Wasatch Global Investors, an asset management company, released its “Wasatch Small Cap Core Growth Strategy” third-quarter 2022 investor letter. A copy of the same can be downloaded here. In the third quarter, the strategy underperformed its benchmark index, the Russell 2000 Growth Index. The stock price weakness of investments in health care, industrials, financials, and consumer discretionary sectors pulled the strategy’s performance relative to the benchmark index. In addition, you can check the top 5 holdings of the fund to know its best picks in 2022.

Wasatch Global Investors highlighted stocks like Holley Inc. (NYSE:HLLY) in its Q3 2022 investor letter. Headquartered in Bowling Green, Kentucky, Holley Inc. (NYSE:HLLY) is an automotive aftermarket products manufacturer. On December 9, 2022, Holley Inc. (NYSE:HLLY) stock closed at $2.7200 per share. One-month return of Holley Inc. (NYSE:HLLY) was -9.03%, and its shares lost 77.46% of their value over the last 52 weeks. Holley Inc. (NYSE:HLLY) has a market capitalization of $321.618 million.

Wasatch Global Investors made the following comment about Holley Inc. (NYSE:HLLY) in its Q3 2022 investor letter:

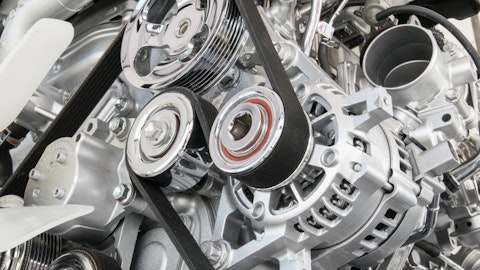

“Another detractor was Holley Inc. (NYSE:HLLY). The company makes high-performance automotive parts for car and truck enthusiasts. We initially invested based on our assessment that Holley had a loyal customer base, healthy margins and specialized product offerings that could enable the company to better withstand the impacts of inflation. Recently, the stock has been down due to lowered revenue and earnings guidance resulting from difficulty in obtaining semiconductor chips for key products on the one hand, and trouble in reducing inventory on the other hand. We’re currently evaluating Holley to determine the extent to which its problems have resulted from poor execution by the company’s leadership. Of particular concern to us is Holley’s debt level in an environment of lower earnings.”

Copyright: urfingus / 123RF Stock Photo

Holley Inc. (NYSE:HLLY) is not on our list of 30 Most Popular Stocks Among Hedge Funds. As per our database, 14 hedge fund portfolios held Holley Inc. (NYSE:HLLY) at the end of the third quarter, which was 15 in the previous quarter.

We discussed Holley Inc. (NYSE:HLLY) in another article and shared Baron Funds’ views on the company In addition, please check out our hedge fund investor letters Q3 2022 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- Most Advanced Countries in Artificial Intelligence

- 11 Best ADR Stocks To Buy

- 15 Largest Weight Loss Companies

Disclosure: None. This article is originally published at Insider Monkey.