indie Semiconductor, Inc. (NASDAQ:INDI) Q4 2022 Earnings Call Transcript February 16, 2023

Operator: Good afternoon and welcome to indie Semiconductor’s Fourth Quarter and Year End 2022 Earnings Call. As a reminder, this conference call is being recorded. I will now turn the call over to Ashish Gupta, Investor Relations. Mr. Gupta, please go ahead.

Ashish Gupta: Thank you, Operator. Good afternoon and welcome to indie Semiconductor’s fourth quarter and year end 2022 earnings call. Joining me today are Donald McClymont, indie’s Co-Founder and CEO; and Tom Schiller, indie’s CFO and EVP of Strategy. Donald will provide opening remarks and discuss business highlights followed by Tom’s review of indie’s Q4 and first quarter outlook. Please note that we will be making forward-looking statements based on current expectations and assumptions, which are subject to risks and uncertainties. These statements reflect our views only as of today and should not be relied upon as representative views of any subsequent date. These statements are subject to a variety of risks and uncertainties that could cause actual results to differ materially from expectations.

For a discussion of the strategic backlog formulation methodology, please refer to our safe harbor statement on our Q3 earnings press release. For material risks and other important factors that could affect our financial results, please review our risk factors in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, as well as other public reports filed with the SEC. Finally, the results and guidance discussed today are based on certain non-GAAP financial measures. For a complete reconciliation to GAAP, please see our Q4 earnings press release, which was issued in advance of this call and can be found on our website at www.indisemi.com. I’ll now turn the call over to Donald.

Donald McClymont: Thanks, Ashish and welcome everybody. indie delivered another quarter of record revenue and gross margin performance in Q4. Once again ahead of expectations and capping off a second consecutive year in which we more than doubled our topline. Our sustained outperformance reflects the strength of our highly innovative Autotech products, backed by an extensive global patent portfolio developed by indie’s team of over 600 dedicated employees around the world. Specifically, during the fourth quarter, we significantly outpaced our addressable markets and grew revenue 74% year-over-year and 10% sequentially to just over $33 million. We expanded gross margin to 52% and gained further design win momentum spanning ADAS, user experience and electrification applications.

Of note, during the period, we ramped our user experience portfolio across leading North American automotive OEMs exceeded 200 million unit cumulative shipments, closed a convertible debt offering of $160 million in support of our acquisition plans, launched a Board authorized $50 million share and warrant repurchase program. And more recently we captured a motor controller design for E-vehicle battery cooling systems. Entered a key partnership with Seeing Machines targeting driver and vehicle occupant monitoring. Demonstrated innovative power delivery, wireless charging, lighting and ADAS solutions at CES, including our Surya coherent LiDAR SoC. And announced our intent to acquire GEO Semiconductor. On a full year 2022 basis, we delivered $111 million in revenue and improved gross margin to nearly 50%.

While substantially increasing our strategic backlog to $4.3 billion as of November 2022, up from $2.6 billion in 2021 and $2 billion at the time of our launch in 2020, setting the stage for sustained, outsized growth through the balance of this decade as design wins translate into program ramps and ultimately revenue and free cash flow generation. Within ADAS, we are approaching a new era of sensor fusion merging multiple disparate technologies together and process information, employing RADARs, LiDARs, ultrasound and computer vision. We believe that following our sensor agnostic approach, indie is the best-positioned Autotech semiconductor and software pure-play to capitalize on this strategic megatrend. First of all, RADAR represents a fundamental ADAS building block technology.

Today RADAR is widely deployed for automatic emergency braking, adaptive cruise control, lane change assist and blind spot detection applications. In the near future, it will also enable the high volume cross-traffic detection application, making it an extremely critical sensor. Recall, we significantly scaled our radar initiative through internal investments and the acquisitions of Analog Devices radar division and Onsemi’s RADAR team. The successful integration of these assets was critical to accelerating our product development, leading to our largest design win-to-date for the top four automotive radar system supplier. Secondly, given LiDARs impressive resolution range and depth perception capabilities, we can deliver this rapidly emerging sensor technology to enhance safety systems within mass-market vehicles far sooner than the anticipated rollout of fully autonomous driving use cases.

