Hedge funds started off 2021 in a lot of flux, inviting the wrath of retail investors and Reddit’s meme-stock armies amid the GameStop saga, adding to their disrepute among average investors. But unlike amateur investors who usually make their opinions based on the news cycle, prudent analysts know that barring a few big names, hedge funds gained a lot in the GameStop fight with retail investors. But there’s more to the hedge funds’ performance than the GameStop factor as can also be seen in the iGaming sector (source: Wetten.com)

In 2020, global hedge funds gained around 12%, posting their strongest full-year returns since 2009. Close to 40% of the managers in the Eurekahedge Hedge Fund Index reported double-digit return for 2020. Data from LCH Investments show that the world’s 20 best-performing hedge funds made a whopping $63.5 billion for clients in 2020, a record in the last 10 years. This might be a “rebound” for those who pay attention to just the hedge fund indices — where returns are shrinking amid fees and several other factors — but Insider Monkey’s strategy of focusing on the top picks of hedge funds and prominent investors has been consistently beating the market over the last several years. For instance, top 10 stocks picks of over 800 hedge funds tracked by Insider Monkey returned 256.5% from 2014 until 2020, versus SPY’s 132.4%.

Insider Monkey has long been a believer of imitating the top stock picks of hedge funds, and this strategy has helped us beat the market consistently over the last several years. For instance, between March 2017 and February 5th 2021 our monthly newsletter’s stock picks returned 187.5%, vs. 75.8% for the SPY. Our stock picks outperformed the market by more than 111 percentage points.

We don’t talk much about our small-cap stock picks but we have been sharing the list of 30 most popular stocks among hedge funds here at Insider Monkey since the end of 2018. The majority of these stocks aren’t traditional value stocks. Three months ago we shared hedge funds’ top 30 stock picks at the end of November 2020. Three months before that we shared hedge funds’ top 30 stock picks for Q2’20. This quarter’s top 30 stocks returned 9.5% so far in 2021 and outperformed the S&P 500 Index by 5 percentage points, while the top 5 stocks returned 5.3% so far in 2021, versus 4.5% for SPY in the same period.

Overall, hedge funds’ top 5 stock picks returned 39.9% in 2020 and beat the market by 21.6 percentage points. From 2015 until the end of 2020, these 5 stocks returned 209.4% and beat the S&P 500 Index by 104 percentage points.

More than half of all investors invest in dumb index funds because they were made to believe that they can’t outperform the market by stock selection (or they are forced to invest in index funds in their companies’ retirement accounts). I am going to share with you a very simple investment strategy that outperformed the dumb S&P 500 Index ETF (SPY) by 126 percentage points since 2015.

This simple strategy’s 10 stock picks returned 74% between 2015 and 2018, versus SPY’s 32% gain during the same period.

This simple strategy’s 10 stock picks also returned nearly 91% in 2019 and 2020, vs. SPY’s 55.3% gain.

This simple strategy’s 10 stock picks thrived in this coronavirus crash returning 34.9% in 2020, vs. 18.4% gain for the S&P 500.

This is why we call index fund investing “dumb”.

The simple strategy I am talking about is hedge funds’ top 10 stock picks.

Every quarter we process more than 800 hedge funds’ 13F filing and identify the top stocks among ALL 800+ hedge funds. The list of top 10 hedge fund stocks hasn’t changed much since the third quarter of 2018. If you had invested in this low turnover simple strategy at the beginning of 2015, you would have outperformed the S&P 500 ETFs by more than 126 percentage points.

Hedge funds knew these 10 stocks are the “best” 10 stocks to buy and they were piling into these stocks.

If you subscribe to our free e-newsletter below, you can get a free email alert whenever we publish something important.

