Looking for high-potential stocks? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 7.6% in the 12 months ending November 21, with more than 51% of the stocks in the index failing to beat the benchmark. Therefore, the odds that one will pin down a winner by randomly picking a stock are less than the odds in a fair coin-tossing game. Conversely, best performing hedge funds’ 30 preferred mid-cap stocks generated a return of 18% during the same 12-month period. Coincidence? It might happen to be so, but it is unlikely. Our research covering a 17-year period indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like Gastar Exploration Inc (NYSEMKT:GST).

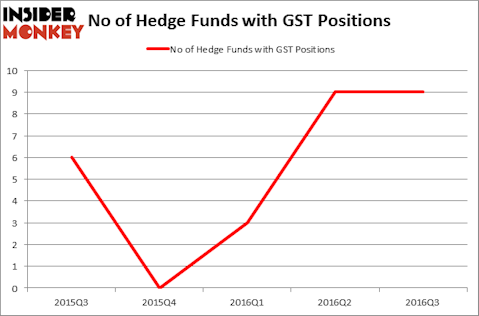

Gastar Exploration Inc (NYSEMKT:GST) shares didn’t see a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 9 hedge funds’ portfolios at the end of September, the same as at the end of June. At the end of this article we will also compare GST to other stocks including Arowana Inc. Ordinary Shares (NASDAQ:ARWA), Attunity Ltd (NASDAQ:ATTU), and Aurinia Pharmaceuticals Inc (NASDAQ:AUPH) to get a better sense of its popularity.

Follow Gastar Exploration Ltd (NYSEMKT:GST)

Follow Gastar Exploration Ltd (NYSEMKT:GST)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Nightman1965/Shutterstock.com

How have hedgies been trading Gastar Exploration Inc (NYSEMKT:GST)?

Heading into the fourth quarter of 2016, a total of 9 of the hedge funds tracked by Insider Monkey were long this stock, unchanged from the second quarter of 2016. Below, you can check out the change in bullish hedge fund positions in GST over the last 5 quarters, which has risen by 50% during that time. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, GRT Capital Partners, led by Gregory Fraser, Rudolph Kluiber, and Timothy Krochuk, holds the largest position in Gastar Exploration Inc (NYSEMKT:GST). GRT Capital Partners has a $2.1 million position in the stock. Coming in second is GLG Partners, led by Noam Gottesman, which holds a $2 million position. Other peers that are bullish encompass Philip Hempleman’s Ardsley Partners, Bruce J. Richards and Louis Hanover’s Marathon Asset Management, and Mark T. Gallogly’s Centerbridge Partners. We should note that GRT Capital Partners is among our list of the 100 best performing hedge funds, which is based on the performance of their 13F long positions in non-micro-cap stocks.

Judging by the fact that Gastar Exploration Inc (NYSMKT:GST) has sustained declining sentiment from hedge fund managers, it’s easy to see that there exists a select few hedgies who were dropping their positions entirely in the third quarter. It’s worth mentioning that Seth Fischer’s Oasis Management got rid of the largest position of all the investors watched by Insider Monkey, worth about $1.4 million in stock. Benjamin A. Smith’s fund, Laurion Capital Management, also sold off its stock, about $0.4 million worth.

Let’s also examine hedge fund activity in other stocks similar to Gastar Exploration Inc (NYSEMKT:GST). We will take a look at Arowana Inc. Ordinary Shares (NASDAQ:ARWA), Attunity Ltd (NASDAQ:ATTU), Aurinia Pharmaceuticals Inc (NASDAQ:AUPH), and Gridsum Holding Inc – ADR (NASDAQ:GSUM). All of these stocks’ market caps match GST’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ARWA | 6 | 12688 | 0 |

| ATTU | 6 | 13133 | -1 |

| AUPH | 3 | 867 | -2 |

| GSUM | 17 | 48219 | 17 |

As you can see these stocks had an average of 8 hedge funds with bullish positions and the average amount invested in these stocks was $19 million. That figure was $10 million in GST’s case. Gridsum Holding Inc – ADR (NASDAQ:GSUM) is the most popular stock in this table. On the other hand Aurinia Pharmaceuticals Inc (NASDAQ:AUPH) is the least popular one with only 3 bullish hedge fund positions. Gastar Exploration Inc (NYSEMKT:GST) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard GSUM might be a better candidate to consider taking a long position in.

Disclosure: None