Looking for high-potential stocks? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 7.6% in the 12 months ending November 21, with more than 51% of the stocks in the index failing to beat the benchmark. Therefore, the odds that one will pin down a winner by randomly picking a stock are less than the odds in a fair coin-tossing game. Conversely, best performing hedge funds’ 30 preferred mid-cap stocks generated a return of 18% during the same 12-month period. Coincidence? It might happen to be so, but it is unlikely. Our research covering a 17-year period indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like AVEO Pharmaceuticals, Inc. (NASDAQ:AVEO).

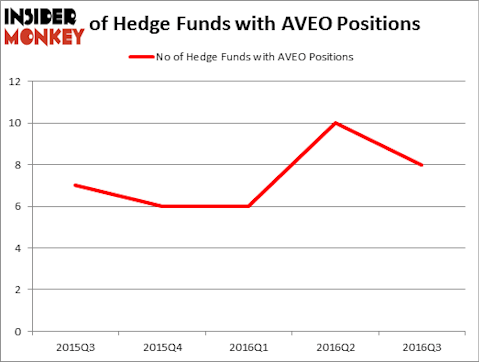

Is AVEO Pharmaceuticals, Inc. (NASDAQ:AVEO) a splendid stock to buy now? Money managers are indeed reducing their bets on the stock. The number of bullish hedge fund positions went down by 2 in recent months. AVEO was in 8 hedge funds’ portfolios at the end of September. There were 10 hedge funds in our database with AVEO positions at the end of the previous quarter. At the end of this article we will also compare AVEO to other stocks including Rentech, Inc. (NYSEAMEX:RTK), Vericel Corp (NASDAQ:VCEL), and Intec Pharma Ltd (NASDAQ:NTEC) to get a better sense of its popularity.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

wavebreakmedia/Shutterstock.co

What have hedge funds been doing with AVEO Pharmaceuticals, Inc. (NASDAQ:AVEO)?

Heading into the fourth quarter of 2016, a total of 8 of the hedge funds tracked by Insider Monkey were long this stock, a drop of 20% from one quarter earlier. On the other hand, there were a total of 6 hedge funds with a bullish position in AVEO at the beginning of this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Joseph Edelman of Perceptive Advisors holds the most valuable position in AVEO Pharmaceuticals, Inc. (NASDAQ:AVEO). Perceptive Advisors has a $2.8 million position in the stock. Sitting at the No. 2 spot is Jim Simons of Renaissance Technologies, one of the largest hedge funds in the world; with a $2.3 million position. Some other members of the smart money that are bullish comprise Alex Denner’s Sarissa Capital Management, Bihua Chen’s Cormorant Asset Management and Paul Tudor Jones’ Tudor Investment Corp. We should note that Sarissa Capital Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Judging by the fact that AVEO Pharmaceuticals, Inc. (NASDAQ:AVEO) has encountered bearish sentiment from hedge fund managers, we can see that there exists a select few funds that slashed their entire stakes last quarter. It’s worth mentioning that Ori Hershkovitz’s Nexthera Capital said goodbye to the largest position of all the investors tracked by Insider Monkey, valued at close to $0.5 million in stock. Nathan Fischel’s fund, DAFNA Capital Management, also dropped its stock, about $0.2 million worth.

Let’s now take a look at hedge fund activity in other stocks similar to AVEO Pharmaceuticals, Inc. (NASDAQ:AVEO). These stocks are Rentech, Inc. (NYSEAMEX:RTK), Vericel Corp (NASDAQ:VCEL), Intec Pharma Ltd (NASDAQ:NTEC), and Vermillion, Inc. (NASDAQ:VRML). All of these stocks’ market caps resemble AVEO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RTK | 6 | 12533 | -1 |

| VCEL | 5 | 9663 | -1 |

| NTEC | 4 | 8843 | 0 |

| VRML | 4 | 4183 | 1 |

As you can see these stocks had an average of 5 hedge funds with bullish positions and the average amount invested in these stocks was $9 million. That figure was $8 million in AVEO’s case. Rentech, Inc. (NYSEAMEX:RTK) is the most popular stock in this table. On the other hand Intec Pharma Ltd (NASDAQ:NTEC) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks AVEO Pharmaceuticals, Inc. (NASDAQ:AVEO) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None