Hedge funds and other investment firms run by legendary investors like Israel Englander, Jeffrey Talpins and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

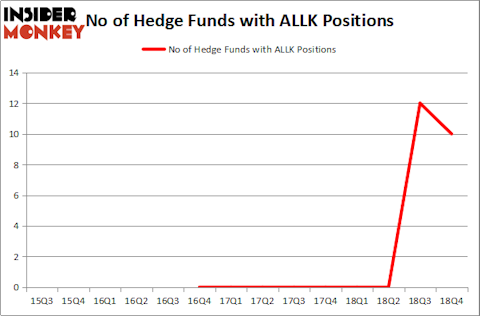

Allakos Inc. (NASDAQ:ALLK) has seen a decrease in support from the world’s most elite money managers recently. ALLK was in 10 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 12 hedge funds in our database with ALLK positions at the end of the previous quarter. Our calculations also showed that ALLK isn’t among the 30 most popular stocks among hedge funds.

In today’s marketplace there are dozens of methods investors employ to size up publicly traded companies. Some of the most innovative methods are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the top picks of the top investment managers can trounce the S&P 500 by a significant margin (see the details here).

We’re going to go over the latest hedge fund action encompassing Allakos Inc. (NASDAQ:ALLK).

How are hedge funds trading Allakos Inc. (NASDAQ:ALLK)?

Heading into the first quarter of 2019, a total of 10 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -17% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards ALLK over the last 14 quarters. With hedgies’ sentiment swirling, there exists a select group of noteworthy hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

Among these funds, Redmile Group held the most valuable stake in Allakos Inc. (NASDAQ:ALLK), which was worth $88.8 million at the end of the fourth quarter. On the second spot was Partner Fund Management which amassed $30.2 million worth of shares. Moreover, Samsara BioCapital, Rock Springs Capital Management, and OrbiMed Advisors were also bullish on Allakos Inc. (NASDAQ:ALLK), allocating a large percentage of their portfolios to this stock.

Since Allakos Inc. (NASDAQ:ALLK) has experienced bearish sentiment from the aggregate hedge fund industry, we can see that there were a few hedgies that decided to sell off their full holdings in the third quarter. It’s worth mentioning that James E. Flynn’s Deerfield Management dumped the biggest investment of the 700 funds watched by Insider Monkey, worth an estimated $10.1 million in stock, and Benjamin A. Smith’s Laurion Capital Management was right behind this move, as the fund dropped about $4.5 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest was cut by 2 funds in the third quarter.

Let’s now review hedge fund activity in other stocks similar to Allakos Inc. (NASDAQ:ALLK). These stocks are Watts Water Technologies Inc (NYSE:WTS), Sanderson Farms, Inc. (NASDAQ:SAFM), Novanta Inc. (NASDAQ:NOVT), and Ultragenyx Pharmaceutical Inc (NASDAQ:RARE). This group of stocks’ market values resemble ALLK’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WTS | 17 | 273895 | 2 |

| SAFM | 13 | 358982 | -2 |

| NOVT | 19 | 105167 | 2 |

| RARE | 14 | 105874 | -3 |

| Average | 15.75 | 210980 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.75 hedge funds with bullish positions and the average amount invested in these stocks was $211 million. That figure was $196 million in ALLK’s case. Novanta Inc. (NASDAQ:NOVT) is the most popular stock in this table. On the other hand Sanderson Farms, Inc. (NASDAQ:SAFM) is the least popular one with only 13 bullish hedge fund positions. Compared to these stocks Allakos Inc. (NASDAQ:ALLK) is even less popular than SAFM. Hedge funds dodged a bullet by taking a bearish stance towards ALLK. Our calculations showed that the top 15 most popular hedge fund stocks returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately ALLK wasn’t nearly as popular as these 15 stock (hedge fund sentiment was very bearish); ALLK investors were disappointed as the stock returned -28% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.