Is The AES Corporation (NYSE:AES) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

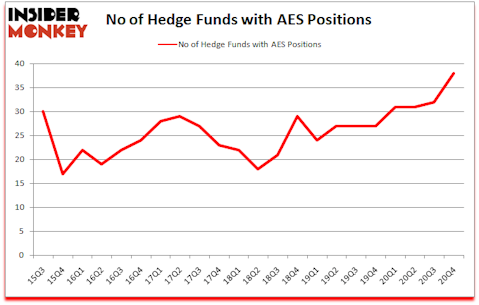

Is AES stock a buy or sell? Money managers were buying. The number of long hedge fund bets moved up by 6 recently. The AES Corporation (NYSE:AES) was in 38 hedge funds’ portfolios at the end of the fourth quarter of 2020. The all time high for this statistic is 32. This means the bullish number of hedge fund positions in this stock currently sits at its all time high. Our calculations also showed that AES isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings).

ohn Levin of Levin Capital Strategies

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, the House passed a landmark bill decriminalizing marijuana. So, we are checking out this under the radar cannabis stock right now. We go through lists like the 10 best battery stocks to buy to identify the next stock with 10x upside potential. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website. With all of this in mind we’re going to take a look at the key hedge fund action encompassing The AES Corporation (NYSE:AES).

Do Hedge Funds Think AES Is A Good Stock To Buy Now?

At the end of December, a total of 38 of the hedge funds tracked by Insider Monkey were long this stock, a change of 19% from one quarter earlier. On the other hand, there were a total of 27 hedge funds with a bullish position in AES a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Electron Capital Partners, managed by Jos Shaver, holds the biggest position in The AES Corporation (NYSE:AES). Electron Capital Partners has a $181.2 million position in the stock, comprising 12.4% of its 13F portfolio. The second most bullish fund manager is Inclusive Capital, led by Jeff Ubben, holding a $125.6 million position; 12.7% of its 13F portfolio is allocated to the stock. Remaining members of the smart money with similar optimism encompass Phill Gross and Robert Atchinson’s Adage Capital Management, Brandon Haley’s Holocene Advisors and Israel Englander’s Millennium Management. In terms of the portfolio weights assigned to each position Inclusive Capital allocated the biggest weight to The AES Corporation (NYSE:AES), around 12.74% of its 13F portfolio. Electron Capital Partners is also relatively very bullish on the stock, earmarking 12.44 percent of its 13F equity portfolio to AES.

With a general bullishness amongst the heavyweights, key money managers were breaking ground themselves. Inclusive Capital, managed by Jeff Ubben, initiated the most outsized position in The AES Corporation (NYSE:AES). Inclusive Capital had $125.6 million invested in the company at the end of the quarter. Daniel Lascano’s Lomas Capital Management also made a $50 million investment in the stock during the quarter. The following funds were also among the new AES investors: Bruce Kovner’s Caxton Associates LP, John A. Levin’s Levin Capital Strategies, and John Smith Clark’s Southpoint Capital Advisors.

Let’s check out hedge fund activity in other stocks similar to The AES Corporation (NYSE:AES). These stocks are KB Financial Group, Inc. (NYSE:KB), Lyft, Inc. (NASDAQ:LYFT), MGM Resorts International (NYSE:MGM), Darden Restaurants, Inc. (NYSE:DRI), Regions Financial Corporation (NYSE:RF), Essex Property Trust Inc (NYSE:ESS), and Caesars Entertainment Inc. (NASDAQ:CZR). This group of stocks’ market caps are closest to AES’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KB | 5 | 42629 | -1 |

| LYFT | 52 | 1166503 | 20 |

| MGM | 44 | 2171039 | 3 |

| DRI | 42 | 1410846 | 1 |

| RF | 26 | 203027 | 3 |

| ESS | 25 | 309571 | -3 |

| CZR | 71 | 1438605 | -3 |

| Average | 37.9 | 963174 | 2.9 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 37.9 hedge funds with bullish positions and the average amount invested in these stocks was $963 million. That figure was $901 million in AES’s case. Caesars Entertainment Inc. (NASDAQ:CZR) is the most popular stock in this table. On the other hand KB Financial Group, Inc. (NYSE:KB) is the least popular one with only 5 bullish hedge fund positions. The AES Corporation (NYSE:AES) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for AES is 65. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 30 most popular stocks among hedge funds returned 81.2% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 26 percentage points. These stocks gained 5.3% in 2021 through March 19th and still beat the market by 0.8 percentage points. Hedge funds were also right about betting on AES as the stock returned 12.7% since the end of Q4 (through 3/19) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Aes Corp (NYSE:AES)

Follow Aes Corp (NYSE:AES)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.