Sands Capital, an investment management company, released its “Sands Capital Select Growth Strategy” Q2 2025 investor letter. A copy of the letter can be downloaded here. U.S. large-cap growth equities recovered from a sharp sell-off in early April by delivering strong returns in the second quarter. The quarterly performance was driven by muted inflation, strong corporate earnings, and improving sentiment around artificial intelligence (AI) and global trade. The portfolio returned 27.7% in the quarter, outperforming the benchmark Russell 1000 Growth Index’s 17.8% gain. You can check the fund’s top 5 holdings to know more about its best picks for 2025.

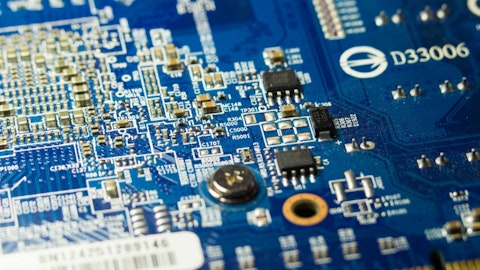

In its second-quarter 2025 investor letter, Sands Capital Select Growth Strategy highlighted stocks such as Broadcom Inc. (NASDAQ:AVGO). Broadcom Inc. (NASDAQ:AVGO) designs and develops various semiconductor and infrastructure software solutions. The one-month return of Broadcom Inc. (NASDAQ:AVGO) was 23.46%, and its shares gained 124.10% of their value over the last 52 weeks. On September 15, 2025, Broadcom Inc. (NASDAQ:AVGO) stock closed at $364.09 per share, with a market capitalization of $1.72 trillion.

Sands Capital Select Growth Strategy stated the following regarding Broadcom Inc. (NASDAQ:AVGO) in its second quarter 2025 investor letter:

“Broadcom Inc. (NASDAQ:AVGO) plays a vital role in advancing system scalability and compute expansion through its Ethernet networking technologies and custom accelerators. Shares gained in the second quarter as investors grew more confident that demand for generative AI infrastructure continues to outstrip supply. Results reinforced this view, with AI-related revenue rising 46 percent year over year to $4.4 billion. Management expects growth to accelerate to accelerate to 60 percent year over year in the third quarter and to continue at a similar pace into 2026. Looking ahead, Broadcom is well positioned to benefit from its leadership in networking technologies that interconnect increasingly complex arrays of AI accelerators. We also expect rising interest in its custom chip design services, as more organizations seek hardware tailored to the specific needs of their AI workloads.”

Broadcom Inc. (NASDAQ:AVGO) is in 12th position on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 156 hedge fund portfolios held Broadcom Inc. (NASDAQ:AVGO) at the end of the second quarter, compared to 158 in the previous quarter. In the fiscal third quarter of 2025, Broadcom Inc. (NASDAQ:AVGO) reported record revenue of $16 billion, up 22% year-over-year. While we acknowledge the risk and potential of Broadcom Inc. (NASDAQ:AVGO) as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than Broadcom Inc. (NASDAQ:AVGO) and that has 10,000% upside potential, check out our report about this cheapest AI stock.

In another article, we covered Broadcom Inc. (NASDAQ:AVGO) and shared stock news you should pay attention to. Broadcom Inc. (NASDAQ:AVGO) was the largest performance contributor to Renaissance Large Cap Growth Strategy in Q2 2025 after reporting strong operating results and guidance. In addition, please check out our hedge fund investor letters Q2 2025 page for more investor letters from hedge funds and other leading investors.

READ NEXT: The Best and Worst Dow Stocks for the Next 12 Months and 10 Unstoppable Stocks That Could Double Your Money.

Disclosure: None. This article is originally published at Insider Monkey.