Hedge funds are not perfect. They have their bad picks just like everyone else. Valeant, a stock hedge funds have loved, lost 79% during the last 12 months ending in November 21. Although hedge funds are not perfect, their consensus picks do deliver solid returns, however. Our data show the top 30 mid-cap stocks among the best performing hedge funds yielded an average return of 18% in the same time period, vs. a gain of 7.6% for the S&P 500 Index. Because hedge funds have a lot of resources and their consensus picks do well, we pay attention to what they think. In this article, we analyze what the successful funds think of Weingarten Realty Investors (NYSE:WRI).

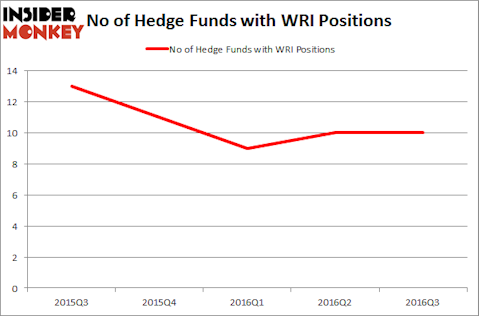

Weingarten Realty Investors (NYSE:WRI) shares didn’t see a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 10 hedge funds’ portfolios at the end of the third quarter of 2016. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Six Flags Entertainment Corp (NYSE:SIX), Michaels Companies Inc (NASDAQ:MIK), and IAC/InterActiveCorp (NASDAQ:IAC) to gather more data points.

Follow Weingarten Realty Investors (NYSE:WRI)

Follow Weingarten Realty Investors (NYSE:WRI)

Receive real-time insider trading and news alerts

Brian A Jackson/Shutterstock.com

With all of this in mind, let’s take a gander at the latest action surrounding Weingarten Realty Investors (NYSE:WRI).

Hedge fund activity in Weingarten Realty Investors (NYSE:WRI)

At the end of the third quarter, a total of 10 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the second quarter of 2016. By comparison, 11 hedge funds held shares or bullish call options in WRI heading into this year. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Millennium Management, one of the 10 largest hedge funds in the world, holds the number one position in Weingarten Realty Investors (NYSE:WRI). Millennium Management has a $36.9 million position in the stock, comprising 0.1% of its 13F portfolio. The second largest stake is held by Echo Street Capital Management, led by Greg Poole, which holds a $9.9 million position; 0.4% of its 13F portfolio is allocated to the stock. Some other hedge funds and institutional investors that hold long positions comprise Ken Fisher’s Fisher Asset Management, Jim Simons’s Renaissance Technologies and Cliff Asness’s AQR Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: D E Shaw. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Echo Street Capital Management).

Let’s now take a look at hedge fund activity in other stocks similar to Weingarten Realty Investors (NYSE:WRI). These stocks are Six Flags Entertainment Corp (NYSE:SIX), Michaels Companies Inc (NASDAQ:MIK), IAC/InterActiveCorp (NASDAQ:IAC), and AutoNation, Inc. (NYSE:AN). This group of stocks’ market values match WRI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SIX | 28 | 1041188 | -4 |

| MIK | 23 | 510205 | 1 |

| IAC | 31 | 1291066 | -4 |

| AN | 25 | 1167090 | -3 |

As you can see these stocks had an average of 26.75 hedge funds with bullish positions and the average amount invested in these stocks was $1002 million. That figure was $62 million in WRI’s case. IAC/InterActiveCorp (NASDAQ:IAC) is the most popular stock in this table. On the other hand Michaels Companies Inc (NASDAQ:MIK) is the least popular one with only 23 bullish hedge fund positions. Compared to these stocks Weingarten Realty Investors (NYSE:WRI) is even less popular than MIK. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.