Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ a complex analysis to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we follow the hedge fund activity in the small-cap space.

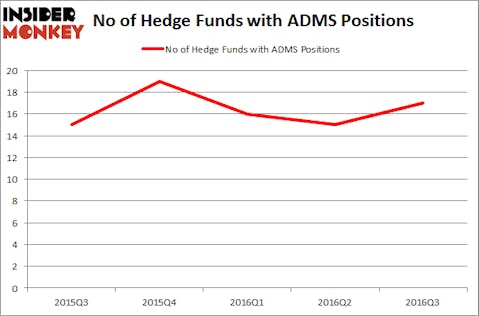

Is Adamas Pharmaceuticals Inc (NASDAQ:ADMS) a good stock to buy right now? Prominent investors are indeed becoming more confident. The number of long hedge fund positions that are disclosed in regulatory 13F filings improved by 2 lately. ADMS was in 17 hedge funds’ portfolios at the end of September. There were 15 hedge funds in our database with ADMS holdings at the end of the previous quarter. At the end of this article we will also compare ADMS to other stocks including Columbus McKinnon Corp. (NASDAQ:CMCO), CNX Coal Resources LP (NYSE:CNXC), and Triumph Bancorp Inc (NASDAQ:TBK) to get a better sense of its popularity.

Follow Adamas Pharmaceuticals Inc (NASDAQ:ADMS)

Follow Adamas Pharmaceuticals Inc (NASDAQ:ADMS)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

GBZero/Shutterstock.com

Now, we’re going to take a gander at the new action regarding Adamas Pharmaceuticals Inc (NASDAQ:ADMS).

Hedge fund activity in Adamas Pharmaceuticals Inc (NASDAQ:ADMS)

At Q3’s end, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, a change of 13% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards ADMS over the last 5 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Great Point Partners, led by Jeffrey Jay and David Kroin, holds the biggest position in Adamas Pharmaceuticals Inc (NASDAQ:ADMS). Great Point Partners has a $42.7 million position in the stock, comprising 10.9% of its 13F portfolio. Coming in second is Joshua Kaufman and Craig Nerenberg of Brenner West Capital Partners, with a $19.2 million position; the fund has 1.7% of its 13F portfolio invested in the stock. Other members of the smart money that hold long positions contain Howard Shainker and Akiva Katz’s Bow Street LLC, Millennium Management, one of the 10 largest hedge funds in the world and Ori Hershkovitz’s Nexthera Capital. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.