ClearBridge Investments, an investment management firm, published its “Sustainability Leaders Strategy” third quarter 2021 investor letter – a copy of which can be downloaded here. The ClearBridge Sustainability Leaders Strategy outperformed its Russell 3000 Index benchmark during the third quarter. On an absolute basis, the Strategy had gains in six of 10 sectors in which it was invested (out of 11 sectors total). You can take a look at the fund’s top 5 holdings to have an idea about their best picks for 2021.

ClearBridge Sustainability Leaders Strategy, in its Q3 2021 investor letter, mentioned ON Semiconductor Corporation (NASDAQ: ON) and discussed its stance on the firm. ON Semiconductor Corporation is a Phoenix, Arizona-based semiconductor manufacturing company with a $30.2 billion market capitalization. ON delivered a 3.31% return since the beginning of the year, while its 12-month returns are up by 114.78%. The stock closed at $70.17 per share on January 03, 2022

Here is what ClearBridge Sustainability Leaders Strategy has to say about ON Semiconductor Corporation in its Q3 2021 investor letter:

“We also added ON Semiconductor, which designs, manufactures and markets semiconductor and power management components. We view ON as an attractive restructuring opportunity under a new management team. It is also levered to attractive sustainable growth markets like electric vehicles (EVs). This has the dual benefit of improving the environment through lower emissions and driving growth, since EVs have 5x more silicon content than gas powered vehicles.

We believe generating attractive returns and promoting positive stakeholder impact are not mutually exclusive; ON Semiconductor is one example of how this is being achieved as we invest thematically in climate change solutions. Our ownership of a number of renewable energy companies is another contribution to this theme. Other themes reflected in the portfolio include natural resource conservation, through holdings that use recycled materials in their manufacturing process, enable efficient use of scarce resources, and prioritize sustainable packaging; improving human health, through biotechnology, life science tools and diagnostics and managed care companies; and diversity and economic inclusion, through companies that provide financial access and education and promote a diverse workforce.”

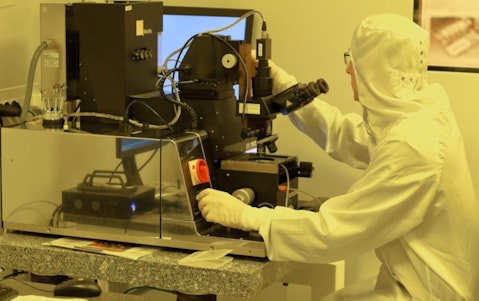

l-n-r2tVRjxzFM8-unsplash

Based on our calculations, ON Semiconductor Corporation (NASDAQ: ON) was not able to clinch a spot in our list of the 30 Most Popular Stocks Among Hedge Funds. ON was in 41 hedge fund portfolios at the end of the third quarter of 2021, compared to 44 funds in the previous quarter. ON Semiconductor Corporation (NASDAQ: ON) delivered a 56.32% return in the past 3 months.

In December 2021, we published an article that includes CNP in the Top 5 Stock Picks of Steve Zheng’s Deepcurrents Investment Group. You can find more than 100 investor letters from hedge funds and prominent investors on our hedge fund investor letters 2021 Q3 page.

Disclosure: None. This article is originally published at Insider Monkey.