Insider Monkey’s mission is to identify promising (and also terrible) hedge fund stock pitches and share them with our subscribers. We launched our monthly newsletter’s activist strategy nearly 4 years ago and this strategy’s picks returned 187.5% since then and beat the SPY by 111 percentage points. Our short strategy was also launched 4 years ago and its short recommendations gained a cumulative 8% (that’s a good thing because we are shorting them) since then. You can improve your returns by subscribing to our premium newsletters. Our subscription prices start at $6.99 per month and come with a 14-day full refund guarantee.

Nowadays most investors believe that hedge funds lost their “magic touch” a long time ago and can’t beat the market. Don’t trust the returns reported by hedge fund indices. Hedge funds underperform because they hedge and they charge an arm and a leg for their services. If you want to compare apples to apples, you need to take a look at the performance of the most popular hedge fund stocks vs. the returns of the S&P 500 Index. Apple, Google, Microsoft, Facebook, and Amazon have consistently been among the top 10 hedge fund picks over the last 8.5 years since we started publishing our quarterly newsletter. You don’t have to be a math wizard to calculate the mind numbing returns of these technology stocks most of which now trade for more than $1 trillion valuation.

The best thing about following hedge funds’ top picks on our website is that you don’t need to pay hedge funds an annual 2% fee and 20% of your profits to beat the market. We do that here free of charge using the holdings data from the legally required SEC portfolio disclosures. Our approach is also superior to investing directly into hedge funds because we don’t like to invest in a hedge funds’ 35th best idea when we can invest in only the best stock picks of the best hedge funds.

Below we listed the 30 most popular stocks among hedge funds at the end of December 2020 (you can also watch our video at the end of this article covering the top 5 hedge fund stocks). If you are only interested in large-cap stocks, check out the top 20 stocks in this list below:

30. CrowdStrike Holdings, Inc. (NASDAQ: CRWD): $239.25

Number of Hedge Funds: 92 (2020Q4)

Number of Hedge Funds: 71 (2020Q3)

Total Dollar Amount of Long Hedge Fund Positions: $7.2 billion

Percent of Hedge Funds with Long Positions: 10.4%

First Quarter Return (through February 18): 12.9%

Popularity Ranking (2020Q3): 59

Popularity Ranking (2020Q2): 41

Noteworthy Hedge Fund Shareholders: Tiger Global Management LLC, Coatue Management

29. Twilio Inc. (NYSE: TWLO): $443.49

Number of Hedge Funds: 94 (2020Q4)

Number of Hedge Funds: 71 (2020Q3)

Total Dollar Amount of Long Hedge Fund Positions: $5.0 billion

Percent of Hedge Funds with Long Positions: 10.6%

First Quarter Return (through February 18): 31%

Popularity Ranking (2020Q3): 60

Popularity Ranking (2020Q2): 68

Noteworthy Hedge Fund Shareholders: SCGE Management, Alkeon Capital Management

28. Fiserv Inc. (NASDAQ: FISV): $113.05

Number of Hedge Funds: 94 (2020Q4)

Number of Hedge Funds: 90 (2020Q3)

Total Dollar Amount of Long Hedge Fund Positions: $5.2 billion

Percent of Hedge Funds with Long Positions: 10.6%

First Quarter Return (through February 18): -0.71%

Popularity Ranking (2020Q3): 25

Popularity Ranking (2020Q2): 35

Noteworthy Hedge Fund Shareholders: Gabriel Plotkin’s Melvin Capital Management, BlueSpruce Investments

27. Pinterest, Inc. (NYSE: PINS): $85.99

Number of Hedge Funds: 95 (2020Q4)

Number of Hedge Funds: 80 (2020Q3)

Total Dollar Amount of Long Hedge Fund Positions: $5.84 billion

Percent of Hedge Funds with Long Positions: 10.7%

First Quarter Return (through February 18): 30.5%

Popularity Ranking (2020Q3): 43

Popularity Ranking (2020Q2): 158

Noteworthy Hedge Fund Shareholders: Select Equity Group, Aubrey Capital Management

