Billionaire hedge fund managers such as Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

Is AFLAC Incorporated (NYSE:AFL) going to take off soon? Hedge funds are getting more optimistic. The number of long hedge fund positions increased by 6 lately. Our calculations also showed that AFL isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s go over the recent hedge fund action surrounding AFLAC Incorporated (NYSE:AFL).

Hedge fund activity in AFLAC Incorporated (NYSE:AFL)

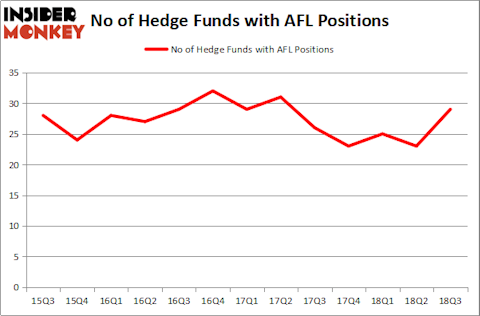

At Q3’s end, a total of 29 of the hedge funds tracked by Insider Monkey were long this stock, a change of 26% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in AFL over the last 13 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, AQR Capital Management held the most valuable stake in AFLAC Incorporated (NYSE:AFL), which was worth $589.8 million at the end of the third quarter. On the second spot was Ariel Investments which amassed $103.7 million worth of shares. Moreover, Two Sigma Advisors, Adage Capital Management, and Arrowstreet Capital were also bullish on AFLAC Incorporated (NYSE:AFL), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, some big names were leading the bulls’ herd. Renaissance Technologies, managed by Jim Simons, assembled the biggest position in AFLAC Incorporated (NYSE:AFL). Renaissance Technologies had $12.4 million invested in the company at the end of the quarter. William Harnisch’s Peconic Partners LLC also initiated a $2.4 million position during the quarter. The other funds with new positions in the stock are Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital, David Costen Haley’s HBK Investments, and James Dondero’s Highland Capital Management.

Let’s also examine hedge fund activity in other stocks similar to AFLAC Incorporated (NYSE:AFL). We will take a look at Marathon Petroleum Corp (NYSE:MPC), Fidelity National Information Services Inc. (NYSE:FIS), Southwest Airlines Co. (NYSE:LUV), and China Unicom (Hong Kong) Limited (NYSE:CHU). This group of stocks’ market caps are closest to AFL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MPC | 66 | 4796468 | 7 |

| FIS | 36 | 1952578 | 4 |

| LUV | 41 | 5209151 | 5 |

| CHU | 6 | 53534 | -3 |

| Average | 37.25 | 3002933 | 3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 37.25 hedge funds with bullish positions and the average amount invested in these stocks was $3.0 trillion. That figure was $923 million in AFL’s case. Marathon Petroleum Corp (NYSE:MPC) is the most popular stock in this table. On the other hand China Unicom (Hong Kong) Limited (NYSE:CHU) is the least popular one with only 6 bullish hedge fund positions. AFLAC Incorporated (NYSE:AFL) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard MPC might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.