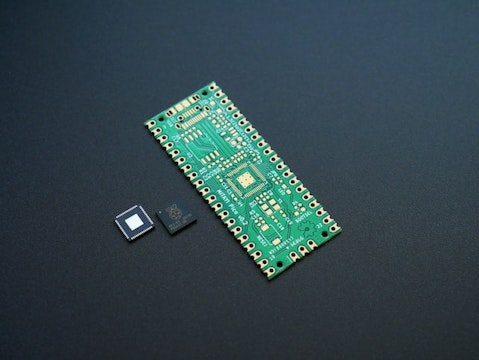

To date, addressing the complex and compute-intensive demands of coherent LiDARs systems has been achieved by using very high-end Field Programmable Gate Arrays. FPGAs are ideal for prototyping and offer high levels of flexibility and versatility, especially beneficial for nascent applications. But FPGAs are also expensive, power hungry, they require complex PCBs and additional discrete components that add significant cost, size, they generate thermal problems and excess of power consumption. This makes any migration to mass market LiDAR in practical for automakers are seeking a sub $500 price point with less than 30 Watts of power dissipation for long range LiDAR. Enter indie Surya LiDAR SoC, the world’s first merchant market coherent LiDAR solution, allowing our customers to implement the highly integrated, high-performance, software-defined data acquisition and signal processing system.

Surya integrates all the necessary multichannel high-speed analog to digital converters, hardware and software digital signal processing, together with the system control interfaces needed for an efficient and cost-effective LiDAR system. When coupled with our differentiated TeraXion lasers, Surya can absolutely catalyze the LiDAR market. Third, Ultrasound is increasingly deployed to provide practical, low spatial resolution and short-range sensing use cases up to a few meters such as park-assist systems. A key benefit of ultrasonic sensors is that they are particularly effective due to their resilience and most weather conditions and are relatively low cost. We are still in the early innings of our own ultrasound product ramp supporting Hyundai’s Smart Park feature set amongst others.

And last, and far from least, computer vision. Image processing systems provide the main sensing function in both ADAS and autonomous applications requiring up to 20 cameras in next-generation vehicles. Many different functions are enabled by computer vision, ranging from simple backup cameras, mirrors and surround view systems, through object and lane detection, night vision and driver and occupant monitoring. Collectively, these functions can realize use cases such as lane change assist, highway pilot, traffic jam pilot, occupant safety, automated parking and other levels of driver automation. In fact, given the increasing attach rate of cameras around the vehicle, IHS is forecasting 265 million camera ECUs will be needed to support the global automotive market in 2023, growing to 430 million units by 2028.

Photo by Vishnu Mohanan on Unsplash

And thus creating an $8.5 billion total addressable semiconductor market. To accelerate our market entry and capitalize on this opportunity, last week, we announced our intent to acquire GEO semiconductor. It’s rare that an acquisition target is a perfect fit, but this is indeed the case with GEO. Underpinned by 100 global patents, GEOs industry-leading camera-based sensing and viewing capabilities are shipping today to some of the world’s largest automotive OEMs, including Honda, Hyundai, Kia, Nissan and Toyota. With design wins across more than 20 Tier-1s, GEO has programs with every major image sensor supplier in the world and is engaged in multiple key vehicle programs. GEOs products comprised three generations of application-specific camera video processors including those focused on viewing, where video is projected on the display and viewed by the driver and sensing where video is processed using advanced computer vision and machine learning algorithms to assist the driver.

The unique ability to support both of these key categories will allow indie to deliver short-term solutions for today’s use cases, both providing a technology platform to provide fully autonomous features for the vehicles of tomorrow. GEO is complementary in terms of products, customers, and global sales channels, while at the same time highly synergistic operationally with massive cross-selling opportunities. Upcoming regulations and OEMs need for differentiation will require a significant increase in camera resolution and the number of image processors per car. These requirements will demand both sensing and viewing features. GEO’s camera processing technology will allow the tailored processing of image for display and machine vision applications, resulting in a high fidelity image delivery to the display and the contrast enhanced image going to the machine vision system for object detection, lower latency and superior time-to-collision performance at ultra-low power.

Indie’s differentiated sensing technologies combined with GEO’s camera processing know-how and IP will uniquely position us to accelerate the adaptation of camera-based sensing technology across the vehicle spectrum. More importantly, GEO is enabling indie to complete our sensor mosaic spanning RADAR, LiDAR, ultrasound and computer vision with scale across each now underpinned by a total of 370 patents and applications. Our next step will be to fuse all sensing methods into integrated platforms to provide our customers with the most optimized and highest performing systems Baron. Switching gears, during the fourth quarter, we also continue to ramp our user experience portfolio across leading global automakers as OEMs prioritize the best-in-class cabin experience more than ever.

