Investing in small cap stocks has historically been a way to outperform the market, as small cap companies typically grow faster on average than the blue chips. That outperformance comes with a price, however, as there are occasional periods of higher volatility and underperformance. The time period between the end of June 2015 and the end of June 2016 was one of those periods, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by more than 10 percentage points. Given that the funds we track tend to have a disproportionate amount of their portfolios in smaller cap stocks, they have been underperforming the large-cap indices. However, things have dramatically changed over the last 5 months. Small-cap stocks reversed their misfortune and beat the large cap indices by almost 11 percentage points since the end of June. In this article, we use our extensive database of hedge fund holdings to find out what the smart money thinks of Quanta Services Inc (NYSE:PWR) .

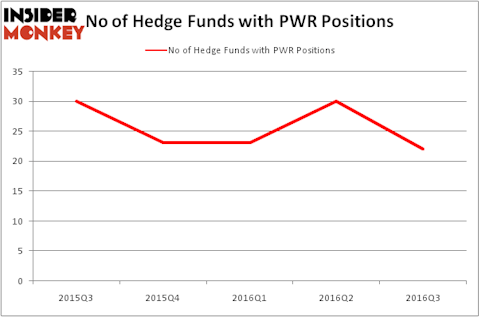

Quanta Services Inc (NYSE:PWR) was in 22 hedge funds’ portfolios at the end of the third quarter of 2016. PWR shareholders have witnessed a decrease in support from the world’s most successful money managers of late. There were 30 hedge funds in our database with PWR positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Seaboard Corporation (NYSEAMEX:SEB), Validus Holdings, Ltd. (NYSE:VR), and Genesee & Wyoming Inc (NYSE:GWR) to gather more data points.

Follow Quanta Services Inc. (NYSE:PWR)

Follow Quanta Services Inc. (NYSE:PWR)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

How are hedge funds trading Quanta Services Inc (NYSE:PWR)?

At the end of the third quarter, a total of 22 of the hedge funds tracked by Insider Monkey were bullish on this stock, a drop of 27% from the previous quarter. By comparison, 23 hedge funds held shares or bullish call options in PWR heading into this year. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, AQR Capital Management, led by Cliff Asness, holds the number one position in Quanta Services Inc (NYSE:PWR). AQR Capital Management has a $92.8 million position in the stock. Sitting at the No. 2 spot is Point72 Asset Management, led by Steve Cohen, holding a $47.4 million position. Some other peers that hold long positions comprise Israel Englander’s Millennium Management, Ken Grossman and Glen Schneider’s SG Capital Management and Anand Parekh’s Alyeska Investment Group. We should note that SG Capital Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Due to the fact that Quanta Services Inc (NYSE:PWR) has gone through falling interest from hedge fund managers, logic holds that there was a specific group of hedgies who were dropping their positions entirely in the third quarter. It’s worth mentioning that George Hall’s Clinton Group sold off the biggest stake of the “upper crust” of funds studied by Insider Monkey, comprising close to $3.1 million in stock. Ben Levine, Andrew Manuel and Stefan Renold’s fund, LMR Partners, also cut its stock, about $2.3 million worth.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Quanta Services Inc (NYSE:PWR) but similarly valued. We will take a look at Seaboard Corporation (NYSEAMEX:SEB), Validus Holdings, Ltd. (NYSE:VR), Genesee & Wyoming Inc (NYSE:GWR), and AGCO Corporation (NYSE:AGCO). This group of stocks’ market caps resemble PWR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SEB | 10 | 51591 | -2 |

| VR | 17 | 220326 | -2 |

| GWR | 12 | 169440 | -4 |

| AGCO | 26 | 577012 | 3 |

As you can see these stocks had an average of 16 hedge funds with bullish positions and the average amount invested in these stocks was $255 million. That figure was $318 million in PWR’s case. AGCO Corporation (NYSE:AGCO) is the most popular stock in this table. On the other hand Seaboard Corporation (NYSEAMEX:SEB) is the least popular one with only 10 bullish hedge fund positions. Quanta Services Inc (NYSE:PWR) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard AGCO might be a better candidate to consider taking a long position in.

Disclosure: None