Is The Children’s Place Inc. (NASDAQ:PLCE) a good equity to bet on right now? We like to check what the smart money thinks first before doing extensive research. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to predict the winners in the stock market.

Is The Children’s Place Inc. (NASDAQ:PLCE) a good stock to buy now? Hedge funds are taking a bullish view. The number of bullish hedge fund bets increased by 3 in recent months. Our calculations also showed that PLCE isn’t among the 30 most popular stocks among hedge funds.

At the moment there are a multitude of metrics stock market investors employ to evaluate stocks. Some of the best metrics are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the top picks of the top investment managers can trounce their index-focused peers by a solid amount (see the details here).

We’re going to analyze the fresh hedge fund action surrounding The Children’s Place Inc. (NASDAQ:PLCE).

How have hedgies been trading The Children’s Place Inc. (NASDAQ:PLCE)?

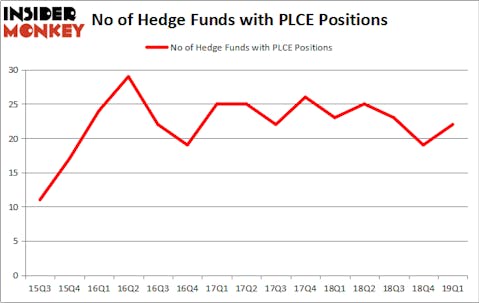

At Q1’s end, a total of 22 of the hedge funds tracked by Insider Monkey were long this stock, a change of 16% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards PLCE over the last 15 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

The largest stake in The Children’s Place Inc. (NASDAQ:PLCE) was held by Royce & Associates, which reported holding $60.8 million worth of stock at the end of March. It was followed by Greenvale Capital with a $36.5 million position. Other investors bullish on the company included Daruma Asset Management, Renaissance Technologies, and Buckingham Capital Management.

Consequently, specific money managers were breaking ground themselves. Greenvale Capital, managed by Bruce Emery, assembled the most valuable position in The Children’s Place Inc. (NASDAQ:PLCE). Greenvale Capital had $36.5 million invested in the company at the end of the quarter. Mariko Gordon’s Daruma Asset Management also initiated a $28.7 million position during the quarter. The following funds were also among the new PLCE investors: Dmitry Balyasny’s Balyasny Asset Management, Alexander Mitchell’s Scopus Asset Management, and Peter S. Park’s Park West Asset Management.

Let’s go over hedge fund activity in other stocks similar to The Children’s Place Inc. (NASDAQ:PLCE). We will take a look at Sirius International Insurance Group, Ltd. (NASDAQ:SG), Rush Enterprises, Inc. (NASDAQ:RUSHA), Big Lots, Inc. (NYSE:BIG), and Mobile Mini Inc (NASDAQ:MINI). This group of stocks’ market values match PLCE’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SG | 1 | 3942 | 0 |

| RUSHA | 19 | 102027 | -2 |

| BIG | 20 | 179321 | 1 |

| MINI | 14 | 96722 | -1 |

| Average | 13.5 | 95503 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.5 hedge funds with bullish positions and the average amount invested in these stocks was $96 million. That figure was $255 million in PLCE’s case. Big Lots, Inc. (NYSE:BIG) is the most popular stock in this table. On the other hand Sirius International Insurance Group, Ltd. (NASDAQ:SG) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks The Children’s Place Inc. (NASDAQ:PLCE) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately PLCE wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on PLCE were disappointed as the stock returned -6.7% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.