An excerpt from the Hidden Value Stocks June 2020 Issue, featuring an interview with Andrew Oskoui, the portfolio manager and founder of Blue Tower Asset Management.

Interview One – Andrew Oskoui: Blue Tower Asset Management

Andrew Oskoui, CFA, is the portfolio manager and founder of Blue Tower Asset Management. Blue Tower combines quantitative and value philosophies by using algorithmic screens to find securities with strong fundamentals and cheap valuations.

These securities then undergo traditional due diligence on the management team and a line of business industry analysis. Andrew previously worked in investment research for YCG and managed an equity strategy for Allometric Research & Management.

Prior to beginning his career in finance, Andrew led a materials science research group for Halcyon Molecular (a Founder’s Fund portfolio company) and researched nanoparticle drug delivery for cancer therapies as an engineer for Covidien.

HVS: Our last interview was just over three years ago in December 2016. How would you say your outlook on the markets has changed since then?

Andrew Oskoui: The most obvious change is the current Coronavirus pandemic. While the virus does not appear to be as lethal as some of the prior pandemics that the world has faced such as the Spanish Flu of 1918 or the 1957 H2N2 pandemic (Asian Flu), there has been a much greater reaction from governments and consumer behavior to this pandemic.

Several noteworthy things are happening in the markets. The underperformance of the value factor has only accelerated in the last few years. The valuation gap between growth and value stocks has widened to levels not seen since the 1999 tech bubble.

Some stocks have been trading this year at multiples not seen since the bottom of the global financial crisis, and high yield bond spreads are at crisis levels.

The monetary and fiscal stimulus from central banks and governments is more substantial than anything seen before. One could argue that this deficit spending, low-interest rates, and rapidly increasing money supply will lead to a sharp increase in inflation after the health crisis passes. It is hard to predict how all of these extreme forces will interact with each other.

At the beginning of the year, I believed that the U.S. construction sector and new housing starts were going to have a solid year due to a housing deficit in the U.S. after multiple years of below-trend construction. Whether this prediction comes true now depends on how fast employment recovers, the length of pandemic-related lockdowns, how much infrastructure spending comes from the U.S. government, and progress on coronavirus vaccines and therapeutics.

HVS: Would you say your investment strategy has changed at all since our last interview? We have not changed significantly.

Andrew Oskoui: We are investing more internationally, and that is primarily driven by the shift in valuations between U.S. equities and those in Europe and Japan.

The U.S. is still our single largest country for investment, but in general, I would agree that the U.S. market is not trading at an attractive multiple compared to Japan or Europe.

Some investors point to the higher GDP growth rate of the U.S. as a reason for it trading at higher multiples to other countries, but historically there has not been a strong relationship between national GDP growth rates and returns to equity investors in those countries.

Another argument is that the U.S. dollars status as the world reserve currency creates a constant demand for dollars globally. This gives a funding advantage to U.S. enterprises as they have easier access to capital markets.

However, this has been true in the past without creating a concurrent elevated market multiple for publicly listed stocks.

By most measures of overall market valuation such as public total market cap vs. GDP, weighted average P/E, or weighted average PEG ratios, the U.S. is at very high multiples relative to other developed economies.

HVS: At the time of our first interview in 2016, Bluetower had 40% of assets in just two positions. Today the fund is a bit more diversified with the top five holdings making up 40% of AUM. Is this a reflection of how your strategy has changed?

Andrew Oskoui: When we had 37% in our top two positions in 2016, that was a reflection of our opportunity set.

When an investor can find a large number of attractive investment opportunities which are subject to risks uncorrelated with the rest of the portfolio, they can make a more broadly diversified portfolio than if they can only find a handful of opportunities.

Currently, we see a more extensive set of investment opportunities than ever before.

HVS: One of the top ten holdings in the portfolio is Facebook (FB). This is a bit of an outlier compared to the rest of the portfolio, which has a median market cap of $435 million and a weighted forward P/E of 7. Why have you decided to include Facebook over other large caps?

Andrew Oskoui: While Facebook is not as cheap as it was in 2018, it is still a good value. Facebook is highly attractive due to the competitive moat of its network effect and the long-term rotation into online advertising from traditional media advertising.

Furthermore, investments in other businesses create multiple pathways towards future growth and monetization of their large user base (currently at 2.4 billion daily active users). Facebook recently completed a 9.99% purchase of Jio, an Indian phone company that is the largest provider of 4G services in the country.

Facebook will be able to integrate JioMart with WhatsApp, a messaging platform particularly popular in India, to create a powerful e-commerce and digital transaction platform for tens of millions of small businesses in that country.

