With the first-quarter round of 13F filings behind us it is time to take a look at the stocks in which some of the best money managers in the world preferred to invest or sell heading into the first quarter. One of these stocks was Telefonaktiebolaget LM Ericsson (publ) (NASDAQ:ERIC).

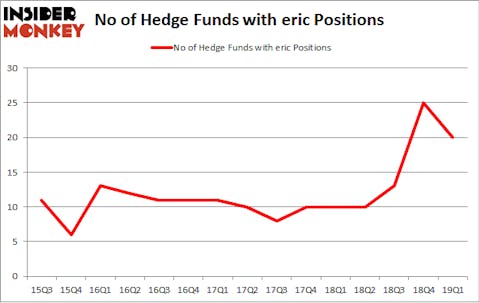

Is Telefonaktiebolaget LM Ericsson (publ) (NASDAQ:ERIC) worth your attention right now? The best stock pickers are getting less optimistic. The number of bullish hedge fund positions were trimmed by 5 recently. Our calculations also showed that eric isn’t among the 30 most popular stocks among hedge funds.

To most traders, hedge funds are perceived as worthless, old investment tools of the past. While there are more than 8000 funds in operation at the moment, Our researchers look at the top tier of this group, about 750 funds. Most estimates calculate that this group of people orchestrate bulk of all hedge funds’ total capital, and by following their first-class equity investments, Insider Monkey has figured out numerous investment strategies that have historically exceeded the broader indices. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by around 5 percentage points per year since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

We’re going to analyze the fresh hedge fund action encompassing Telefonaktiebolaget LM Ericsson (publ) (NASDAQ:ERIC).

How are hedge funds trading Telefonaktiebolaget LM Ericsson (publ) (NASDAQ:ERIC)?

Heading into the second quarter of 2019, a total of 20 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -20% from one quarter earlier. On the other hand, there were a total of 10 hedge funds with a bullish position in ERIC a year ago. With hedgies’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

More specifically, Renaissance Technologies was the largest shareholder of Telefonaktiebolaget LM Ericsson (publ) (NASDAQ:ERIC), with a stake worth $193.7 million reported as of the end of March. Trailing Renaissance Technologies was Arrowstreet Capital, which amassed a stake valued at $104.8 million. Cavalry Asset Management, 13D Management, and Masters Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Since Telefonaktiebolaget LM Ericsson (publ) (NASDAQ:ERIC) has witnessed falling interest from the aggregate hedge fund industry, logic holds that there was a specific group of hedge funds that decided to sell off their entire stakes heading into Q3. Intriguingly, Larry Chen and Terry Zhang’s Tairen Capital said goodbye to the biggest stake of all the hedgies watched by Insider Monkey, totaling about $22.6 million in stock, and Mark Moore’s ThornTree Capital Partners was right behind this move, as the fund said goodbye to about $10.7 million worth. These bearish behaviors are interesting, as aggregate hedge fund interest fell by 5 funds heading into Q3.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Telefonaktiebolaget LM Ericsson (publ) (NASDAQ:ERIC) but similarly valued. These stocks are Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN), Public Service Enterprise Group Incorporated (NYSE:PEG), HP Inc. (NYSE:HPQ), and Credit Suisse Group AG (NYSE:CS). This group of stocks’ market valuations match ERIC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ALXN | 35 | 2311990 | -6 |

| PEG | 28 | 1019022 | -2 |

| HPQ | 35 | 868419 | -5 |

| CS | 14 | 194661 | 0 |

| Average | 28 | 1098523 | -3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28 hedge funds with bullish positions and the average amount invested in these stocks was $1099 million. That figure was $425 million in ERIC’s case. Alexion Pharmaceuticals, Inc. (NASDAQ:ALXN) is the most popular stock in this table. On the other hand Credit Suisse Group AG (NYSE:CS) is the least popular one with only 14 bullish hedge fund positions. Telefonaktiebolaget LM Ericsson (publ) (NASDAQ:ERIC) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on ERIC as the stock returned 5.4% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.