The first quarter was a breeze as Powell pivoted, and China seemed eager to reach a deal with Trump. Both the S&P 500 and Russell 2000 delivered very strong gains as a result, with the Russell 2000, which is composed of smaller companies, outperforming the large-cap stocks slightly during the first quarter. Unfortunately sentiment shifted in May as this time China pivoted and Trump put more pressure on China by increasing tariffs. Hedge funds’ top 20 stock picks performed spectacularly in this volatile environment. These stocks delivered a total gain of 18.7% through May 30th, vs. a gain of 12.1% for the S&P 500 ETF. In this article we will look at how this market volatility affected the sentiment of hedge funds towards Affiliated Managers Group, Inc. (NYSE:AMG), and what that likely means for the prospects of the company and its stock.

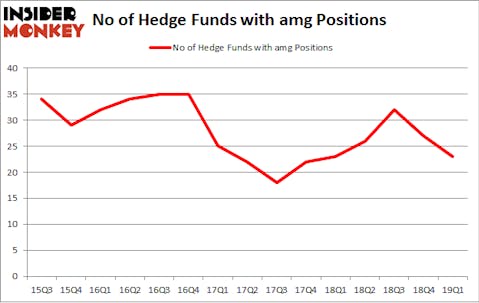

Affiliated Managers Group, Inc. (NYSE:AMG) shareholders have witnessed a decrease in enthusiasm from smart money recently. AMG was in 23 hedge funds’ portfolios at the end of the first quarter of 2019. There were 27 hedge funds in our database with AMG holdings at the end of the previous quarter. Our calculations also showed that amg isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of gauges market participants employ to size up publicly traded companies. A couple of the most useful gauges are hedge fund and insider trading sentiment. Our researchers have shown that, historically, those who follow the best picks of the best investment managers can beat the market by a solid amount (see the details here).

Let’s analyze the fresh hedge fund action regarding Affiliated Managers Group, Inc. (NYSE:AMG).

How have hedgies been trading Affiliated Managers Group, Inc. (NYSE:AMG)?

At the end of the first quarter, a total of 23 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -15% from the fourth quarter of 2018. Below, you can check out the change in hedge fund sentiment towards AMG over the last 15 quarters. With hedgies’ capital changing hands, there exists a few noteworthy hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

Among these funds, Southeastern Asset Management held the most valuable stake in Affiliated Managers Group, Inc. (NYSE:AMG), which was worth $181.2 million at the end of the first quarter. On the second spot was Renaissance Technologies which amassed $137.1 million worth of shares. Moreover, Citadel Investment Group, Ariel Investments, and D E Shaw were also bullish on Affiliated Managers Group, Inc. (NYSE:AMG), allocating a large percentage of their portfolios to this stock.

Since Affiliated Managers Group, Inc. (NYSE:AMG) has faced falling interest from hedge fund managers, we can see that there is a sect of fund managers that slashed their full holdings in the third quarter. At the top of the heap, Paul Marshall and Ian Wace’s Marshall Wace LLP said goodbye to the largest investment of the “upper crust” of funds tracked by Insider Monkey, totaling close to $19.8 million in stock, and Amy Minella’s Cardinal Capital was right behind this move, as the fund cut about $11 million worth. These transactions are interesting, as total hedge fund interest fell by 4 funds in the third quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Affiliated Managers Group, Inc. (NYSE:AMG) but similarly valued. These stocks are Gardner Denver Holdings, Inc. (NYSE:GDI), Coupa Software Incorporated (NASDAQ:COUP), Pilgrim’s Pride Corporation (NASDAQ:PPC), and First Solar, Inc. (NASDAQ:FSLR). This group of stocks’ market values resemble AMG’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GDI | 23 | 386157 | -4 |

| COUP | 41 | 1385130 | 5 |

| PPC | 14 | 140859 | -3 |

| FSLR | 23 | 358479 | 1 |

| Average | 25.25 | 567656 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25.25 hedge funds with bullish positions and the average amount invested in these stocks was $568 million. That figure was $517 million in AMG’s case. Coupa Software Incorporated (NASDAQ:COUP) is the most popular stock in this table. On the other hand Pilgrim’s Pride Corporation (NASDAQ:PPC) is the least popular one with only 14 bullish hedge fund positions. Affiliated Managers Group, Inc. (NYSE:AMG) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately AMG wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); AMG investors were disappointed as the stock returned -19.4% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.