Facebook also has a venture-like portfolio of businesses such as virtual reality focused Oculus and user interface focused Ctrl Labs.

For value investors, the future growth of a business is an essential determinant of its present value. It is acceptable to pay higher current multiples if investors will be sufficiently compensated in the future.

In the case of Facebook, I believe the company can achieve 20% annualized revenue growth over the next four years while maintaining margins. At current prices, this suggests the stock is trading at a low-teen multiple of 2023 free cash flow.

The most considerable risk to Facebook is the threat of regulatory action either from the U.S. or European governments.

Facebook could face challenges on anything from monopoly concerns, ad policies to user privacy. Some countries are also enlisting Facebook to act as a censor on user content with threats of fines for failing to police content unacceptable to regulators. Another possible avenue of regulation involves news aggregation and revenue sharing with publishers.

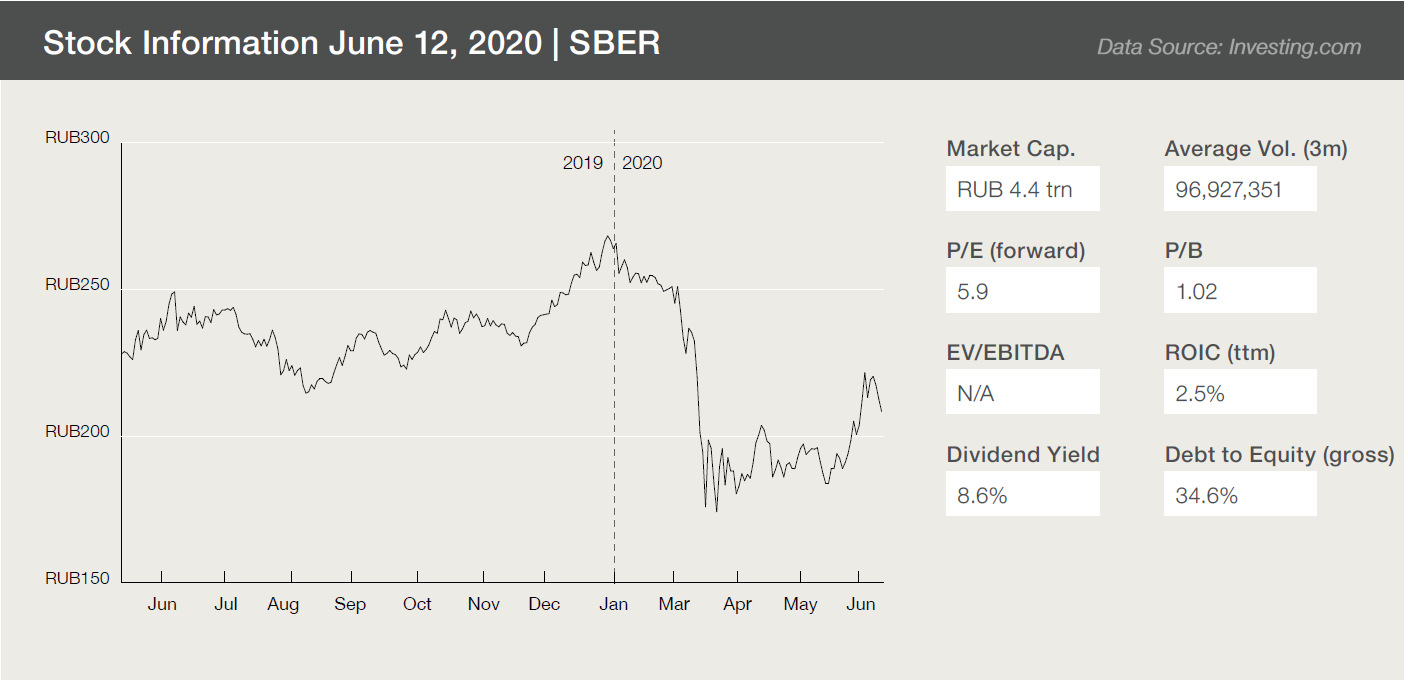

HVS: One international investment we discussed in our last interview was the Russian bank Sberbank (SBER). The stock is still a top-five holding in the portfolio today. Has the business “outperformed rivals” as you expected since 2016?

Andrew Oskoui: Yes, Sberbank’s stock price has dramatically outperformed its main public competitor in Russia, VTB Bank.

The company has roughly maintained its market share in Russia from where it was in 2016. The business has used its earnings to significantly deleverage its balance sheet over the last several years as well as invest in technology to create new lines of business and increase efficiency.

