At the end of February we announced the arrival of the first US recession since 2009 and we predicted that the market will decline by at least 20% in (Recession is Imminent: We Need A Travel Ban NOW). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards A-Mark Precious Metals, Inc. (NASDAQ:AMRK).

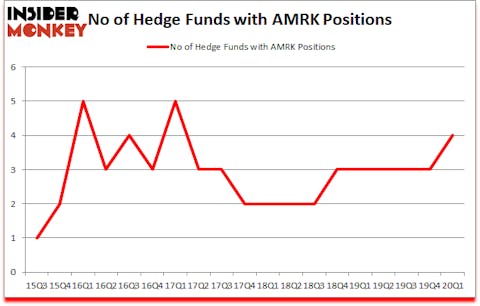

Is A-Mark Precious Metals, Inc. (NASDAQ:AMRK) a good investment today? The smart money is turning bullish. The number of long hedge fund bets rose by 1 recently. Our calculations also showed that AMRK isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks). AMRK was in 4 hedge funds’ portfolios at the end of March. There were 3 hedge funds in our database with AMRK positions at the end of the previous quarter.

Video: Watch our video about the top 5 most popular hedge fund stocks.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by 51 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

J. Carlo Cannell of Cannell Capital

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, 2020’s unprecedented market conditions provide us with the highest number of trading opportunities in a decade. So we are checking out stocks recommended/scorned by legendary Bill Miller. We interview hedge fund managers and ask them about their best ideas. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. With all of this in mind let’s take a gander at the fresh hedge fund action regarding A-Mark Precious Metals, Inc. (NASDAQ:AMRK).

Hedge fund activity in A-Mark Precious Metals, Inc. (NASDAQ:AMRK)

Heading into the second quarter of 2020, a total of 4 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 33% from the previous quarter. By comparison, 3 hedge funds held shares or bullish call options in AMRK a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Cannell Capital, managed by J. Carlo Cannell, holds the number one position in A-Mark Precious Metals, Inc. (NASDAQ:AMRK). Cannell Capital has a $0.6 million position in the stock, comprising 0.2% of its 13F portfolio. Coming in second is Cove Street Capital, led by Jeffrey Bronchick, holding a $0.5 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Remaining members of the smart money that hold long positions comprise Renaissance Technologies, Thomas Bailard’s Bailard Inc and . In terms of the portfolio weights assigned to each position Cannell Capital allocated the biggest weight to A-Mark Precious Metals, Inc. (NASDAQ:AMRK), around 0.23% of its 13F portfolio. Cove Street Capital is also relatively very bullish on the stock, earmarking 0.09 percent of its 13F equity portfolio to AMRK.

Consequently, specific money managers have jumped into A-Mark Precious Metals, Inc. (NASDAQ:AMRK) headfirst. Bailard Inc, managed by Thomas Bailard, initiated the most outsized position in A-Mark Precious Metals, Inc. (NASDAQ:AMRK). Bailard Inc had $0.1 million invested in the company at the end of the quarter.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as A-Mark Precious Metals, Inc. (NASDAQ:AMRK) but similarly valued. We will take a look at The Lovesac Company (NASDAQ:LOVE), Reading International, Inc. (NASDAQ:RDI), Tailored Brands, Inc. (NYSE:TLRD), and Servicesource International Inc (NASDAQ:SREV). This group of stocks’ market valuations match AMRK’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LOVE | 7 | 6858 | 0 |

| RDI | 12 | 10016 | 1 |

| TLRD | 6 | 9030 | -6 |

| SREV | 12 | 20636 | -2 |

| Average | 9.25 | 11635 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.25 hedge funds with bullish positions and the average amount invested in these stocks was $12 million. That figure was $1 million in AMRK’s case. Reading International, Inc. (NASDAQ:RDI) is the most popular stock in this table. On the other hand Tailored Brands, Inc. (NYSE:TLRD) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks A-Mark Precious Metals, Inc. (NASDAQ:AMRK) is even less popular than TLRD. Hedge funds clearly dropped the ball on AMRK as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 8.3% in 2020 through the end of May and still beat the market by 13.2 percentage points. A small number of hedge funds were also right about betting on AMRK as the stock returned 37.9% so far in the second quarter and outperformed the market by an even larger margin.

Follow Gold.com Inc. (NASDAQ:GOLD)

Follow Gold.com Inc. (NASDAQ:GOLD)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.