The current low-yield environment around the world is making high-quality equity plays that pay dividends very attractive among investors. In efforts to present to their clients selections of attractive high-quality dividend stocks, several investment banks have come up with favored top picks. So has done United Bank of Switzerland, commonly known by its acronym as the UBS.

Recently, UBS presented a list of its top high-quality stock picks, which features the likes of McDonald’s Corp. (NYSE:MCD), Intel Corporation (NASDAQ:INTC), Abbott Laboratories (NYSE:ABT), Johnson & Johnson (NYSE:JNJ), and a few others. The selection was made based on strong returns on capital, solid growth and cash flows, the strength and sustainability of earnings, and a commitment to returning capital to shareholders.

Here is a closer look at five high quality stocks that UBS recommends to its clients. All of these stocks pay attractive dividends and are reasonably priced.

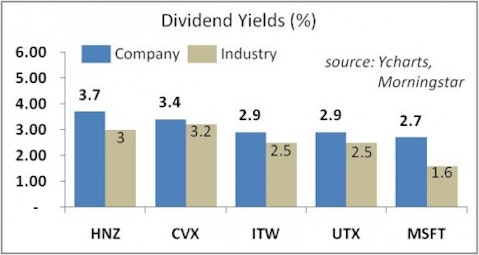

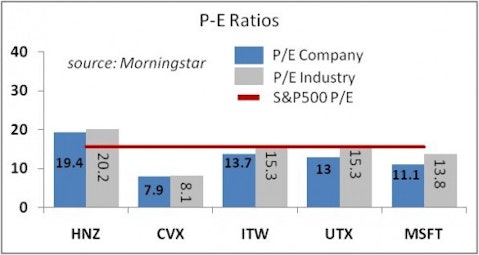

H. J. Heinz Company (NYSE:HNZ) is a $17.7 billion food products manufacturer serving consumers and restaurants. The company, famous for its “57 Varieties” and Heinz ketchup, pays a dividend yield of 3.7% on a payout ratio of 72% of earnings and 62% of its free cash flow. Its peers Archer-Daniels-Midland Company (NYSE:ADM), Kraft Foods (NYSE:KFT), and ConAgra Foods (NYSE:CAG) pay dividend yields of 2.6%, 2.9%, and 3.9%, respectively. Over the past five years, the company’s dividend and EPS grew at average rates of 6.5% and 3.7% per year, respectively. Analysts forecast that the EPS growth will average a higher 6% per year for the next five years. H. J. Heinz Company has a return on invested capital (ROIC) of 12.5% and a free cash flow yield of 2.6%. The stock is changing hands at $55.25 a share, up nearly 3% over the past 12 months. On a forward P/E basis, the stock is trading on par with the food products industry. Billionaires Jim Simons and Nelson Peltz (Trian Partners—see its top picks) hold large positions in the company.

Chevron Corporation (NYSE:CVX) is a $125 billion oil and natural gas giant. Chevron pays a dividend yield of 3.4% on a payout ratio of 26% of earnings and 50% of free cash flow. Its competitor Exxon Mobil (NYSE:XOM) and ConocoPhillips (NYSE:COP) pay dividend yields of 2.7% and 4.7%, respectively. Over the past half decade, the company’s dividend and EPS rose at average annual rates of 9% and 11.5% per year, respectively. The EPS is forecast to increase at a much smaller 2.1% average annual rate over the next five years. Chevron Corporation has a ROIC of 20.2% and a free cash flow yield of 2.6%. The stock is trading at $108.84 a share, up 1.3% over the past year. On a forward P/E basis, the shares are trading at a slight discount to the integrated oil and gas industry. The stock is also popular with Cliff Asness and Jim Simons.

Illinois Tool Works (NYSE:ITW) is a $26 billion manufacturer of diversified industrial products and equipment used in a number of industries, including the automotive, construction, food/restaurant, electronics and other industries. The company’s dividend yields 2.9% on a payout ratio of 37% of earnings and 45% of free cash flow. Its rivals Dover (NYSE:DOV), IDEX Corporation (NYSE:IEX), Graco Inc. (NYSE:GGG), and Danaher Corp. (NYSE:DHR) pay dividend yields of 2.4%, 2.2%, 2.1%, and 0.2%, respectively. The company’s dividend and EPS grew at average rates of 11.4% and 8.2% per year, respectively, over the past five years. For the next five, the EPS is forecast to grow at an average annual rate of nearly 12%. Illinois Tool Works has a ROIC of 14.2% and a free cash flow yield of 4.4%. The stock is trading at $53.64 a share and is down 5.3% over the past 12 months. On a forward P/E basis, it is trading at a slight discount to the industrial machinery industry. Among fund managers Ralph V. Whitworth and billionaire Steven Cohen are fans of the stock.

United Technologies (NYSE:UTX) is a $69 billion company providing technology products and services to the building systems and aerospace industries. It sells helicopters, aircraft parts, elevators, and heating and air conditioning systems. United Technologies derives the lion’s share of its revenues from abroad. United Technologies pays a dividend yield of 2.9% on a payout ratio of 45% of earnings and 35% of free cash flow. The company’s rivals General Electric (NYSE:GE), SPX Corporation (SPW), and Honeywell International (HON) pay dividends yielding 3.4%, 1.7%, and 2.7%, respectively. United Technologies’ dividend and EPS increased at average annual rates of 12.6% and 8.2%, respectively, over the past five years. Analysts forecast that the EPS growth will average 12.3% per year for the next five years. The company’s ROIC is 13.7% and its free cash flow yield is 5.6%. UTX stock is trading at $75.82 a share, down nearly 15% over the past year. The company’s shares have a forward P/E of 13.7, which is below the aerospace industry and the industrials sector. The stock is popular with billionaires Ken Fisher, Dan Loeb, and James Dinan.

Microsoft Corporation (NASDAQ:MSFT) is a $258 billion maker and licensor of software products, internet services company, and gaming console producer. Microsoft pays a dividend yield of 2.7% on a payout ratio of 29% of earnings and 28% of free cash flow. Its competitor Oracle pays a dividend yield of 0.8%. Rival Google (NASDAQ:GOOG) does not pay any dividends, while Apple Inc. (NASDAQ:AAPL) will start paying an annualized dividend of 1.9% this quarter. Over the past five years, Microsoft’s dividend and EPS grew at average annual rates of 14.3% and 17.6%, respectively. Analysts forecast that the company’s EPS will expand at an average rate of close to 10% per year for the next five years. The company has a ROIC of 29% and a free cash flow yield of 8.3%. Microsoft is trading at $30.67 a share, up 11.4% over the past year. On a forward P/E basis, the shares are trading at a major discount to the software industry and the technology sector. Microsoft is the third most popular stock among hedge funds (see the 10 most popular stocks).