Oracle Corporation (NASDAQ:ORCL) has introduced product life cycle management (PLM) and product management for process into the market. They will both assist companies of different types to make innovations profitable and enhance usability and processes. I will explain how product management spending will favor the growth of Oracle’s new products. Specifically, I will look at the effect of the PLM market and the demand for the products on Oracle’s new releases. These trends will enable Oracle to sell more of these products and improve its price multiples.

Why will Oracle achieve sales growth? It’s all about the significant rebound in the PLM market in the past few years. The market totaled more than $10.5 billion in 2011, marking the first time it grew beyond $10.0 billion. Its suppliers witnessed recoveries in industries like automotive and A&D, as well as great improvement in markets like consumer goods, energy, AEC, and shipbuilding. The industry’s market revenues for the first two quarters of 2012 showed impressive growth.

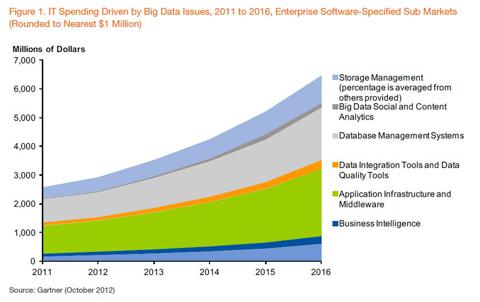

In the accompanying chart released in October 2012, Gartner, the respected analysts, predicted continuing growth over the next 5-year forecast period for database management systems. The stats about big data software bolsters the idea that Oracle’s life cycle management and product management for process will be successful.

Financials

Due to the strong sales growth of its product lifecycle management and other software, Oracle announced revenues of $9.1 billion in its second quarter 2013, an increase of 3%. GAAP operating margin of 38%, and non-GAAP operating margin was 47%. GAAP net income grew 18% to $2.6 billion, while non-GAAP net income also went up 12% to $3.1 billion. GAAP earnings per share was $0.53, up 24% compared to last year, while non-GAAP earnings per share was up 18% to $0.64. New software licenses and cloud software subscriptions revenues were up 17% to $2.4 billion. Software license updates and product support revenues were up 7% to $4.3 billion.

“Strong organic growth in our software business coupled with a focus on the highly profitable engineered systems segment of our hardware business enabled a Q2 non-GAAP operating margin of 47%,” said Oracle President and CFO Safra Catz.

Oracle announced in its first quarter 2013 report that operating income was up 7% to $2.9 billion, and tis operating margin was 35%. Non-GAAP operating income increased by 1% to $3.6 billion, and non-GAAP operating margin was 44%. Net income grew 11% to $2.0 billion, while non-GAAP net income also went up 6% to $2.6 billion. More importantly, new software licenses and cloud software subscriptions revenues were up 5% to $1.6 billion, while non-GAAP new software licenses and cloud software subscriptions revenues were up 6% to $1.6 billion.

“On a non-GAAP basis, new software licenses and cloud software subscriptions sales grew 11% in constant currency and operating margin increased to 44% in Q1,” said Safra Catz. “Q1 operating cash flow increased to a record high of $5.7 billion. We’re off to a good start in the new year.”

Oracle’s Initiative in Product Lifestyle Management

Oracle has done a lot in the past few months to increase its market share in the product lifestyle management industry. The company announced the release of applications called Innovation Management, a software to challenge the industry’s definition of product life cycle management. It also released Agile PLM 9.3.2 into the competitive PLM market. It improved on products such as the PLM for Discrete Manufacturing, for Process, for AutoVue and for Enterprise Visualization.

Oracle’s new PLM products introduce new features such as governance and compliance, cost management, and quality management into the Agile product line. For instance, Oracle Agile PLM for Process will provide innovation in formula modeling and compliance and also introduce a new module. The module enables information to be to open to concerned staff in a company by offering a condition to access and process information related to quality within the product record.

