Looking for high-potential stocks? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 7.6% in the 12 months ending November 21, with more than 51% of the stocks in the index failing to beat the benchmark. Therefore, the odds that one will pin down a winner by randomly picking a stock are less than the odds in a fair coin-tossing game. Conversely, best performing hedge funds’ 30 preferred mid-cap stocks generated a return of 18% during the same 12-month period. Coincidence? It might happen to be so, but it is unlikely. Our research covering a 17-year period indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like Adeptus Health Inc (NYSE:ADPT) .

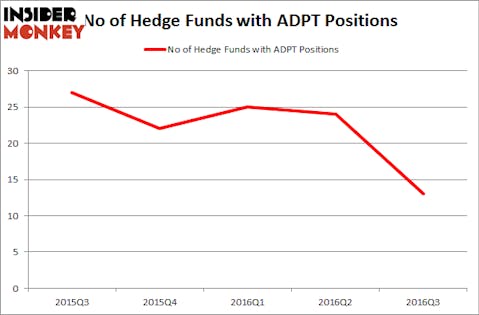

Adeptus Health Inc (NYSE:ADPT) shareholders have witnessed a decrease in support from the world’s most successful money managers recently. ADPT was in 13 hedge funds’ portfolios at the end of the third quarter of 2016. There were 24 hedge funds in our database with ADPT holdings at the end of the previous quarter. At the end of this article we will also compare ADPT to other stocks including Flow International Corporation (NASDAQ:FLOW), Etsy Inc (NASDAQ:ETSY), and Apollo Commercial Real Est. Finance Inc (NYSE:ARI) to get a better sense of its popularity.

Follow Adeptus Health Inc. (NASDAQ:ADPT)

Follow Adeptus Health Inc. (NASDAQ:ADPT)

Receive real-time insider trading and news alerts

Adeptus Health Inc (ADPT) is one of the leading independent emergency room operators in the United States. It is also a battleground stock. On one hand, many top funds were long the stock at the end of September. On the other hand, over half of the company’s float is short.

Bullish investors believe ADPT has potential. Given the aging population and the lack of quality emergency facilities in the United States, ADPT bulls think the stock should trade for more than its current valuation. Before November 2, many bulls also thought ADPT had a lot of growth ahead of it given its previous history of increasing its top and bottom line.

The bears don’t believe ADPT’s earnings and growth rate will hold up. The following is an excerpt from Lakewood Capital Management‘s investor letter concerning its ADPT short at the beginning of the year:

‘We believe the room for further price increases is limited, and the company’s underlying issues will soon become apparent. Declining volumes and increasing bad debt is undoubtedly a toxic mix in a high fixed cost business, and we expect unit economics to deteriorate meaningfully this year. Given these ongoing pressures and our concerns about the durability of the business model, we do not believe the company is worth a significant premium to the capital invested in the business of approximately $150 million. Even at a valuation of two times invested capital, Adeptus shares would be worth less than $10, over 80% below current levels”.

As it turned out, Lakewood Capital’s commentary over ADPT was on point and the bulls were wrong. In early September, ADPT shares fell sharply after its CEO, Thomas Hall, informed the company that he intends to step down as soon as a new CEO is found. On Nov 2, ADPT fell 68% to below $9 per share after it reported horrible third quarter results, with EPS of $0.06 per share versus estimates of $0.56 per share. Revenue came in at $85.4 million, down 3.2% year-over-year, and $4.59 million below the Street’s estimates. Adjusted EBITDA dropped 48% year-over-year, as weaker than expected volumes, collections issues, higher costs, and other factors weighed on results. In addition, management lowered adjusted EBITDA guidance for 2016 to $70-$80 million from $110-$115 million. Due to the lower EBITDA guidance, many investors worried about the company’s debt and headed for the exits.

michaeljung/Shutterstock.com

Keeping this in mind, we’re going to view the new action regarding Adeptus Health Inc (NYSE:ADPT).

What have hedge funds been doing with Adeptus Health Inc (NYSE:ADPT)?

At Q3’s end, a total of 13 of the hedge funds tracked by Insider Monkey were long this stock, a change of -46% from the second quarter of 2016. The graph below displays the number of hedge funds with bullish position in ADPT over the last 5 quarters. With the smart money’s capital changing hands, there exists an “upper tier” of key hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, James E. Flynn’s Deerfield Management has the biggest position in Adeptus Health Inc (NYSE:ADPT), worth close to $68.9 million, amounting to 3.2% of its total 13F portfolio. The second most bullish fund manager is Dinakar Singh of TPG-AXON Management LP, with a $65.9 million position; the fund has 14% of its 13F portfolio invested in the stock. Other members of the smart money with similar optimism encompass John Smith Clark’s Southpoint Capital Advisors, Philip Hempleman’s Ardsley Partners and Philip Hempleman’s Ardsley Partners. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

We already know that not all hedge funds are bullish on the stock and some hedge funds actually dropped their positions entirely. It’s worth mentioning that Jerome Pfund and Michael Sjostrom’s Sectoral Asset Management dropped the largest position of the “upper crust” of funds watched by Insider Monkey, comprising close to $32 million in stock. Gilchrist Berg’s fund, Water Street Capital, also dropped its stock, about $20.7 million worth.

Let’s go over hedge fund activity in other stocks similar to Adeptus Health Inc (NYSE:ADPT). These stocks are Flow International Corporation (NASDAQ:FLOW), Etsy Inc (NASDAQ:ETSY), Apollo Commercial Real Est. Finance Inc (NYSE:ARI), and Cubic Corporation (NYSE:CUB). This group of stocks’ market values resemble ADPT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FLOW | 17 | 132679 | 2 |

| ETSY | 21 | 339597 | 5 |

| ARI | 8 | 9166 | 0 |

| CUB | 17 | 113374 | 2 |

As you can see these stocks had an average of 15.75 hedge funds with bullish positions and the average amount invested in these stocks was $149 million. That figure was $184 million in ADPT’s case. Etsy Inc (NASDAQ:ETSY) is the most popular stock in this table. On the other hand Apollo Commercial Real Est. Finance Inc (NYSE:ARI) is the least popular one with only 8 bullish hedge fund positions. Adeptus Health Inc (NYSE:ADPT) is not the least popular stock in this group but hedge fund interest is still below average. This, combined with the recent sharp decline in hedge fund interest, is a negative signal.

Given the stock’s recent major fall, some of ADPT’s bears have covered their short positions. Whereas more than 80% of the float was short in August, around 45% of the float is short in November. Given the company’s difficulties, it remains to be seen whether the company can turn itself around in the long term, however.