This focus towards creating a unique cockpit environment where communication, entertainment and information sharing has become paramount and indeed is a much greater customer differentiation than traditional torque, horsepower and 0 to 60 metrics. Providing the ultimate user experience throughout the entire cabin is the new standard. In particular, seamless mobile device integration within the automotive environment is increasingly a way OEMs are differentiating their cars, which means implementing systems such as Apple CarPlay and Android Auto that enable drivers to safely make calls, send and receive messages and enjoy their favorite music without taking their eyes off the road. This key feature is set is everything for teen drivers and even more important for their nervous parents.

Similarly, vehicle lighting is gaining an importance as it is a strong generator of brand recognition. Illuminating a car’s interior and exterior creates an emotional ambiance that drives the unique connection. Car manufacturers understand the significance of this dynamic and are striving to perfect the integration of lighting conditions for a more harmonious driving experience. Finally, in the EV area, we’re seeing the start of a long-term secular tailwind as OEMs led by consumer demand shift towards electrification. According to Cox Automotive, EV sales were up 66% versus the prior year in the US and the EV share of the total market nearly doubled to around 6%. While penetration of EVs has increased considerably, there still lies an enormous blue-sky opportunity ahead.

And indie remains especially well positioned here, given our strong relationships with an increasing number of leading OEMs around the world, who are seeking more highly integrated and power-efficient semiconductors to continually shortened charging times and extend vehicle range. I will now turn the call over to Tom for discussion of our Q4 results and Q1 outlook.

Tom Schiller: Thanks, Donald. indie delivered a solid fourth quarter once again outpacing top line and gross margin expectations. In fact Q4 represents our seventh consecutive quarter of beating or at least meeting our revenue and gross margin targets post indie’s IPO. Revenue for the period was up 74% year-over-year and up 10% sequentially to $33 million, gross profit was $17.2 million translating into a 52.2% gross margin, up 590 basis points year-over-year and 180 basis points sequentially, better than our 51% guidance. To put this performance in context. At the time of our IPO announcement in the fourth quarter of 2020 indie was a quarterly revenue of just $6.7 million with a gross margin of 35.4%. In the two years since and despite the challenging supply chain environment, we’ve effectively 5X our revenue base, while expanding gross margin by nearly 1,700 basis points.

Turning back to our Q4 results. R&D was $24.9 million in support of accelerated product development with SG&A of $7.4 million, reflecting continued investments to extend indie’s sales reach, plus the implementation of a highly scalable ERP system. In turn, our Q4 operating loss was $15.1 million, slightly better than our guidance. Below the line, interest income was $0.7 million versus our guidance for $0.8 million, stemming from incremental convertible debt interest we hadn’t contemplated in our original forecast 90 days ago. We also bought back 1.1 million shares last quarter, ending the period at 151.1 million shares against our guidance for 152 million shares. As a result, our net loss was $14.4 million and we posted a $0.10 loss per share in the fourth quarter with the delta between our guidance and results tied to the slightly lower level of interest income and reduced share base.

Turning to the balance sheet. We exited the year with $321.9 million of cash, up $171.1 million from Q3, including $154.7 million of net proceeds from our convertible debt offering and $41.9 million from our Wuxi subsidiaries capital raise. These increases were partially offset by $14.9 million of net cash used in operating activities, $4.3 million in CapEx for expanded lab and IT equipment, as well as $7.4 million in share repurchases. Looking forward, based on the depth of our new product pipeline, multiple program ramps and the planned addition of GEO later this quarter, we plan to deliver accelerating top-line growth throughout 2023. For the first quarter, we plan to scale to $160 million annualized revenue run rate, including the stub portion of GEO revenue with non-GAAP gross margin in the 52% range.

