It seems that the masses and most of the financial media hate hedge funds and what they do, but why is this hatred of hedge funds so prominent? At the end of the day, these asset management firms do not gamble the hard-earned money of the people who are on the edge of poverty. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. The Standard and Poor’s 500 Index returned approximately 5.7% in the 12 months ending October 26 (including dividend payments). Conversely, hedge funds’ 30 preferred S&P 500 stocks (as of June 2018) generated a return of 15.1% during the same 12-month period, with 53% of these stock picks outperforming the broader market benchmark. Coincidence? It might happen to be so, but it is unlikely. Our research covering the last 18 years indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like AGNC Investment Corp. (NASDAQ:AGNC).

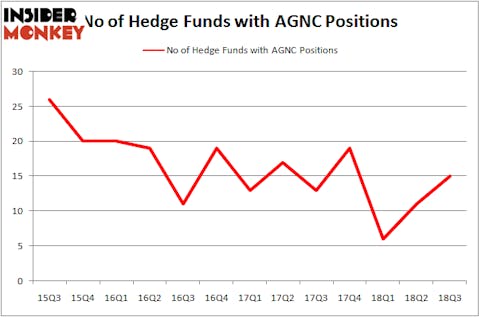

AGNC Investment Corp. (NASDAQ:AGNC) investors should pay attention to an increase in hedge fund sentiment lately. AGNC was in 15 hedge funds’ portfolios at the end of September. There were 11 hedge funds in our database with AGNC holdings at the end of the previous quarter. Our calculations also showed that AGNC isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a gander at the key hedge fund action encompassing AGNC Investment Corp. (NASDAQ:AGNC).

How have hedgies been trading AGNC Investment Corp. (NASDAQ:AGNC)?

Heading into the fourth quarter of 2018, a total of 15 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 36% from the previous quarter. On the other hand, there were a total of 19 hedge funds with a bullish position in AGNC at the beginning of this year. With hedgies’ sentiment swirling, there exists a few noteworthy hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

More specifically, Two Sigma Advisors was the largest shareholder of AGNC Investment Corp. (NASDAQ:AGNC), with a stake worth $75.6 million reported as of the end of September. Trailing Two Sigma Advisors was Renaissance Technologies, which amassed a stake valued at $73.6 million. Citadel Investment Group, Millennium Management, and Citadel Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

As one would reasonably expect, specific money managers have jumped into AGNC Investment Corp. (NASDAQ:AGNC) headfirst. Pentwater Capital Management, managed by Matthew Halbower, assembled the largest position in AGNC Investment Corp. (NASDAQ:AGNC). Pentwater Capital Management had $1.6 million invested in the company at the end of the quarter. Roger Ibbotson’s Zebra Capital Management also initiated a $0.7 million position during the quarter. The following funds were also among the new AGNC investors: Andre F. Perold’s HighVista Strategies, Ray Dalio’s Bridgewater Associates, and Jeffrey Talpins’s Element Capital Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as AGNC Investment Corp. (NASDAQ:AGNC) but similarly valued. We will take a look at Goldcorp Inc. (NYSE:GG), Pinnacle West Capital Corporation (NYSE:PNW), Cimarex Energy Co (NYSE:XEC), and Hyatt Hotels Corporation (NYSE:H). This group of stocks’ market values resemble AGNC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GG | 18 | 94622 | -3 |

| PNW | 20 | 630912 | 3 |

| XEC | 23 | 1185374 | 2 |

| H | 31 | 826605 | -7 |

| Average | 23 | 684378 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $684 million. That figure was $216 million in AGNC’s case. Hyatt Hotels Corporation (NYSE:H) is the most popular stock in this table. On the other hand Goldcorp Inc. (NYSE:GG) is the least popular one with only 18 bullish hedge fund positions. Compared to these stocks AGNC Investment Corp. (NASDAQ:AGNC) is even less popular than GG. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.