At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Tiger Global because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

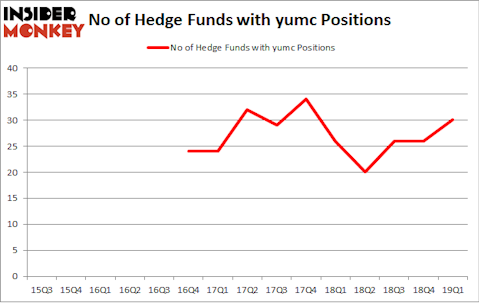

Is Yum China Holdings, Inc. (NYSE:YUMC) going to take off soon? Investors who are in the know are in an optimistic mood. The number of bullish hedge fund positions inched up by 4 recently. Our calculations also showed that yumc isn’t among the 30 most popular stocks among hedge funds. YUMC was in 30 hedge funds’ portfolios at the end of the first quarter of 2019. There were 26 hedge funds in our database with YUMC holdings at the end of the previous quarter.

At the moment there are several metrics stock market investors employ to analyze their holdings. Some of the less known metrics are hedge fund and insider trading indicators. We have shown that, historically, those who follow the best picks of the best money managers can outpace the market by a healthy amount (see the details here).

Let’s take a look at the key hedge fund action encompassing Yum China Holdings, Inc. (NYSE:YUMC).

How have hedgies been trading Yum China Holdings, Inc. (NYSE:YUMC)?

At the end of the first quarter, a total of 30 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 15% from the fourth quarter of 2018. The graph below displays the number of hedge funds with bullish position in YUMC over the last 15 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Renaissance Technologies held the most valuable stake in Yum China Holdings, Inc. (NYSE:YUMC), which was worth $99.2 million at the end of the first quarter. On the second spot was Millennium Management which amassed $61.8 million worth of shares. Moreover, D E Shaw, Southeastern Asset Management, and GLG Partners were also bullish on Yum China Holdings, Inc. (NYSE:YUMC), allocating a large percentage of their portfolios to this stock.

Consequently, key hedge funds have jumped into Yum China Holdings, Inc. (NYSE:YUMC) headfirst. Chiron Investment Management, managed by Ryan Caldwell, initiated the most outsized position in Yum China Holdings, Inc. (NYSE:YUMC). Chiron Investment Management had $12.8 million invested in the company at the end of the quarter. Run Ye, Junji Takegami and Hoyon Hwang’s Tiger Pacific Capital also made a $9.8 million investment in the stock during the quarter. The other funds with new positions in the stock are Manoj JaináandáSohit Khurana’s Maso Capital, Brett Barakett’s Tremblant Capital, and Ronald Hua’s Qtron Investments.

Let’s check out hedge fund activity in other stocks similar to Yum China Holdings, Inc. (NYSE:YUMC). We will take a look at CoStar Group Inc (NASDAQ:CSGP), Franklin Resources, Inc. (NYSE:BEN), Total System Services, Inc. (NYSE:TSS), and CGI Inc. (NYSE:GIB). This group of stocks’ market values resemble YUMC’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CSGP | 32 | 993601 | 9 |

| BEN | 28 | 819583 | 0 |

| TSS | 40 | 1151114 | 5 |

| GIB | 18 | 340331 | 1 |

| Average | 29.5 | 826157 | 3.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.5 hedge funds with bullish positions and the average amount invested in these stocks was $826 million. That figure was $479 million in YUMC’s case. Total System Services, Inc. (NYSE:TSS) is the most popular stock in this table. On the other hand CGI Inc. (NYSE:GIB) is the least popular one with only 18 bullish hedge fund positions. Yum China Holdings, Inc. (NYSE:YUMC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately YUMC wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on YUMC were disappointed as the stock returned -12.2% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.