This has allowed the banking group to decrease its number of employees and branch locations in Russia while still growing their business. Globally, Sberbank’s headcount has reduced from 325k employees in 2016 to 281k in 2019. At current prices (197.25 RUB), it now offers a forward dividend yield of approximately 9.5%.

HVS: In 2016 you highlighted that between 2011 and 2015, Sberbank’s total assets grew by 26% per year and book value per share by 17% per year. Has the company managed to maintain this rate of growth?

Andrew Oskoui: Sanctions on Russia have significantly impacted Sberbank’s ability to grow internationally. This has led to a loss of market share in some countries and persuaded them to sell their subsidiary in Turkey (DenizBank) and scale back operations in Ukraine and E.U. countries.

As a result, they have failed to maintain their asset growth. Per share assets grew 5.7% per annum between the end of 2016 to the end of 2019.

Due to increasing efficiencies, reinvested earnings, and deleveraging, Sberbank has managed to maintain the growth of its book value per share at 16.7% per annum. It has continued to grow and gain market share in some countries, including Belarus, Kazakhstan, and Bosnia and Herzegovina. Another business you spoke about in 2016, and that’s still in the portfolio, is Ezcorp (EZPW).

HVS: At the time of our interview, you placed a total market value of $813 million on the stock, giving a conservative target share price of $15.90. Has your estimate of intrinsic value changed?

Andrew Oskoui: I believe the company is even more valuable today than it was in 2016. It has paid off much of its convertible debt with cash and has made significant technology investments, including a new point of sale system, specialized for the pawn industry, and a new mobile app for customers to manage their loans online.

Given the current global situation, it is difficult to make an accurate sum-of-the-parts value analysis of the company. It had not reported a quarterly result since February 3rd before the Covid-19 pandemic had spread throughout North America. If Ezcorp were trading at the same trailing EV/EBITDA multiple as public competitor, First Cash Financial Services, on May 1st, the shares would be worth more than $17.

HVS: Do you think the stock’s still a buy after recent declines?

Andrew Oskoui: Yes, as a countercyclical industry, a recession is an excellent environment for pawn shops to operate. With Ezcorp’s U.S. geographic concentration within Texas and Florida, the group will likely see increased credit demand from borrowers affected by the declines in the tourism and energy sectors.

HVS: Another stock you highlighted in our interview in 2016 was Nicholas Financial (NICK). You suggested that a return to a pre-crisis valuation of 1.64x tangible book value would translate into a price of $22.78 per share. The stock has struggled to get above $12. What has gone wrong for the business?

Andrew Oskoui: For financial stocks, a company needs to have either an underwriting or funding advantage. Otherwise, there will be no ability for them to outperform their competition over the longterm.

Originally, Nicholas Financial had an underwriting advantage over other subprime auto-lenders due to its unusual compensation structure for local branch managers where compensation was tied to the credit quality of their loan book.

However, technological innovation and aggressive competition have put Nicholas Financial at a significant disadvantage. For example, some subprime auto-lenders have started using starter interrupt devices, which allows the lender to disable a car when the borrower is behind on payments, and GPS trackers in the cars they lend against.

This makes collections and repossession much more manageable and creates a strong incentive for the borrower to be on time with their payments. Nicholas Financial’s failure to integrate these new technologies and regulatory changes from the Consumer Financial Protection Bureau (CFPB) affected their collections, and the lack of scale put them at a significant disadvantage.

For the above reasons, we exited in July 2017.

We sold for less than our average weighted purchase price, and the company has declined significantly more since we sold.

The lesson to take from this investment is to be observant of how legislative changes or technological disruption can break a company’s competitive advantage.

Many value stocks in the world today are “melting ice cubes”; businesses that will have deteriorating enterprise value and negative organic growth.

Historically, many of these companies have been excellent investments if their decline was slow enough, and the purchase price low enough. Technological disruption has become a more significant factor in investing, and today ice cubes melt faster.

Want to hear more from? Andrew Oskoui Sign up to see the full thing

Video: Top 5 Stocks Among Hedge Funds

At Insider Monkey we scour multiple sources to uncover the next great investment idea. There is a lot of volatility in the markets and this presents amazing investment opportunities from time to time. For example, this trader claims to deliver juiced up returns with one trade a week, so we are checking out his highest conviction idea. A second trader claims to score lucrative profits by utilizing a “weekend trading strategy”, so we look into his strategy’s picks. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We recently recommended several stocks partly inspired by legendary Bill Miller’s investor letter. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 in February after realizing the coronavirus pandemic’s significance before most investors. You can subscribe to our free enewsletter below to receive our stories in your inbox: