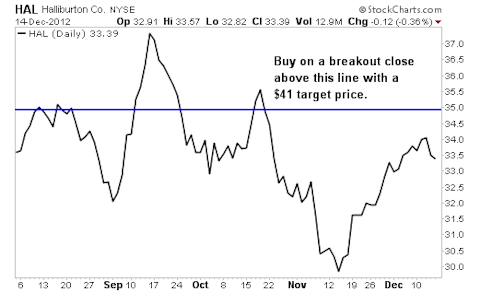

But recent upticks in natural gas prices, increasing U.S. oil production and renewed interest in Gulf of Mexico deepwater oil exploration have all contributed to Haliburton’s recent bounce from its lows. In addition, the potential for international shale gas extraction is staggering and Haliburton is perfectly poised to profit as this gas extraction technique spreads worldwide. As a result, the stock has bounced from its mid-November lows in the $30 range to just above $34. But the uptrend may be stalling, because of declining volume, making the breakout strategy a wise tactic right now. A daily close above $35 a share will trigger a long entry with a 12-month target of $41.

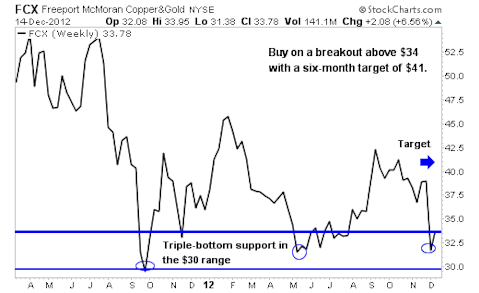

2. Freeport-McMoRan Copper & Gold Inc. (NYSE:FCX)

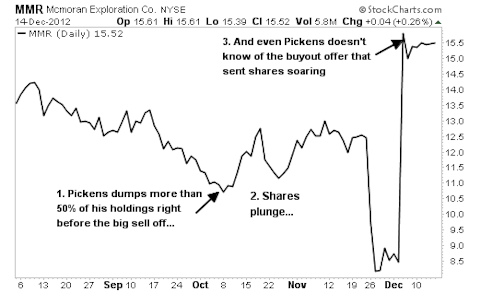

Pickens dumped more than 50% of his position in Mcmoran Exploration Co (NYSE:MMR) last quarter, and now holds roughly 345,000 shares of the stock. As the stock plunged from about $13 a share in late November to roughly $7 in December. The sell-off was primarily caused by a mechanical failure at the company’s Davy Jones Well. However, just to show that even the most knowledgeable insider investors don’t know everything, the former parent company of McMoRan Exploration, Freeport-McMoRan Copper & Gold Inc. (NYSE:FCX) made an offer to buy the company back at a 74% premium from the Dec. 4 closing price of $8.46 a share. McMoRan Exploration trades now at almost double that, roughly $15.50.

Clearly, Freeport-McMoRan believes there is value in their former exploration company. This repurchase partially resulted in shares of Freeport-McMoRan plunging to technical support just above the $30 range, forming a triple bottom on the weekly chart. The stock has started to bounce higher and is presently in the mid-$32 range, setting up another classic breakout trade. This recent selloff has created aninvestment opportunity in Freeport-McMoRan. As the global economy continues to improve, this acquisition-seeking miner will likely see strong upside. My strategy would be to buy Freeport-McMoRan on the first daily close above $34 with a six month target price of $41.

Risks to Consider: The fact that Pickens was selling his shares in McMoRan Exploration prior to the buyback offer is a clear lesson that even the most sophisticated insiders don’t always know what the future holds. While I firmly think that following the big funds and insiders is a smart way to invest, it certainly isn’t fool-proof. In addition, Haliburton and Freeport-McMoRan are highly dependent on the world’s economy for their success. Investment in either stock boils down to a macro play on the continued improvement of the world’s economic situation. It’s critical to keep this in mind prior to investing.

Action to Take –> I am a global macro bull going into 2013, therefore I am bullish on both stocks. While it’s likely too late to capitalize on the McMoRan Exploration deal directly, I like the parent company Freeport-McMoRan and Haliburton as stocks with good potential for at least a 30% increase next year. Remember to always use stops and position size correctly based on your risk tolerance whenever investing in the stock market.

This article was originally written by Dave Goodboy, and posted on StreetAuthority.