Carillon Tower Advisers, an investment management firm, published its fourth quarter 2020 “Carillon Eagle Small Cap Growth Fund” investor letter – a copy of which can be downloaded here. In the letter, the fund talked about their best and worst securities, together with their outlook for this year from an investment perspective. You can view the fund’s top 5 holdings to have a peek at their top bets for 2021.

Carillon Eagle Small Cap Growth Fund, in their Q4 2020 investor letter, mentioned Entegris, Inc. (NASDAQ: ENTG) and emphasized their views on the company. Entegris, Inc. is a Billerica, Massachusetts-based manufacturing company that currently has a $13.9 billion market capitalization. Since the beginning of the year, ENTG delivered a 6.82% return, impressively extending its 12-month gains to 112.61%. As of March 24, 2021, the stock closed at $102.65 per share.

Here is what Carillon Eagle Small Cap Growth Fund has to say about Entegris, Inc. in their Q4 2020 investor letter:

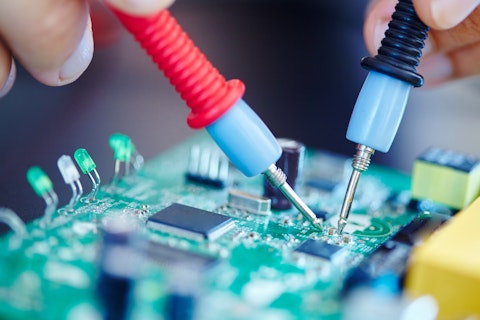

“Entegris provides specialty semiconductor materials for the microelectronics industry. Despite the volatility in the markets, semiconductor chip production continues unabated and has in fact accelerated. Entegris, as a key consumable supplier to this industry, continues to benefit. At its recent investor day, the firm’s management team laid out a mid-term plan that investors appreciated for both top-line growth as well as margin potential.”

allstars/Shutterstock.com

Our calculations show that Entegris, Inc. (NASDAQ: ENTG) does not belong in our list of the 30 Most Popular Stocks Among Hedge Funds. As of the end of the fourth quarter of 2020, Entegris, Inc. was in 30 hedge fund portfolios, compared to 25 funds in the third quarter. ENTG delivered a 6.64% return in the past 3 months.

The top 10 stocks among hedge funds returned 231.2% between 2015 and 2020, and outperformed the S&P 500 Index ETFs by more than 126 percentage points. We know it sounds unbelievable. You have been dismissing our articles about top hedge fund stocks mostly because you were fed biased information by other media outlets about hedge funds’ poor performance. You could have doubled the size of your nest egg by investing in the top hedge fund stocks instead of dumb S&P 500 ETFs. Here you can watch our video about the top 5 hedge fund stocks right now. All of these stocks had positive returns in 2020.

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, Federal Reserve has been creating trillions of dollars electronically to keep the interest rates near zero. We believe this will lead to inflation and boost real estate prices. So, we recommended this real estate stock to our monthly premium newsletter subscribers. We go through lists like the 15 best innovative stocks to buy to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our website:

Disclosure: None. This article is originally published at Insider Monkey.