“October lived up to its scary reputation—the S&P 500 falling in the month by the largest amount in the last 40 years, the only worse Octobers being ’08 and the Crash of ’87. For perspective, there have been only 5 occasions in those 40 years when the S&P 500 declined by greater than 20% from peak to trough. Other than the ’87 Crash, all were during recessions. There were 17 other instances, over the same time frame, when the market fell by over 10% but less than 20%. Furthermore, this is the 18th correction of 5% or more since the current bull market started in March ’09. Corrections are the norm. They can be healthy as they often undo market complacency—overbought levels—potentially allowing the market to base and move even higher.” This is how Trapeze Asset Management summarized the recent market moves in its investor letter. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards one of the stocks hedge funds invest in.

Urstadt Biddle Properties Inc (NYSE:UBA) has experienced a decrease in activity from the world’s largest hedge funds in recent months. Our calculations also showed that UBA isn’t among the 30 most popular stocks among hedge funds.

According to most investors, hedge funds are assumed to be slow, outdated investment tools of years past. While there are more than 8000 funds trading at present, We look at the moguls of this group, about 750 funds. These money managers orchestrate most of all hedge funds’ total asset base, and by keeping track of their inimitable stock picks, Insider Monkey has spotted various investment strategies that have historically outperformed the S&P 500 index. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by nearly 5 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s check out the key hedge fund action regarding Urstadt Biddle Properties Inc (NYSE:UBA).

What have hedge funds been doing with Urstadt Biddle Properties Inc (NYSE:UBA)?

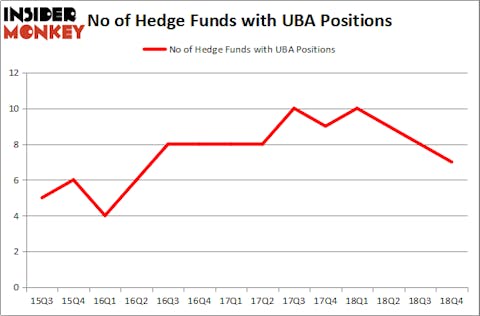

At Q4’s end, a total of 7 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -13% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards UBA over the last 14 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were adding to their holdings significantly (or already accumulated large positions).

The largest stake in Urstadt Biddle Properties Inc (NYSE:UBA) was held by Renaissance Technologies, which reported holding $19.9 million worth of stock at the end of December. It was followed by AQR Capital Management with a $2.1 million position. Other investors bullish on the company included Two Sigma Advisors, Millennium Management, and Algert Coldiron Investors.

Seeing as Urstadt Biddle Properties Inc (NYSE:UBA) has experienced bearish sentiment from the smart money, it’s easy to see that there lies a certain “tier” of funds that elected to cut their positions entirely heading into Q3. Intriguingly, Ken Griffin’s Citadel Investment Group sold off the largest investment of the “upper crust” of funds followed by Insider Monkey, valued at an estimated $0.3 million in stock, and J. Alan Reid, Jr.’s Forward Management was right behind this move, as the fund cut about $0 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest was cut by 1 funds heading into Q3.

Let’s go over hedge fund activity in other stocks similar to Urstadt Biddle Properties Inc (NYSE:UBA). These stocks are Extraction Oil & Gas, Inc. (NASDAQ:XOG), NV5 Holdings Inc (NASDAQ:NVEE), Irsa Inversiones y Rprsntcins SA (NYSE:IRS), and Rite Aid Corporation (NYSE:RAD). All of these stocks’ market caps match UBA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| XOG | 22 | 121852 | 2 |

| NVEE | 13 | 34100 | 0 |

| IRS | 7 | 59154 | -3 |

| RAD | 13 | 32565 | -5 |

| Average | 13.75 | 61918 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.75 hedge funds with bullish positions and the average amount invested in these stocks was $62 million. That figure was $26 million in UBA’s case. Extraction Oil & Gas, Inc. (NASDAQ:XOG) is the most popular stock in this table. On the other hand Irsa Inversiones y Rprsntcins SA (NYSE:IRS) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Urstadt Biddle Properties Inc (NYSE:UBA) is even less popular than IRS. Hedge funds dodged a bullet by taking a bearish stance towards UBA. Our calculations showed that the top 15 most popular hedge fund stocks returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately UBA wasn’t nearly as popular as these 15 stock (hedge fund sentiment was very bearish); UBA investors were disappointed as the stock returned 12.1% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.