Is Ingersoll-Rand PLC (NYSE:IR) a good equity to bet on right now? We like to check what the smart money thinks first before doing extensive research. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to find the latest market-moving information.

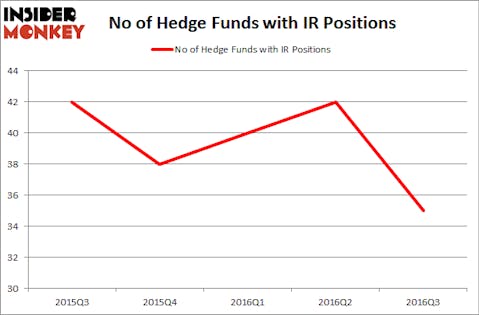

Ingersoll-Rand PLC (NYSE:IR) has seen a decrease in activity from the world’s largest hedge funds recently. 35 hedge funds that we track were long the stock on September 30. There were 42 hedge funds in our database with IR positions at the end of the June quarter. At the end of this article we will also compare IR to other stocks including Expedia Inc (NASDAQ:EXPE), Ctrip.com International, Ltd. (ADR) (NASDAQ:CTRP), and AmerisourceBergen Corp. (NYSE:ABC) to get a better sense of its popularity.

Follow Trane Technologies Plc (NYSE:TT)

Follow Trane Technologies Plc (NYSE:TT)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Mrkevvzime/Shutterstock.com

What have hedge funds been doing with Ingersoll-Rand PLC (NYSE:IR)?

At the end of the third quarter, a total of 35 of the hedge funds tracked by Insider Monkey were bullish on this stock, a 17% fall from the second quarter of 2016, dropping hedge fund ownership of the stock to a yearly low. By comparison, 38 hedge funds held shares or bullish call options in IR heading into this year. With the smart money’s sentiment swirling, there exists a select group of notable hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Generation Investment Management, led by David Blood and Al Gore, holds the most valuable position in Ingersoll-Rand PLC (NYSE:IR). Generation Investment Management has a $653.1 million position in the stock, comprising 7.1% of its 13F portfolio. Coming in second is Cliff Asness of AQR Capital Management, with a $137.2 million position. Remaining professional money managers with similar optimism consist of David E. Shaw’s D E Shaw, John Overdeck and David Siegel’s Two Sigma Advisors, and Anand Parekh’s Alyeska Investment Group. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.