AAT). These stocks are Pattern Energy Group Inc (NASDAQ:PEGI), Rice Midstream Partners LP(NYSE:RMP), Cott Corporation (USA) (NYSE:COT), and Allegheny Technologies Incorporated (NYSE:ATI). This group of stocks’ market valuations match AAT’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PEGI | 15 | 164750 | -2 |

| RMP | 7 | 125322 | 3 |

| COT | 22 | 370670 | 7 |

| ATI | 13 | 183180 | -4 |

As you can see these stocks had an average of 14 funds with bullish positions and the average amount invested in these stocks was $211 million. That figure was $145 million in AAT’s case. Cott Corporation (USA) (NYSE:COT) is the most popular stock in this table. On the other hand Rice Midstream Partners LP (NYSE:RMP) is the least popular one with only seven bullish hedge fund positions. Compared to these stocks American Assets Trust, Inc (NYSE:AAT) is even less popular than RMP. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None