Pixabay/Public Domain

26. Citigroup Inc. (NYSE: C): $63.48

Number of Hedge Funds: 95 (2020Q4)

Number of Hedge Funds: 91 (2020Q3)

Total Dollar Amount of Long Hedge Fund Positions: $7.12 billion

Percent of Hedge Funds with Long Positions: 10.7%

First Quarter Return (through February 18): 3.8%

Popularity Ranking (2020Q3): 23

Popularity Ranking (2020Q2): 23

Noteworthy Hedge Fund Shareholders: Kahn Brothers

25. ServiceNow, Inc. (NYSE: NOW): $575.8

Number of Hedge Funds: 96 (2020Q4)

Number of Hedge Funds: 82 (2020Q3)

Total Dollar Amount of Long Hedge Fund Positions: $6.85 billion

Percent of Hedge Funds with Long Positions: 10.8%

First Quarter Return (through February 18): 4.6%

Popularity Ranking (2020Q3): 36

Popularity Ranking (2020Q2): 34

Noteworthy Hedge Fund Shareholders: Tiger Global Management LLC, GQG Partners

24. Salesforce.com, inc. (NYSE: CRM): $247.01

Number of Hedge Funds: 97 (2020Q4)

Number of Hedge Funds: 106 (2020Q3)

Total Dollar Amount of Long Hedge Fund Positions: $10.6 billion

Percent of Hedge Funds with Long Positions: 10.9%

First Quarter Return (through February 18): 11%

Popularity Ranking (2020Q3): 16

Popularity Ranking (2020Q2): 17

Noteworthy Hedge Fund Shareholders: Fisher Asset Management, Altimeter Capital Management

Ken Fisher of Fisher Asset Management

23. Wells Fargo & Company (NYSE: WFC): $36.96

Number of Hedge Funds: 99 (2020Q4)

Number of Hedge Funds: 90 (2020Q3)

Total Dollar Amount of Long Hedge Fund Positions: $8.75 billion

Percent of Hedge Funds with Long Positions: 11.2%

First Quarter Return (through February 18): 22.9%

Popularity Ranking (2020Q3): 24

Popularity Ranking (2020Q2): 33

Noteworthy Hedge Fund Shareholders: Berkshire Hathaway

22. Bank of America Corporation (NYSE: BAC): $34.19

Number of Hedge Funds: 99 (2020Q4)

Number of Hedge Funds: 88 (2020Q3)

Total Dollar Amount of Long Hedge Fund Positions: $35.3 billion

Percent of Hedge Funds with Long Positions: 11.2%

First Quarter Return (through February 18): 12.8%

Popularity Ranking (2020Q3): 27

Popularity Ranking (2020Q2): 29

Noteworthy Hedge Fund Shareholders: Berkshire Hathaway, Harris Associates

Pixabay/Public Domain

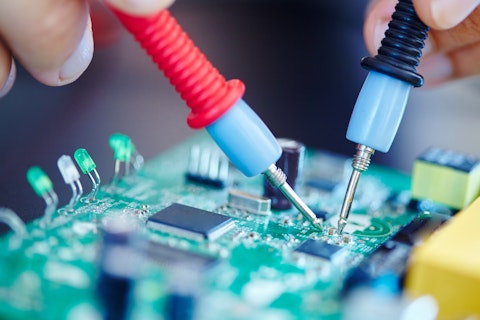

21. Micron Technology, Inc. (NASDAQ: MU): $88.54

Number of Hedge Funds: 100 (2020Q4)

Number of Hedge Funds: 79 (2020Q3)

Total Dollar Amount of Long Hedge Fund Positions: $8.14 billion

Percent of Hedge Funds with Long Positions: 11.3%

First Quarter Return (through February 18): 17.8%

Popularity Ranking (2020Q3): 44

Popularity Ranking (2020Q2): 37

Noteworthy Hedge Fund Shareholders: Arrowstreet Capital, Appaloosa Management LP

allstars/Shutterstock.com

20. T-Mobile US, Inc. (NASDAQ: TMUS): $123.04

Number of Hedge Funds: 103 (2020Q4)

