Hedge funds and other investment firms that we track manage billions of dollars of their wealthy clients’ money, and needless to say, they are painstakingly thorough when analyzing where to invest this money, as their own wealth also depends on it. Regardless of the various methods used by elite investors like David Tepper and David Abrams, the resources they expend are second-to-none. This is especially valuable when it comes to small-cap stocks, which is where they generate their strongest outperformance, as their resources give them a huge edge when it comes to studying these stocks compared to the average investor, which is why we intently follow their activity in the small-cap space.

Is West Pharmaceutical Services Inc. (NYSE:WST) a bargain? Prominent investors are becoming hopeful. The number of long hedge fund positions went up by 1 lately. Our calculations also showed that WST isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a look at the latest hedge fund action surrounding West Pharmaceutical Services Inc. (NYSE:WST).

What does the smart money think about West Pharmaceutical Services Inc. (NYSE:WST)?

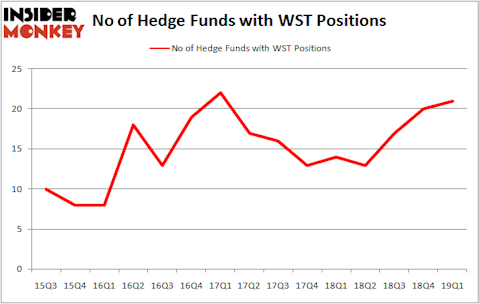

Heading into the second quarter of 2019, a total of 21 of the hedge funds tracked by Insider Monkey were long this stock, a change of 5% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards WST over the last 15 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Fisher Asset Management, managed by Ken Fisher, holds the most valuable position in West Pharmaceutical Services Inc. (NYSE:WST). Fisher Asset Management has a $90.7 million position in the stock, comprising 0.1% of its 13F portfolio. The second most bullish fund manager is Renaissance Technologies, led by Jim Simons, holding a $46.4 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Other hedge funds and institutional investors with similar optimism comprise Israel Englander’s Millennium Management, Barry Dargan’s Intermede Investment Partners and Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management.

With a general bullishness amongst the heavyweights, key money managers have been driving this bullishness. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, assembled the most outsized position in West Pharmaceutical Services Inc. (NYSE:WST). Marshall Wace LLP had $8.8 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also made a $8.7 million investment in the stock during the quarter. The other funds with brand new WST positions are D. E. Shaw’s D E Shaw, Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital, and Jeffrey Talpins’s Element Capital Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as West Pharmaceutical Services Inc. (NYSE:WST) but similarly valued. These stocks are Vereit Inc (NYSE:VER), Herbalife Nutrition Ltd. (NYSE:HLF), SAGE Therapeutics Inc (NASDAQ:SAGE), and Formula One Group (NASDAQ:FWONK). All of these stocks’ market caps match WST’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VER | 21 | 403492 | 3 |

| HLF | 32 | 3529120 | 3 |

| SAGE | 28 | 552183 | -1 |

| FWONK | 35 | 1781125 | 0 |

| Average | 29 | 1566480 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29 hedge funds with bullish positions and the average amount invested in these stocks was $1566 million. That figure was $290 million in WST’s case. Formula One Group (NASDAQ:FWONK) is the most popular stock in this table. On the other hand Vereit Inc (NYSE:VER) is the least popular one with only 21 bullish hedge fund positions. Compared to these stocks West Pharmaceutical Services Inc. (NYSE:WST) is even less popular than VER. Hedge funds clearly dropped the ball on WST as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on WST as the stock returned 5.3% during the same period and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.