We are also planning $29 million in R&D, an $8 million of SG&A on a consolidated basis for the quarter. Below the line, we anticipate $0.4 million of net interest income and no taxes. Assuming 156 million shares outstanding, including approximately 4 million shares for GEO on a weighted average basis, we expect a $0.10 net loss per share. Further, and perhaps most importantly, we believe the combination of indie’s steeper growth trajectory, sustain gross margin expansion, particularly post-GEO synergies and planned operating expense leverage will enable us to reach profitability in the back half of this year, representing another key milestone towards realizing our 60% gross and 30% operating margin target model. On that note, I’ll turn the call back to Donald for his closing comments.

Donald McClymont: Thanks, Tom. In conclusion, we posted solid Q4 and 2022 results and are executing to our ambitious growth plans. And although we’ve made substantial progress since our IPO and extending our support of the car brands like Audi, BMW, BYD, Daimler, Ford, General Motors, Hyundai, Nissan, Porsche, Stellantis and Volkswagen, indie is now just getting started. Our acquisition of GEO immediately rounds out our sensor offering by accelerating our computer vision product portfolio with field-proven differentiated solutions, enabling us to capitalize on the rapid proliferation of automotive image processors around the vehicle. This acquisition effectively fast forwards our ability to provide a highly differentiated and true sensor fusion platform to our customers.

In this way, we will vastly simplify sensing architectures and thus democratize access to higher-level autonomous and ADAS features bringing as a massive step towards realizing our strategic vision of enabling the uncrashable car becoming an Autotech powerhouse and in the process of creating extraordinary shareholder value. That concludes our prepared remarks. Operator, let’s open the call for questions.

See also 25 Most Viewed YouTube Videos of All Time and 16 Largest Photography Companies in the World.

Q&A Session

Follow Indie Semiconductor Inc. (NASDAQ:INDI)

Follow Indie Semiconductor Inc. (NASDAQ:INDI)

Receive real-time insider trading and news alerts

Operator: Our first question comes from the line of Suji Desilva with ROTH. Please proceed with your questions.

Suji Desilva: Hi. Donald. Hi, Tom. Congratulations on a strong finish to ’22 and even really, it sounds like a better outlook for ’23. So great job, guys.

Tom Schiller: Thank you.

Suji Desilva: Yes, no problem. So maybe a financial question first on the backlog growth, very strong growth there, very impressive, the $4.3 billion. Can you give us some way of understanding how much of that might cover for the next 12 to 24 months near-term versus longer term and what’s the realistic expectation for how that backlog grows over the next few years, because it’s having really strong growth here. Is that kind of growth sustainable or just how to think about that. Thanks.

Donald McClymont: Well, kind of going in reverse order. I mean, for sure, we’re still accelerating into the market. We’ve only been a public company for a little over 18 months. And still the positive effect that, that has with their customers hasn’t really been fully harvested yet. So, no, I do anticipate that we’ll be able to pull in some very large projects and those will be added to the strategic backlog in due course, as you know, Suji, on an annual basis. So in terms of what our expectation is for the next 12 months. I mean, we’ve been very clear, our absolute target, our absolute mandate, my mandate to the entire team is that we hit profitability in the second half of this year. And you can kind of draw a line between that from where we are now and where we have to get to in revenue in order to realize that.

And I think over time, if you consider just making an easy math, a 10-year run for some of these projects. And you can approximately divide by 10 to get to the run rate at the midpoint of that area. So in terms of where we are, we’re very much on track to meet the plan that we originally set out when we came to the market and IPO. We’re very confident about that. And we delivered on it in the first 18 months or so and we’ll continue to do such.

Suji Desilva: That’s great. It’s very helpful color and perspective there, Donald. And then one question perhaps on the GEO Semi acquisition. Noticing clearly that there is strong success there geographically in the Japan, Korea region. I’m wondering if that came through a particular partnership or just a focus there and how would you take that and expand that success geographically through the combined GEO vision queue effort? Is there something you need to do additional partnerships? Thanks.

Donald McClymont: Well, as we’ve discussed before, we decided to enter particularly the Japan market latest or last in our evolution, just simply because the market is quite conservative over there and takes a long time. And so one of the things that attracted us to GEO was in fact that they had a great presence in the Japanese market, fairly strong representation there, without the name brand, OEMs with a bunch of the Tier 1s. They have a very good supply chain through into that market. So that was basically just a huge opportunity for us to enable cross-selling into a new market for our products. And conversely also where they are less strong in the other parts of the world, where we’ve built up a great reputation and a great footprint, we have the ability, really in the short term to deploy their products into our customers.