Number of Hedge Funds: 94 (2020Q3)

Total Dollar Amount of Long Hedge Fund Positions: $9.1 billion

Percent of Hedge Funds with Long Positions: 11.6%

First Quarter Return (through February 18): -8.8%

Popularity Ranking (2020Q3): 21

Popularity Ranking (2020Q2): 14

Noteworthy Hedge Fund Shareholders: Viking Global

19. Booking Holdings Inc. (NASDAQ: BKNG): $2,259.79

Number of Hedge Funds: 108 (2020Q4)

Number of Hedge Funds: 113 (2020Q3)

Total Dollar Amount of Long Hedge Fund Positions: $8.25 billion

Percent of Hedge Funds with Long Positions: 12.2%

First Quarter Return (through February 18): 1.5%

Popularity Ranking (2020Q3): 13

Popularity Ranking (2020Q2): 24

Noteworthy Hedge Fund Shareholders: Melvin Capital Management

18. Berkshire Hathaway Inc. (NYSE: BRK-A): $367,400

Number of Hedge Funds: 110 (2020Q4)

Number of Hedge Funds: 109 (2020Q3)

Total Dollar Amount of Long Hedge Fund Positions: $20.8 billion

Percent of Hedge Funds with Long Positions: 12.4%

First Quarter Return (through February 18): 1.5%

Popularity Ranking (2020Q3): 15

Popularity Ranking (2020Q2): 16

Noteworthy Hedge Fund Shareholders: Bill & Melinda Gates Foundation Trust

17. JPMorgan Chase & Co. (NYSE: JPM): $145.59

Number of Hedge Funds: 112 (2020Q4)

Number of Hedge Funds: 118 (2020Q3)

Total Dollar Amount of Long Hedge Fund Positions: $6.97 billion

Percent of Hedge Funds with Long Positions: 12.6%

First Quarter Return (through February 18): 15.4%

Popularity Ranking (2020Q3): 12

Popularity Ranking (2020Q2): 12

Noteworthy Hedge Fund Shareholders: Viking Global, D1 Capital Partners

pcruciatti / Shutterstock.com

16. Adobe Inc. (NASDAQ: ADBE): $488.37

Number of Hedge Funds: 114 (2020Q4)

Number of Hedge Funds: 106 (2020Q3)

Total Dollar Amount of Long Hedge Fund Positions: $11.9 billion

Percent of Hedge Funds with Long Positions: 12.9%

First Quarter Return (through February 18): -2.3%

Popularity Ranking (2020Q3): 17

Popularity Ranking (2020Q2): 19

Noteworthy Hedge Fund Shareholders: Aubrey Capital Management, Fisher Asset Management

Copyright: photogearch / 123RF Stock Photo

15. Sea Limited (NYSE: SE): $267.50

Number of Hedge Funds: 115 (2020Q4)

Number of Hedge Funds: 95 (2020Q3)

Total Dollar Amount of Long Hedge Fund Positions: $10.9 billion

Percent of Hedge Funds with Long Positions: 13%

First Quarter Return (through February 18): 34.4%

Popularity Ranking (2020Q3): 20

Popularity Ranking (2020Q2): 38

Noteworthy Hedge Fund Shareholders: Tiger Global Management LLC

Chase Coleman of Tiger Global

14. Netflix, Inc. (NASDAQ: NFLX): $548.22

Number of Hedge Funds: 116 (2020Q4)

Number of Hedge Funds: 104 (2020Q3)

