How do you pick the next stock to invest in? One way would be to spend hours of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding Invitation Homes Inc. (NYSE:INVH).

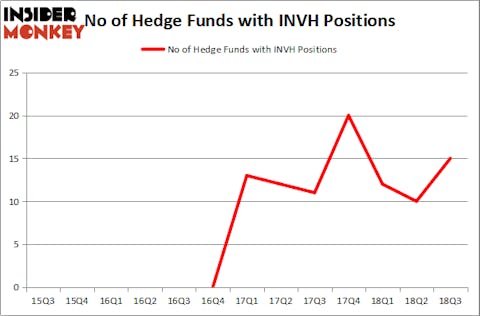

Is Invitation Homes Inc. (NYSE:INVH) the right investment to pursue these days? The best stock pickers are taking a bullish view. The number of bullish hedge fund bets went up by 5 recently. Our calculations also showed that INVH isn’t among the 30 most popular stocks among hedge funds. INVH was in 15 hedge funds’ portfolios at the end of the third quarter of 2018. There were 10 hedge funds in our database with INVH holdings at the end of the previous quarter.

In today’s marketplace there are numerous indicators stock traders can use to evaluate their stock investments. A pair of the most under-the-radar indicators are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the best picks of the top investment managers can outperform the S&P 500 by a superb amount (see the details here).

We’re going to review the new hedge fund action encompassing Invitation Homes Inc. (NYSE:INVH).

What have hedge funds been doing with Invitation Homes Inc. (NYSE:INVH)?

At Q3’s end, a total of 15 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 50% from the previous quarter. On the other hand, there were a total of 20 hedge funds with a bullish position in INVH at the beginning of this year. With hedgies’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

More specifically, Zimmer Partners was the largest shareholder of Invitation Homes Inc. (NYSE:INVH), with a stake worth $114 million reported as of the end of September. Trailing Zimmer Partners was Capital Growth Management, which amassed a stake valued at $37.3 million. Cardinal Capital, Millennium Management, and Land & Buildings Investment Management were also very fond of the stock, giving the stock large weights in their portfolios.

Now, key money managers have jumped into Invitation Homes Inc. (NYSE:INVH) headfirst. Capital Growth Management, managed by Ken Heebner, assembled the largest position in Invitation Homes Inc. (NYSE:INVH). Capital Growth Management had $37.3 million invested in the company at the end of the quarter. Clint Carlson’s Carlson Capital also made a $11.3 million investment in the stock during the quarter. The other funds with brand new INVH positions are Jim Simons’s Renaissance Technologies, Noam Gottesman’s GLG Partners, and George Zweig, Shane Haas and Ravi Chander’s Signition LP.

Let’s go over hedge fund activity in other stocks similar to Invitation Homes Inc. (NYSE:INVH). These stocks are Universal Health Services, Inc. (NYSE:UHS), Andeavor Logistics LP (NYSE:ANDX), Vedanta Ltd (NYSE:VEDL), and FMC Corporation (NYSE:FMC). All of these stocks’ market caps match INVH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UHS | 32 | 1165594 | 1 |

| ANDX | 6 | 11720 | 0 |

| VEDL | 5 | 52265 | -4 |

| FMC | 37 | 1881821 | 0 |

| Average | 20 | 777850 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $778 million. That figure was $251 million in INVH’s case. FMC Corporation (NYSE:FMC) is the most popular stock in this table. On the other hand Vedanta Ltd (NYSE:VEDL) is the least popular one with only 5 bullish hedge fund positions. Invitation Homes Inc. (NYSE:INVH) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard FMC might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.