Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of September. At Insider Monkey, we follow over 700 of the best-performing investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is Brunswick Corporation (NYSE:BC), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

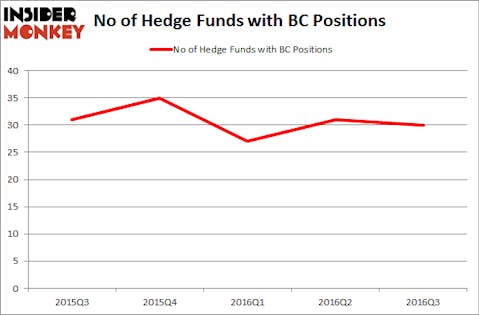

Brunswick Corporation (NYSE:BC) investors should pay attention to a slight decrease in hedge fund interest in recent months. At the end of September, 30 funds in our database held shares of the company, compared to 31 funds a quarter earlier. At the end of this article we will also compare BC to other stocks including Cracker Barrel Old Country Store, Inc. (NASDAQ:CBRL), Olin Corporation (NYSE:OLN), and IDACORP Inc (NYSE:IDA) to get a better sense of its popularity.

Follow Brunswick Corp (NYSE:BC)

Follow Brunswick Corp (NYSE:BC)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Italianvideophotoagency/Shutterstock.com

Now, let’s view the new action surrounding Brunswick Corporation (NYSE:BC).

Hedge fund activity in Brunswick Corporation (NYSE:BC)

At the end of the third quarter, a total of 30 of the hedge funds tracked by Insider Monkey held long positions in Brunswick Corporation, down by 3% from the previous quarter. With the smart money’s sentiment swirling, there exists a few key hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Ken Griffin’s Citadel Investment Group has the largest position in Brunswick Corporation (NYSE:BC), worth close to $69.7 million, amounting to 0.1% of its total 13F portfolio. The second largest stake is held by Cliff Asness’ AQR Capital Management holding a $68.7 million position; 0.1% of its 13F portfolio is allocated to the company. Remaining peers that hold long positions comprise Israel Englander’s Millennium Management, Anand Parekh’s Alyeska Investment Group, and Alexander Mitchell’s Scopus Asset Management.

Since Brunswick Corporation (NYSE:BC) has experienced a decline in interest from the entirety of the hedge funds we track, it’s easy to see that there was a specific group of hedgies who were dropping their positions entirely last quarter. Interestingly, Brian Taylor’s Pine River Capital Management sold off the largest position of the 700 funds watched by Insider Monkey, totaling about $5.4 million in stock. Brad Dunkley and Blair Levinsky’s fund, Waratah Capital Advisors, also cut its stock, valued at about $3.6 million.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Brunswick Corporation (NYSE:BC) but similarly valued. These stocks are Cracker Barrel Old Country Store, Inc. (NASDAQ:CBRL), Olin Corporation (NYSE:OLN), IDACORP Inc (NYSE:IDA), and Advanced Micro Devices, Inc. (NYSE:AMD). This group of stocks’ market values resemble BC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CBRL | 22 | 127400 | 7 |

| OLN | 18 | 989434 | -10 |

| IDA | 6 | 96192 | -4 |

| AMD | 47 | 644564 | 22 |

As you can see these stocks had an average of 23 funds with bullish positions and the average amount invested in these stocks was $464 million, compared to $501 million in BC’s case. Advanced Micro Devices, Inc. (NYSE:AMD) is the most popular stock in this table. On the other hand IDACORP Inc (NYSE:IDA) is the least popular one with only six funds holding shares. Brunswick Corporation (NYSE:BC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard Advanced Micro Devices, Inc. (NYSE:AMD) might be a better candidate to consider a long position.

Suggested Articles:

Biggest Trucking Companies In America

Best Places To Visit In Middle East

Easiest Air Force Jobs To Get

Disclosure: None