The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge funds have been producing disappointing net returns in recent years, however that was partly due to the poor performance of small-cap stocks in general. Well, small-cap stocks finally turned the corner and have been beating the large-cap stocks by more than 10 percentage points over the last 5 months.This means the relevancy of hedge funds’ public filings became inarguable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Imation Corp. (NYSE:IMN).

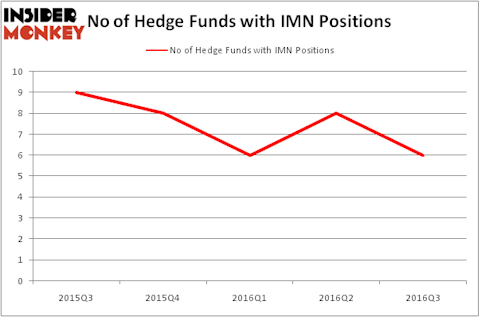

Imation Corp. (NYSE:IMN) investors should pay attention to a decrease in support from the world’s most successful money managers lately. There were 8 hedge funds in our database with IMN positions at the end of the second quarter, while only 6 still held the stock a quarter later. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Echelon Corporation (NASDAQ:ELON), Mast Therapeutics Inc (NYSEAMEX:MSTX), and SMTC Corporation (USA) (NASDAQ:SMTX) to gather more data points.

Follow Glassbridge Enterprises Inc. (OTC:GLAE)

Follow Glassbridge Enterprises Inc. (OTC:GLAE)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Portogas D Ace/Shutterstock.com

What does the smart money think about Imation Corp. (NYSE:IMN)?

At the end of the third quarter, a total of 6 of the hedge funds tracked by Insider Monkey held long positions in this stock, a 25% drop from the previous quarter. Below, you can check out the change in hedge fund sentiment towards IMN over the last 5 quarters, which has fallen by 50% during that time. With hedgies’ sentiment swirling, there exists a select group of noteworthy hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, John W. Rogers’ Ariel Investments has the largest position in Imation Corp. (NYSE:IMN), worth close to $5.1 million. The second most bullish fund manager is Private Capital Management, led by Gregg J. Powers, holding a $1.8 million position. Some other professional money managers with similar optimism contain Renaissance Technologies, one of the largest hedge funds in the world, George Hall’s Clinton Group, and Israel Englander’s Millennium Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds, which is based on the performance of their 13F long positions in non-micro-cap stocks.