The worries about the election and the ongoing uncertainty about the path of interest-rate increases have been keeping investors on the sidelines. Of course, most hedge funds and other asset managers have been underperforming main stock market indices since the middle of 2015. Interestingly though, smaller-cap stocks registered their best performance relative to the large-capitalization stocks since the end of the June quarter, suggesting that this may be the best time to take a cue from their stock picks. In fact, the Russell 2000 Index gained more than 15% since the beginning of the third quarter, while the Standard and Poor’s 500 benchmark returned less than 6%. This article will lay out and discuss the hedge fund and institutional investor sentiment towards Alon USA Energy, Inc. (NYSE:ALJ).

Alon USA Energy, Inc. (NYSE:ALJ) has experienced a decrease in activity from the world’s largest hedge funds recently. More specifically, there were 15 hedge funds in our database with ALJ holdings at the end of the third quarter. At the end of this article we will also compare ALJ to other stocks including Natera Inc (NASDAQ:NTRA), John B. Sanfilippo & Son, Inc. (NASDAQ:JBSS), and Middlesex Water Company (NASDAQ:MSEX) to get a better sense of its popularity.

Follow Alon Usa Energy Inc. (NYSE:ALJ)

Follow Alon Usa Energy Inc. (NYSE:ALJ)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Corepics VOF/Shutterstock.com

With all of this in mind, let’s take a look at the new action regarding Alon USA Energy, Inc. (NYSE:ALJ).

How are hedge funds trading Alon USA Energy, Inc. (NYSE:ALJ)?

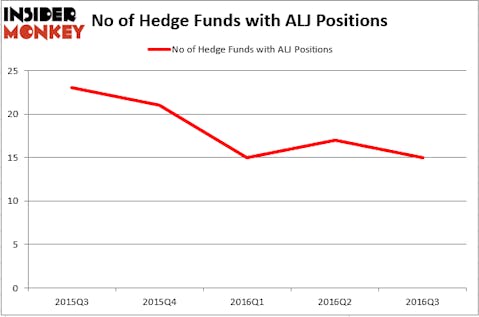

At the end of September, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on Alon USA Energy, down by two funds over the quarter. Below, you can check out the change in hedge fund sentiment towards ALJ over the last five quarters. With hedgies’ sentiment swirling, there exists a select group of notable hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Steve Cohen’s Point72 Asset Management has the number one position in Alon USA Energy, Inc. (NYSE:ALJ), worth close to $17.4 million, comprising 0.1% of its total 13F portfolio. On Point72 Asset Management’s heels is David E. Shaw’s D E Shaw holding a $15 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Remaining peers that hold long positions include Dmitry Balyasny’s Balyasny Asset Management, Ken Griffin’s Citadel Investment Group, and Richard Driehaus’ Driehaus Capital. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.