SLS Management is a New York-based hedge fund that was founded by Scott Lawrence Swid. The fund had an equity portfolio worth $58.07 million at the end of September, compared to $45.55 million a quarter earlier. According to our calculations, which take into account only the fund’s long positions in companies worth at least $1.0 billion, SLS Management returned 12.43% in the third quarter, based on the size of eight holdings at the end of June.

Investor exodus, contracting returns and insider trading scandals have resulted in a declining confidence in the hedge fund industry, but Insider Monkey comprehensive research has revealed some interesting aspects of the story. When we look at the third-quarter returns of the hedge funds in our database which had at least five long positions in companies valued at $1 billion or more, we see their long picks returned 8.3% on average, a full 5.0 percentage points above S&P 500 ETFs. However, that long stock-picking prowess is often overshadowed by the hedged portion of their portfolios, in options, bonds, and short positions. We believe that investors should pay attention to hedge funds’ top picks for a chance to beat the market. In this article, we’ll take a closer look at four companies, NorthStar Asset Management Group Inc (NYSE:NSAM), PTC Inc (NASDAQ:PTC), CONMED Corporation (NASDAQ:CNMD), and Myriad Genetics, Inc. (NASDAQ:MYGN) and will see how the fund traded them between July and September.

Inozemtsev Konstantin/Shutterstock.com

SLS Management upped its stake in NorthStar Asset Management Group Inc (NYSE:NSAM) by 3% in the third quarter, amassing a total of over 2.06 million shares of the company worth $26.62 million at the end of September. The stock advanced by 27.7% during the third quarter. A total of 48 of the hedge funds tracked by Insider Monkey were long NorthStar Asset Management’s stock, down by 9% over the quarter. The largest stake in NorthStar Asset Management Group Inc (NYSE:NSAM) was held by MSDC Management, which reported holding $130.4 million worth of stock as of the end of June. It was followed by Abrams Capital Management with a $111.4 million position. Other investors bullish on the company included Samlyn Capital, MSD Capital, and Adage Capital Management.

Follow Northstar Asset Management Group Inc.

Follow Northstar Asset Management Group Inc.

Receive real-time insider trading and news alerts

At the end of September, there were 73,915 shares of PTC Inc (NASDAQ:PTC) worth $3.27 million in SLS Management’s portfolio. The fund cut its stake by 42% during the third quarter, as the stock gained 17.9%. During the second quarter, the number of funds from our database long PTC Inc (NASDAQ:PTC) inched up by 3% to 32. Eminence Capital was the largest shareholder of PTC Inc (NASDAQ:PTC), with a stake worth $109.8 millions reported as of the end of June. Trailing Eminence Capital was P2 Capital Partners, which amassed a stake valued at $69.7 million. Palestra Capital Management, Tensile Capital, and Citadel Investment Group also held valuable positions in the company.

Follow Ptc Inc. (NASDAQ:PTC)

Follow Ptc Inc. (NASDAQ:PTC)

Receive real-time insider trading and news alerts

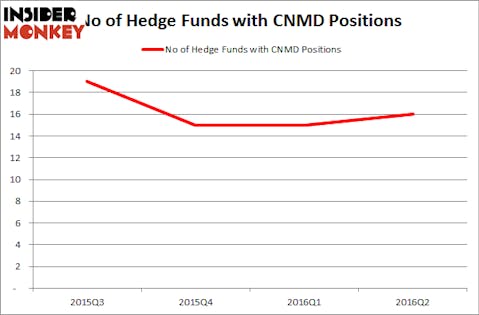

SLS Management closed its stake in CONMED Corporation (NASDAQ:CNMD), having unloaded 96,001 shares it had held at the end of June. The move was made as the stock lost 15.7% between July and September. The number of funds followed by us long CONMED Corporation increased by one to 16 during the second quarter. Among these funds, Scopia Capital held the largest stake in CONMED Corporation (NASDAQ:CNMD), which was worth $132.4 million at the end of June. Trailing Scopia Capital was Fisher Asset Management, which amassed a stake valued at $21.8 million. Huber Capital Management, Point72 Asset Management, and Ghost Tree Capital also held valuable positions in the company.

Follow Conmed Corp (NYSE:CNMD)

Follow Conmed Corp (NYSE:CNMD)

Receive real-time insider trading and news alerts

Myriad Genetics, Inc. (NASDAQ:MYGN) is another company that SLS Management dumped during the third quarter as the stock plunged by 32.7%. In this way, the fund sold all of its 109,300 shares it had reported in its 13F for the second quarter. At the end of June, 28 of the hedge funds tracked by Insider Monkey were long this stock, up by 33% over the quarter. Among these funds, Scopia Capital held the most valuable stake in Myriad Genetics, Inc. (NASDAQ:MYGN), which was worth $142.4 million at the end of the second quarter. On the second spot was Iridian Asset Management which amassed $98.4 million worth of shares. Moreover, D E Shaw, Renaissance Technologies, and Royce & Associates were also bullish on Myriad Genetics, Inc. (NASDAQ:MYGN).

Follow Myriad Genetics Inc (NASDAQ:MYGN)

Follow Myriad Genetics Inc (NASDAQ:MYGN)

Receive real-time insider trading and news alerts

Disclosure: none