“One of the most complex challenges that organizations of all sizes and types face is how to innovate profitably,” said John Kelley, vice president of product value chain strategy, Oracle. “With the enhancements to Oracle’s Agile PLM and Oracle’s Agile PLM for Process as well as the introduction of innovative new modules like Oracle’s Agile Product Quality Management (PQM) for Process, Oracle is able to help organizations further shorten cycle times, increase sales, lower costs and reduce risks associated with innovation. This combination helps organizations cost-effectively reach their innovation goals.”

It is noticeable that the new Oracle initiative is the first for the PLM sector this year. Now it is understandable that gaining a head start is wise for Oracle. We have related Oracle’s previous PLM and software initiative to its recent financial statements, and we found that Oracle has been improved in comparison to the previous year.

Competition

Let’s check how Oracle is performing compared to its competitors. With a gross margin of 80.27%, compared with 69.24% for SAP AG (ADR) (NYSE:SAP), 51.76% for International Business Machines Corp. (NYSE:IBM), and 73.47% for Microsoft Corporation (NASDAQ:MSFT), and earnings per share of 2.13, compared with 1.62 for Microsoft and 0.49 for Alcatel Lucent SA (ADR) (NYSE:ALU), and price-to-earning ratio of 16.56, compared to 26.11 for SAP and 32.76 for Dassault Systemes S.A. (ADR) (PINK:DASTY), Oracle is outperforming its peers.

SAP completes with Oracle through its cloud computing and social enterprise solutions to various businesses and industries around the globe. SAP reported fourth quarter revenue growth of 12% year-over-year. The company saw strong demand for its cloud applications, its HANA in-memory database, and mobile applications. The company generated $6.6 billion in revenue in the fourth quarter. Software and software-related service revenue grew by 14% year-over-year. SAP forecasts software and software-related service revenue growth of 11% to 13%, and also expects software and cloud subscriptions revenue growth between 14% to 20%.

SAP recently announced that it will be deepening its collaboration with NetApp Inc. (NASDAQ:NTAP) in order to support next-generation solutions, which includes the SAP HANA platform and SAP NetWeaver Landscape Virtualization Management software. By enhancing this collaboration, the companies will be in a better position to provide a more robust data infrastructure for SAP applications that could create competitive advantage and reduce ownership costs.

Sure, SAP product Lifecycle Management application is used by more than 8,300 customers worldwide, but the company does not have a new product in this category to challenge Oracle’s this year. Though SAP is a threat with its cloud computing products, Oracle has a broader range of products and is winning the revenue race. I believe Oracle is the better buy here.

Dassault’s revenue results for the fourth quarter were in line with its expectations. Dassault saw revenue growth of 7% (IFRS) and 8% (non-IFRS) based on constant currencies. The company saw strong revenue growth of 14% in Asia. In North America, non-IFRS revenue jumped 9% year-over-year. Revenue from the company’s software segment jumped 8% (IFRS) and 9% (non-IFRS).

Dassault also competes with Oracle in the cloud computing space. Oracle acquired Taleo for $1.9 billion, but Dassault only paid $26 million for Netvibes. While the Taleo acquisition solidifies Oracle’s commitment to rapidly expand its cloud platform, the Netvibes should not be ignore by investors looking at these companies. In acquiring Netvibes, Dassault added social monitoring, analytics, and decision support capabilities into its PLM platform. However, Dassault is lacking a tool that can properly manage the ideation process. This is where Oracle wins out – looking at the social collaboration angle, bringing the Oracle Social Network to Taleo will be very enticing to customers. I believe Oracle is the better investment between these two companies.

Dassault has the V6R2013x in the market, but Oracle’s new products matches it in usability and efficiency. But Oracle does face significant challenges, including the potential for market share erosion from smaller, specialized companies such as Navatar Group, a provider of financial cloud computing solutions for Wall Street firms.

Conclusion

Looking at the new product releases in relation to their prospects and Oracle’s improving margins, I can safely say that Oracle is a good buy at the moment.

The article How PLM Will Affect Oracle originally appeared on Fool.com and is written by Maxwell Fisher.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.