You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund investors like Carl Icahn and George Soros hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

Hedge fund interest in Seaspan Corporation (NYSE:SSW) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare SSW to other stocks including GNC Holdings Inc (NYSE:GNC), Adecoagro SA (NYSE:AGRO), and Accelerate Diagnostics Inc (NASDAQ:AXDX) to get a better sense of its popularity.

Follow Seaspan Corp (NYSE:SSW)

Follow Seaspan Corp (NYSE:SSW)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

weerasak saeku/Shutterstock.com

With all of this in mind, let’s take a glance at the key action encompassing Seaspan Corporation (NYSE:SSW).

How are hedge funds trading Seaspan Corporation (NYSE:SSW)?

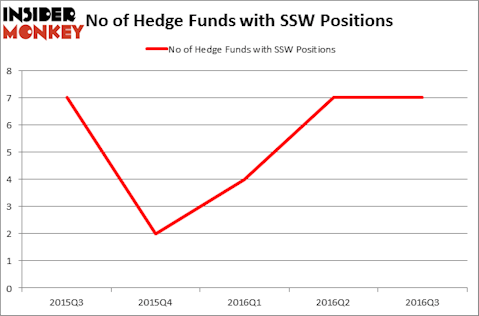

Heading into the fourth quarter of 2016, a total of 7 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards SSW over the last 5 quarters. With hedge funds’ sentiment swirling, there exists a few key hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Renaissance Technologies, one of the largest hedge funds in the world, holds the biggest position in Seaspan Corporation (NYSE:SSW). Renaissance Technologies has a $15.7 million position in the stock, comprising less than 0.1%% of its 13F portfolio. Coming in second is John Overdeck and David Siegel of Two Sigma Advisors, with a $1.5 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining members of the smart money that hold long positions encompass D. E. Shaw’s D E Shaw, Israel Englander’s Millennium Management and Ken Griffin’s Citadel Investment Group. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.