Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Navios Maritime Holdings Inc. (NYSE:NM).

Hedge fund interest in Navios Maritime Holdings Inc. (NYSE:NM) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare NM to other stocks including Armstrong Flooring, Inc. (NYSE:AFI), WidePoint Corporation (NYSE:WYY), and CSI Compressco LP (NASDAQ:CCLP) to get a better sense of its popularity.

Video: Watch our video about the top 5 most popular hedge fund stocks.

At the moment there are a large number of formulas investors can use to assess their stock investments. Two of the most underrated formulas are hedge fund and insider trading signals. Our researchers have shown that, historically, those who follow the top picks of the best money managers can outclass the broader indices by a significant margin (see the details here).

Jim Simons of Renaissance Technologies

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, legendary investor Bill Miller told investors to sell 7 extremely popular recession stocks last month. So, we went through his list and recommended another stock with 100% upside potential instead. We interview hedge fund managers and ask them about their best ideas. You can watch our latest hedge fund manager interview here and find out the name of the large-cap healthcare stock that Sio Capital’s Michael Castor expects to double. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Now let’s take a peek at the latest hedge fund action encompassing Navios Maritime Holdings Inc. (NYSE:NM).

How have hedgies been trading Navios Maritime Holdings Inc. (NYSE:NM)?

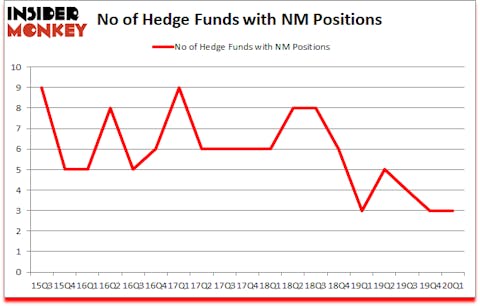

At Q1’s end, a total of 3 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. On the other hand, there were a total of 3 hedge funds with a bullish position in NM a year ago. With hedge funds’ sentiment swirling, there exists a select group of noteworthy hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

The largest stake in Navios Maritime Holdings Inc. (NYSE:NM) was held by Renaissance Technologies, which reported holding $1.9 million worth of stock at the end of September. It was followed by Nut Tree Capital with a $0.9 million position. The only other hedge fund that is bullish on the company was Citadel Investment Group.

Earlier we told you that the aggregate hedge fund interest in the stock was unchanged and we view this as a negative development. Even though there weren’t any hedge funds dumping their holdings during the third quarter, there weren’t any hedge funds initiating brand new positions. This indicates that hedge funds, at the very best, perceive this stock as dead money and they haven’t identified any viable catalysts that can attract investor attention.

Let’s also examine hedge fund activity in other stocks similar to Navios Maritime Holdings Inc. (NYSE:NM). We will take a look at Armstrong Flooring, Inc. (NYSE:AFI), WidePoint Corporation (NYSE:WYY), CSI Compressco LP (NASDAQ:CCLP), and Zosano Pharma Corp (NASDAQ:ZSAN). All of these stocks’ market caps are closest to NM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AFI | 13 | 10277 | -2 |

| WYY | 3 | 5246 | -2 |

| CCLP | 2 | 386 | 0 |

| ZSAN | 4 | 892 | 1 |

| Average | 5.5 | 4200 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 5.5 hedge funds with bullish positions and the average amount invested in these stocks was $4 million. That figure was $3 million in NM’s case. Armstrong Flooring, Inc. (NYSE:AFI) is the most popular stock in this table. On the other hand CSI Compressco LP (NASDAQ:CCLP) is the least popular one with only 2 bullish hedge fund positions. Navios Maritime Holdings Inc. (NYSE:NM) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 7.9% in 2020 through May 22nd and surpassed the market by 15.6 percentage points. Unfortunately NM wasn’t nearly as popular as these 10 stocks (hedge fund sentiment was quite bearish); NM investors were disappointed as the stock returned -7.4% during the second quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2020.

Disclosure: None. This article was originally published at Insider Monkey.