Hedge funds and other investment firms that we track manage billions of dollars of their wealthy clients’ money, and needless to say, they are painstakingly thorough when analyzing where to invest this money, as their own wealth also depends on it. Regardless of the various methods used by elite investors like David Tepper and David Abrams, the resources they expend are second-to-none. This is especially valuable when it comes to small-cap stocks, which is where they generate their strongest outperformance, as their resources give them a huge edge when it comes to studying these stocks compared to the average investor, which is why we intently follow their activity in the small-cap space.

Is Westlake Chemical Corporation (NYSE:WLK) undervalued? Investors who are in the know are betting on the stock. The number of long hedge fund positions inched up by 2 recently. Our calculations also showed that WLK isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a peek at the latest hedge fund action regarding Westlake Chemical Corporation (NYSE:WLK).

What have hedge funds been doing with Westlake Chemical Corporation (NYSE:WLK)?

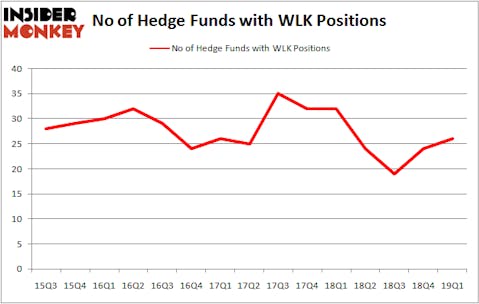

At Q1’s end, a total of 26 of the hedge funds tracked by Insider Monkey were long this stock, a change of 8% from the previous quarter. By comparison, 32 hedge funds held shares or bullish call options in WLK a year ago. With hedge funds’ sentiment swirling, there exists a few key hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

The largest stake in Westlake Chemical Corporation (NYSE:WLK) was held by Millennium Management, which reported holding $73.1 million worth of stock at the end of March. It was followed by Holocene Advisors with a $59 million position. Other investors bullish on the company included Citadel Investment Group, AQR Capital Management, and Point72 Asset Management.

As industrywide interest jumped, key money managers were breaking ground themselves. Holocene Advisors, managed by Brandon Haley, assembled the biggest position in Westlake Chemical Corporation (NYSE:WLK). Holocene Advisors had $59 million invested in the company at the end of the quarter. Steve Cohen’s Point72 Asset Management also made a $29.8 million investment in the stock during the quarter. The other funds with new positions in the stock are Zach Schreiber’s Point State Capital, Nick Niell’s Arrowgrass Capital Partners, and Ray Dalio’s Bridgewater Associates.

Let’s go over hedge fund activity in other stocks similar to Westlake Chemical Corporation (NYSE:WLK). We will take a look at Cognex Corporation (NASDAQ:CGNX), Snap-on Incorporated (NYSE:SNA), Albemarle Corporation (NYSE:ALB), and Grupo Aval Acciones y Valores S.A. (NYSE:AVAL). This group of stocks’ market valuations are closest to WLK’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CGNX | 13 | 230572 | 0 |

| SNA | 25 | 498590 | 0 |

| ALB | 25 | 186420 | -3 |

| AVAL | 8 | 15040 | -1 |

| Average | 17.75 | 232656 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.75 hedge funds with bullish positions and the average amount invested in these stocks was $233 million. That figure was $365 million in WLK’s case. Snap-on Incorporated (NYSE:SNA) is the most popular stock in this table. On the other hand Grupo Aval Acciones y Valores S.A. (NYSE:AVAL) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Westlake Chemical Corporation (NYSE:WLK) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately WLK wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on WLK were disappointed as the stock returned -12.8% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.