Insider Monkey finished processing more than 700 13F filings made by hedge funds and prominent investors. These filings show these funds’ portfolio positions as of September 30. In this article we are going to take a look at smart money sentiment towards Teleflex Incorporated (NYSE:TFX).

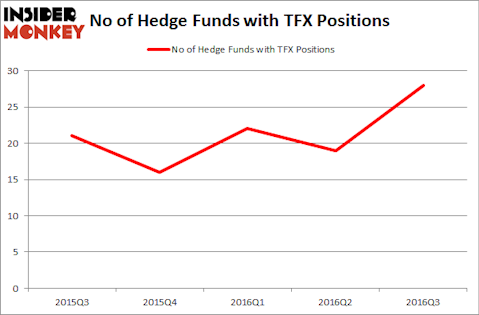

Is Teleflex Incorporated (NYSE:TFX) undervalued? Investors who are in the know are getting more bullish. The number of long hedge fund positions increased by 9 lately. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as A. O. Smith Corporation (NYSE:AOS), Broadridge Financial Solutions, Inc. (NYSE:BR), and Camden Property Trust (NYSE:CPT) to gather more data points.

Follow Teleflex Inc (NYSE:TFX)

Follow Teleflex Inc (NYSE:TFX)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

everything possible/Shutterstock.com

Hedge fund activity in Teleflex Incorporated (NYSE:TFX)

At the end of the third quarter, a total of 28 of the hedge funds tracked by Insider Monkey were long this stock, a 47% jump from the second quarter of 2016, pushing hedge fund ownership of the stock to its highest level in a year. With the smart money’s capital changing hands, there exists an “upper tier” of notable hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Robert Joseph Caruso’s Select Equity Group has the largest position in Teleflex Incorporated (NYSE:TFX), worth close to $365.4 million, amounting to 3.2% of its total 13F portfolio. Coming in second is AQR Capital Management, led by Cliff Asness, holding a $65.9 million position. Remaining members of the smart money with similar optimism include John Osterweis’ Osterweis Capital Management, Chuck Royce’s Royce & Associates and Bain Capital’s Brookside Capital.

As aggregate interest increased, some big names have been driving this bullishness. Clinton Group, managed by George Hall, created the most valuable position in Teleflex Incorporated (NYSE:TFX). Clinton Group had $7 million invested in the company at the end of the quarter. Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners also made a $6.9 million investment in the stock during the quarter. The following funds were also among the new TFX investors: Ken Griffin’s Citadel Investment Group, Glenn Russell Dubin’s Highbridge Capital Management, and Noam Gottesman’s GLG Partners.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Teleflex Incorporated (NYSE:TFX) but similarly valued. These stocks are A. O. Smith Corporation (NYSE:AOS), Broadridge Financial Solutions, Inc. (NYSE:BR), Camden Property Trust (NYSE:CPT), and Alexandria Real Estate Equities Inc (NYSE:ARE). This group of stocks’ market values match TFX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AOS | 24 | 351501 | 0 |

| BR | 21 | 207829 | 6 |

| CPT | 8 | 149422 | -2 |

| ARE | 11 | 54049 | 0 |

As you can see these stocks had an average of 16 hedge funds with bullish positions and the average amount invested in these stocks was $191 million. That figure was $596 million in TFX’s case. A. O. Smith Corporation (NYSE:AOS) is the most popular stock in this table. On the other hand Camden Property Trust (NYSE:CPT) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Teleflex Incorporated (NYSE:TFX) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, and ownership of the stock just surged, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None