Jackson Peak Capital, an investment management firm, released its fourth quarter 2023 investor letter, a copy of which can be downloaded here. As of Q4 2023, the company has completed ten months of investing activities since its March 2023 launch. Jackson Peak had a great quarter with a net return of +9.9% and a gross return of +12.0%. Following the pattern seen in Q3, broad equities markets fell in October before pulling back sharply to rebound in November and December. In addition, please check the fund’s top five holdings to know its best picks in 2023.

Jackson Peak Capital featured stocks like Advanced Micro Devices, Inc. (NASDAQ:AMD) in the fourth quarter 2023 investor letter. Headquartered in Santa Clara, California, Advanced Micro Devices, Inc. (NASDAQ:AMD) is a semiconductor company. On February 27, 2024, Advanced Micro Devices, Inc. (NASDAQ:AMD) stock closed at $178.00 per share. One-month return of Advanced Micro Devices, Inc. (NASDAQ:AMD) was 6.15%, and its shares gained 127.36% of their value over the last 52 weeks. Advanced Micro Devices, Inc. (NASDAQ:AMD) has a market capitalization of $287.611 billion.

Jackson Peak Capital stated the following regarding Advanced Micro Devices, Inc. (NASDAQ:AMD) in its fourth quarter 2023 investor letter:

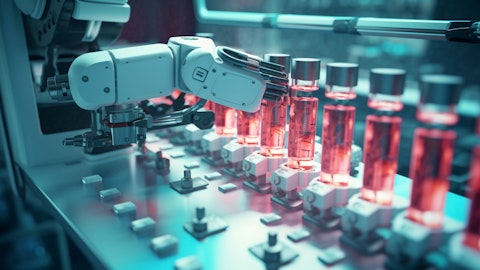

“On the long side of the portfolio, a core theme we remain invested behind is the data center infrastructure buildout and AI chips arms race that we’ve discussed since our first letter in Q2. Some skepticism has crept into the market, and it’s understandable given the huge ramp in 2023. However, our research continues to suggest 2023 was the start of a multi-year platform shift. Value will accrue to varying segments of the AI value chain at different parts of the cycle. We continue to see value in the “boots on the ground” winners in the data center buildout (Vertiv, Modine Manufacturing, Celestica). Our positioning in AI semiconductor companies (NVDA and Advanced Micro Devices, Inc. (NASDAQ:AMD)) has ebbed and flowed given we are cognizant (perhaps too much so) that these names are crowded positions across investor style types. We’ve done well in these chip stocks since inception and NVDA is currently a long, and we’re trying to “let winners run” while using sizing to risk manage these names due to the market-wide positioning bias in semiconductors.”

Advanced Micro Devices, Inc. (NASDAQ:AMD) is in 15th position on our list of 30 Most Popular Stocks Among Hedge Funds. At the end of the fourth quarter, Advanced Micro Devices, Inc. (NASDAQ:AMD) was held by 120 hedge fund portfolios, down from 110 in the previous quarter, according to our database.

We discussed Advanced Micro Devices, Inc. (NASDAQ:AMD) in another article and shared the list of stocks that will make you rich in 2024. In addition, please check out our hedge fund investor letters Q4 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- Warren Buffett 2024 Portfolio: Top 12 Stock Picks

- 15 Countries with Cyber Warfare Capabilities

- These 10 Stocks Can Skyrocket if Donald Trump Wins US Election 2024

Disclosure: None. This article is originally published at Insider Monkey.