Total Dollar Amount of Long Hedge Fund Positions: $15.6 billion

Percent of Hedge Funds with Long Positions: 13.1%

First Quarter Return (through February 18): 1.4%

Popularity Ranking (2020Q3): 18

Popularity Ranking (2020Q2): 13

Noteworthy Hedge Fund Shareholders: Fisher Asset Management, Lone Pine Capital

Copyright: lculig / 123RF Stock Photo

13. Bristol-Myers Squibb Company (NYSE: BMY): $61.02

Number of Hedge Funds: 131 (2020Q4)

Number of Hedge Funds: 124 (2020Q3)

Total Dollar Amount of Long Hedge Fund Positions: $6.1 billion

Percent of Hedge Funds with Long Positions: 14.8%

First Quarter Return (through February 18): -1.6%

Popularity Ranking (2020Q3): 11

Popularity Ranking (2020Q2): 10

Noteworthy Hedge Fund Shareholders: Jim Simons, Warren Buffett

12. Uber Technologies, Inc. (NYSE: UBER): $59

Number of Hedge Funds: 135 (2020Q4)

Number of Hedge Funds: 100 (2020Q3)

Total Dollar Amount of Long Hedge Fund Positions: $10.1 billion

Percent of Hedge Funds with Long Positions: 15.2%

First Quarter Return (through February 18): 15.7%

Popularity Ranking (2020Q3): 19

Popularity Ranking (2020Q2): 25

Noteworthy Hedge Fund Shareholders: Altimeter Capital Management, Tiger Global Management LLC

GongTo/Shutterstock.com

11. The Walt Disney Company (NYSE: DIS): $183

Number of Hedge Funds: 144 (2020Q4)

Number of Hedge Funds: 112 (2020Q3)

Total Dollar Amount of Long Hedge Fund Positions: $16.42 billion

Percent of Hedge Funds with Long Positions: 16.2%

First Quarter Return (through February 18): 1.0%

Popularity Ranking (2020Q3): 14

Popularity Ranking (2020Q2): 18

Noteworthy Hedge Fund Shareholders: Philippe Laffont’s Coatue Management, Ken Fisher’s Fisher Asset Management

Copyright: blanscape / 123RF Stock Photo

10. Apple Inc. (NASDAQ: AAPL): $129.71

Number of Hedge Funds: 146 (2020Q4)

Number of Hedge Funds: 134 (2020Q3)

Total Dollar Amount of Long Hedge Fund Positions: $141.8 billion

Percent of Hedge Funds with Long Positions: 16.5%

First Quarter Return (through February 18): -2.1%

Popularity Ranking (2020Q3): 9

Popularity Ranking (2020Q2): 11

Noteworthy Hedge Fund Shareholders: Berkshire Hathaway

9. PayPal Holdings, Inc. (NASDAQ: PYPL): $290.81

Number of Hedge Funds: 147 (2020Q4)

Number of Hedge Funds: 150 (2020Q3)

Total Dollar Amount of Long Hedge Fund Positions: $15.96 billion

Percent of Hedge Funds with Long Positions: 16.6%

First Quarter Return (through February 18): 24.2%

Popularity Ranking (2020Q3): 8

Popularity Ranking (2020Q2): 9

Noteworthy Hedge Fund Shareholders: Philippe Laffont, Christopher Lyle, Fisher Asset Management

Ken Fisher of Fisher Asset Management

8. Mastercard Incorporated (NYSE: MA): $338.46

Number of Hedge Funds: 154 (2020Q4)

Number of Hedge Funds: 133 (2020Q3)

Total Dollar Amount of Long Hedge Fund Positions: $18 billion

Percent of Hedge Funds with Long Positions: 17.4%

First Quarter Return (through February 18): -5.1%

Popularity Ranking (2020Q3): 10

Popularity Ranking (2020Q2): 7

Noteworthy Hedge Fund Shareholders: Akre Capital Management, Berkshire Hathaway

Valeri Potapova / Shutterstock.com

7. Alibaba Group Holding Limited (NYSE: BABA): $264.51

Number of Hedge Funds: 156 (2020Q4)

Number of Hedge Funds: 166 (2020Q3)

