As it turned out, Lakewood Capital’s commentary over ADPT was on point and the bulls were wrong. In early September, ADPT shares fell sharply after its CEO, Thomas Hall, informed the company that he intends to step down as soon as a new CEO is found. On Nov 2, ADPT fell 68% to below $9 per share after it reported horrible third quarter results, with EPS of $0.06 per share versus estimates of $0.56 per share. Revenue came in at $85.4 million, down 3.2% year-over-year, and $4.59 million below the Street’s estimates. Adjusted EBITDA dropped 48% year-over-year, as weaker than expected volumes, collections issues, higher costs, and other factors weighed on results. In addition, management lowered adjusted EBITDA guidance for 2016 to $70-$80 million from $110-$115 million. Due to the lower EBITDA guidance, many investors worried about the company’s debt and headed for the exits.

michaeljung/Shutterstock.com

Keeping this in mind, we’re going to view the new action regarding Adeptus Health Inc (NYSE:ADPT).

What have hedge funds been doing with Adeptus Health Inc (NYSE:ADPT)?

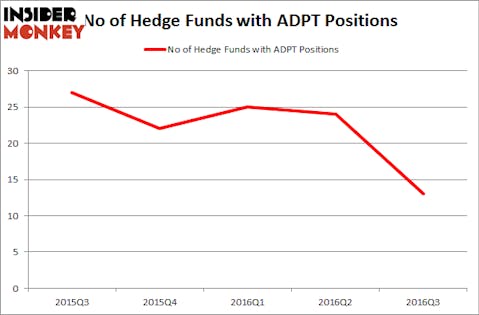

At Q3’s end, a total of 13 of the hedge funds tracked by Insider Monkey were long this stock, a change of -46% from the second quarter of 2016. The graph below displays the number of hedge funds with bullish position in ADPT over the last 5 quarters. With the smart money’s capital changing hands, there exists an “upper tier” of key hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, James E. Flynn’s Deerfield Management has the biggest position in Adeptus Health Inc (NYSE:ADPT), worth close to $68.9 million, amounting to 3.2% of its total 13F portfolio. The second most bullish fund manager is Dinakar Singh of TPG-AXON Management LP, with a $65.9 million position; the fund has 14% of its 13F portfolio invested in the stock. Other members of the smart money with similar optimism encompass John Smith Clark’s Southpoint Capital Advisors, Philip Hempleman’s Ardsley Partners and Philip Hempleman’s Ardsley Partners. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

We already know that not all hedge funds are bullish on the stock and some hedge funds actually dropped their positions entirely. It’s worth mentioning that Jerome Pfund and Michael Sjostrom’s Sectoral Asset Management dropped the largest position of the “upper crust” of funds watched by Insider Monkey, comprising close to $32 million in stock. Gilchrist Berg’s fund, Water Street Capital, also dropped its stock, about $20.7 million worth.