Artisan Partners, an investment management company, released its “Artisan Mid Cap Fund” fourth quarter 2023 investor letter. A copy of the same can be downloaded here. The final quarter of 2023 saw a continuous fluctuation between recessionary fears and soft-landing optimism. In the fourth quarter, the fund’s Investor Class fund ARTMX returned 8.86%, Advisor Class fund APDMX posted a return of 8.93%, and Institutional Class fund APHMX returned 8.96%, compared to a 14.55% return for the Russell Midcap Growth Index. The portfolio generated a positive absolute return in Q4 but underperformed the Russell Midcap Growth Index due to poor security selection, particularly in health care and information technology. In addition, please check the fund’s top five holdings to know its best picks in 2023.

Artisan Mid Cap Fund featured stocks like DexCom, Inc. (NASDAQ:DXCM) in its Q4 2023 investor letter. Headquartered in San Diego, California, DexCom, Inc. (NASDAQ:DXCM) is a medical device company. On March 6, 2024, DexCom, Inc. (NASDAQ:DXCM) stock closed at $133.72 per share. One-month return of DexCom, Inc. (NASDAQ:DXCM) was 5.25%, and its shares gained 19.31% of their value over the last 52 weeks. DexCom, Inc. (NASDAQ:DXCM) has a market capitalization of $51.551 billion.

Artisan Mid Cap Fund stated the following regarding DexCom, Inc. (NASDAQ:DXCM) in its fourth quarter 2023 investor letter:

“Among our top contributors were Chipotle, DexCom, Inc. (NASDAQ:DXCM) and Shopify. DexCom is the leader in continuous glucose-monitoring systems (CGM). We believe it is well positioned to continue penetrating the Type 1 diabetes market and to drive adoption in the much larger Type 2 diabetes market, with data increasingly supporting the clinical and economic case for using CGM sensors. By most indicators, DexCom is poised for a period of significant top- and bottom-line growth. Having made substantial investments in global distribution, product development and branding, the company has a receptive base of patients, physicians and payors ready for its newly launched next-generation G7 sensor. Shares experienced weakness earlier in the year due to market concerns that the rapid growth of GLP-1 diabetes/obesity drugs will reduce demand for diabetes management technologies. However, our view is that while the magnitude of the GLP-1 adoption will likely have both good and bad impacts on how CGMs are used, these changes will be slow to play out. Given this view, and an opportunistic valuation, we added to our position in Q4. Our patience was rewarded as shares rallied after the company reported strong financial results and management provided evidence of the synergies between CGMs and GLP-1 drugs in the fight against the obesity epidemic.”

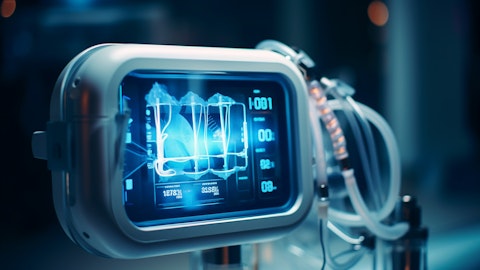

A doctor demonstrating how to use the medical device to a patient with diabetes.

DexCom, Inc. (NASDAQ:DXCM) is not on our list of 30 Most Popular Stocks Among Hedge Funds. At the end of the fourth quarter, DexCom, Inc. (NASDAQ:DXCM) was held by 69 hedge fund portfolios, down from 78 in the previous quarter, according to our database.

We discussed DexCom, Inc. (NASDAQ:DXCM) in another article and shared the list of most valuable digital health companies in the US. In addition, please check out our hedge fund investor letters Q4 2023 page for more investor letters from hedge funds and other leading investors.

Suggested Articles:

- 15 European Cities with the Best Public Transportation

- 10 Best Private Hospitals in Europe

- 20 Cloudiest Cities in the World

Disclosure: None. This article is originally published at Insider Monkey.