There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Carl Icahn and George Soros think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other successful funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze Genocea Biosciences Inc (NASDAQ:GNCA) .

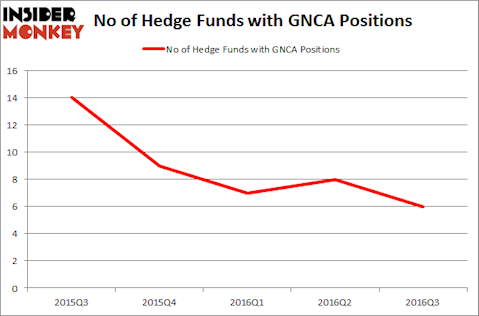

Genocea Biosciences Inc (NASDAQ:GNCA) investors should be aware of a decrease in enthusiasm from smart money recently. There were 6 hedge funds in our database with GNCA holdings at the end of September. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Genie Energy Ltd (NYSE:GNE), Willdan Group, Inc. (NASDAQ:WLDN), and Fortress Biotech Inc (NASDAQ:FBIO) to gather more data points.

Follow Genocea Biosciences Inc. (NASDAQ:GNCA)

Follow Genocea Biosciences Inc. (NASDAQ:GNCA)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

hywards/Shutterstock.com

Now, let’s take a look at the recent action regarding Genocea Biosciences Inc (NASDAQ:GNCA).

Hedge fund activity in Genocea Biosciences Inc (NASDAQ:GNCA)

Heading into the fourth quarter of 2016, a total of 6 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -25% from one quarter earlier. On the other hand, there were a total of 9 hedge funds with a bullish position in GNCA at the beginning of this year. With the smart money’s sentiment swirling, there exists a few notable hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Deerfield Management, led by James E. Flynn, holds the largest position in Genocea Biosciences Inc (NASDAQ:GNCA). Deerfield Management has a $3.5 million position in the stock, comprising 0.2% of its 13F portfolio. Sitting at the No. 2 spot is Kris Jenner, Gordon Bussard, Graham McPhail of Rock Springs Capital Management, with a $2.5 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Other members of the smart money that hold long positions contain Anand Parekh’s Alyeska Investment Group, Israel Englander’s Millennium Management, one of the 10 largest hedge funds in the world, and Matthew Strobeck’s Birchview Capital. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Since Genocea Biosciences Inc (NASDAQ:GNCA) has experienced falling interest from the aggregate hedge fund industry, it’s easy to see that there exists a select few funds who were dropping their full holdings in the third quarter. Interestingly, Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners cashed in the biggest position of the 700 funds studied by Insider Monkey, worth about $0.1 million in stock. Joseph Edelman’s fund, Perceptive Advisors, also sold off its stock, about $0.1 million worth.

Let’s go over hedge fund activity in other stocks similar to Genocea Biosciences Inc (NASDAQ:GNCA). These stocks are Genie Energy Ltd (NYSE:GNE), Willdan Group, Inc. (NASDAQ:WLDN), Fortress Biotech Inc (NASDAQ:FBIO), and Hardinge Inc. (NASDAQ:HDNG). This group of stocks’ market valuations are similar to GNCA’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GNE | 5 | 5897 | -2 |

| WLDN | 4 | 6888 | 4 |

| FBIO | 2 | 5451 | -2 |

| HDNG | 5 | 21059 | -1 |

As you can see these stocks had an average of 4 hedge funds with bullish positions and the average amount invested in these stocks was $10 million. That figure was $8 million in GNCA’s case. Genie Energy Ltd (NYSE:GNE) is the most popular stock in this table. On the other hand Fortress Biotech Inc (NASDAQ:FBIO) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Genocea Biosciences Inc (NASDAQ:GNCA) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None