Total Dollar Amount of Long Hedge Fund Positions: $17.9 billion

Percent of Hedge Funds with Long Positions: 17.6%

First Quarter Return (through February 18): 13.7%

Popularity Ranking (2020Q3): 4

Popularity Ranking (2020Q2): 5

Noteworthy Hedge Fund Shareholders: Ken Fisher

Pieter Beens / Shutterstock.com

6. Alphabet Inc. Class C (NASDAQ: GOOG): $2,117.20

Number of Hedge Funds: 157 (2020Q4)

Number of Hedge Funds: 150 (2020Q3)

Total Dollar Amount of Long Hedge Fund Positions: $20.6 billion

Percent of Hedge Funds with Long Positions: 17.7%

First Quarter Return (through February 18): 20.9%

Popularity Ranking (2020Q3): 7

Popularity Ranking (2020Q2): 8

Noteworthy Hedge Fund Shareholders: Boykin Curry

5. Visa Inc. (NYSE: V): $209.35

Number of Hedge Funds: 166 (2020Q4)

Number of Hedge Funds: 160 (2020Q3)

Total Dollar Amount of Long Hedge Fund Positions: $23.6 billion

Percent of Hedge Funds with Long Positions: 18.7%

First Quarter Return (through February 18): -4.1%

Popularity Ranking (2020Q3): 6

Popularity Ranking (2020Q2): 6

Noteworthy Hedge Fund Shareholders: Ken Fisher, Warren Buffett

JMiks / Shutterstock.com

4. Alphabet Inc. Class A (NASDAQ: GOOGL): $2,105.81

Number of Hedge Funds: 179 (2020Q4)

Number of Hedge Funds: 162 (2020Q3)

Total Dollar Amount of Long Hedge Fund Positions: $21.9 billion

Percent of Hedge Funds with Long Positions: 20.2%

First Quarter Return (through February 18): 20.2%

Popularity Ranking (2020Q3): 5

Popularity Ranking (2020Q2): 4

Noteworthy Hedge Fund Shareholders: Ken Griffin

Asif Islam / Shutterstock.com

3. Facebook, Inc. (NASDAQ: FB): $269.39

Number of Hedge Funds: 242 (2020Q4)

Number of Hedge Funds: 230 (2020Q3)

Total Dollar Amount of Long Hedge Fund Positions: $38.23 billion

Percent of Hedge Funds with Long Positions: 27.3%

First Quarter Return (through February 18): -1.4%

Popularity Ranking (2020Q3): 3

Popularity Ranking (2020Q2): 3

Noteworthy Hedge Fund Shareholders: Tiger Global Management LLC

Chase Coleman of Tiger Global

2. Microsoft Corporation (NASDAQ: MSFT): $243.79

Number of Hedge Funds: 258 (2020Q4)

Number of Hedge Funds: 234 (2020Q3)

Total Dollar Amount of Long Hedge Fund Positions: $52.9 billion

Percent of Hedge Funds with Long Positions: 29.1%

First Quarter Return (through February 18): 9.9%

Popularity Ranking (2020Q3): 2

Popularity Ranking (2020Q2): 2

Noteworthy Hedge Fund Shareholders: Viking Global

drserg / Shutterstock.com

1. Amazon.com, Inc. (NASDAQ: AMZN): $3,328.23

Number of Hedge Funds: 273 (2020Q4)

Number of Hedge Funds: 245 (2020Q3)

Total Dollar Amount of Long Hedge Fund Positions: $51.5 billion

Percent of Hedge Funds with Long Positions: 30.8%

First Quarter Return (through February 18): 2.2%

Popularity Ranking (2020Q3): 1

Popularity Ranking (2020Q2): 1

Noteworthy Hedge Fund Shareholders: Masayoshi Son

Please also see Bill Gates’ Most Recent Investments and Warren Buffett’s Top 10 Stock Picks.

Disclosure: None.