A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended September 30, so let’s proceed with the discussion of the hedge fund sentiment on Ocular Therapeutix Inc (NASDAQ:OCUL).

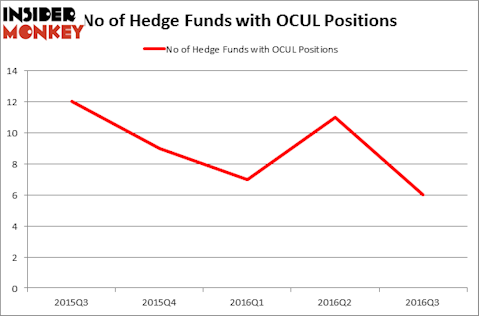

Ocular Therapeutix Inc (NASDAQ:OCUL) investors should be aware of a decrease in enthusiasm from smart money of late. There were 11 hedge funds in our database with OCUL holdings at the end of the second quarter, which fell by 5 during the third quarter. At the end of this article we will also compare OCUL to other stocks including Avenue Income Credit Strategies Fund (NYSE:ACP), Pacific Mercantile Bancorp (NASDAQ:PMBC), and CyberOptics Corporation (NASDAQ:CYBE) to get a better sense of its popularity.

Follow Ocular Therapeutix Inc (NASDAQ:OCUL)

Follow Ocular Therapeutix Inc (NASDAQ:OCUL)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

wavebreakmedia/Shutterstock.com

How are hedge funds trading Ocular Therapeutix Inc (NASDAQ:OCUL)?

At the end of the third quarter, a total of 6 of the hedge funds tracked by Insider Monkey were long this stock, a 45% tumble from the previous quarter. By comparison, 9 hedge funds held shares or bullish call options in OCUL heading into this year, which has fallen by 33% in 2016. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Columbus Circle Investors, holds the biggest position in Ocular Therapeutix Inc (NASDAQ:OCUL). Columbus Circle Investors has a $3.4 million position in the stock. The second most bullish fund manager is Thomas Bailard of Bailard Inc, with a $2.2 million position. Some other hedge funds and institutional investors with similar optimism comprise Brian Ashford-Russell and Tim Woolley’s Polar Capital, Hal Mintz’s Sabby Capital, and Mike Vranos’ Ellington. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds, which is based on the performance of their 13F long positions in non-micro-cap stocks.

Because Ocular Therapeutix Inc (NASDAQ:OCUL) has encountered a decline in interest from the smart money, we can see that there was a specific group of hedge funds who were dropping their full holdings in the third quarter. Intriguingly, Phil Frohlich’s Prescott Group Capital Management sold off the largest position of the 700 funds followed by Insider Monkey, comprising about $1.8 million in stock. James A. Silverman’s fund, Opaleye Management, also said goodbye to its stock, about $1.3 million worth.

Let’s now take a look at hedge fund activity in other stocks similar to Ocular Therapeutix Inc (NASDAQ:OCUL). We will take a look at Avenue Income Credit Strategies Fund (NYSE:ACP), Pacific Mercantile Bancorp (NASDAQ:PMBC), CyberOptics Corporation (NASDAQ:CYBE), and EnerNOC, Inc. (NASDAQ:ENOC). This group of stocks’ market values match OCUL’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ACP | 4 | 6629 | 1 |

| PMBC | 2 | 10176 | 0 |

| CYBE | 5 | 12463 | 5 |

| ENOC | 5 | 24289 | -5 |

As you can see these stocks had an average of 4 hedge funds with bullish positions and the average amount invested in these stocks was $13 million. That figure was $6 million in OCUL’s case. CyberOptics Corporation (NASDAQ:CYBE) is the most popular stock in this table. On the other hand Pacific Mercantile Bancorp (NASDAQ:PMBC) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Ocular Therapeutix Inc (NASDAQ:OCUL) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio, though the huge decline in hedge fund ownership is worrisome.

Disclosure: None