Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ complex research processes to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we pay special attention to the hedge fund activity in the small-cap space. Nevertheless, it is also possible to find underpriced large-cap stocks by following the hedge funds’ moves. In this article, we look at what those funds think of FireEye Inc (NASDAQ:FEYE) based on that data.

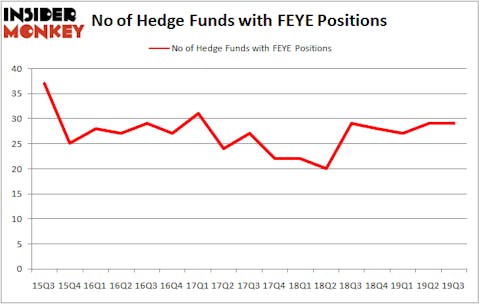

FireEye Inc (NASDAQ:FEYE) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 29 hedge funds’ portfolios at the end of the third quarter of 2019. At the end of this article we will also compare FEYE to other stocks including Coca-Cola Consolidated, Inc. (NASDAQ:COKE), QTS Realty Trust Inc (NYSE:QTS), and Moog Inc (NYSE:MOG) to get a better sense of its popularity.

In the 21st century investor’s toolkit there are numerous formulas shareholders put to use to value their holdings. Two of the most under-the-radar formulas are hedge fund and insider trading activity. Our experts have shown that, historically, those who follow the top picks of the best fund managers can outperform the market by a solid margin (see the details here).

Dmitry Balyasny of Balyasny Asset Managemnet

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock is still extremely cheap despite already gaining 20 percent. With all of this in mind let’s view the new hedge fund action regarding FireEye Inc (NASDAQ:FEYE).

Hedge fund activity in FireEye Inc (NASDAQ:FEYE)

At the end of the third quarter, a total of 29 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from the second quarter of 2019. By comparison, 29 hedge funds held shares or bullish call options in FEYE a year ago. With hedge funds’ sentiment swirling, there exists a select group of notable hedge fund managers who were adding to their stakes considerably (or already accumulated large positions).

Among these funds, Citadel Investment Group held the most valuable stake in FireEye Inc (NASDAQ:FEYE), which was worth $88 million at the end of the third quarter. On the second spot was Fisher Asset Management which amassed $36.7 million worth of shares. Masters Capital Management, Renaissance Technologies, and Osterweis Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Kettle Hill Capital Management allocated the biggest weight to FireEye Inc (NASDAQ:FEYE), around 3.79% of its 13F portfolio. Boardman Bay Capital Management is also relatively very bullish on the stock, setting aside 2.8 percent of its 13F equity portfolio to FEYE.

Because FireEye Inc (NASDAQ:FEYE) has faced falling interest from the aggregate hedge fund industry, we can see that there exists a select few fund managers that elected to cut their positions entirely heading into Q4. Intriguingly, Anand Parekh’s Alyeska Investment Group cut the largest stake of the “upper crust” of funds watched by Insider Monkey, valued at an estimated $50.9 million in stock, and Cynthia Paul’s Lynrock Lake was right behind this move, as the fund said goodbye to about $16 million worth. These transactions are important to note, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as FireEye Inc (NASDAQ:FEYE) but similarly valued. We will take a look at Coca-Cola Consolidated, Inc. (NASDAQ:COKE), QTS Realty Trust Inc (NYSE:QTS), MOGU Inc. (NYSE:MOG), and AllianceBernstein Holding LP (NYSE:AB). This group of stocks’ market caps are closest to FEYE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| COKE | 14 | 20018 | 3 |

| QTS | 24 | 382800 | 1 |

| MOG | 20 | 102823 | 2 |

| AB | 8 | 18589 | -2 |

| Average | 16.5 | 131058 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.5 hedge funds with bullish positions and the average amount invested in these stocks was $131 million. That figure was $255 million in FEYE’s case. QTS Realty Trust Inc (NYSE:QTS) is the most popular stock in this table. On the other hand AllianceBernstein Holding LP (NYSE:AB) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks FireEye Inc (NASDAQ:FEYE) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. Unfortunately FEYE wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on FEYE were disappointed as the stock returned 2% in 2019 and trailed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 65 percent of these stocks outperformed the market in 2019.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.