Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips or bumps on the charts, usually don’t make them change their opinion towards a company. This time it may be different. During the fourth quarter of 2018 we observed increased volatility and small-cap stocks underperformed the market. Things completely reversed during the first quarter. Hedge fund investor letters indicated that they are cutting their overall exposure, closing out some position and doubling down on others. Let’s take a look at the hedge fund sentiment towards Synchrony Financial (NYSE:SYF) to find out whether it was one of their high conviction long-term ideas.

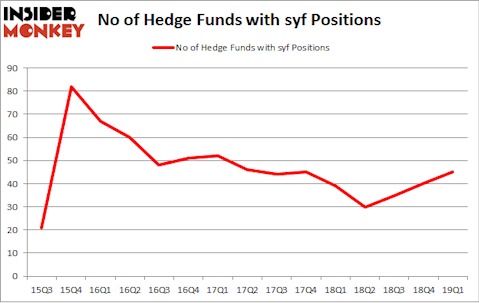

Synchrony Financial (NYSE:SYF) has experienced an increase in hedge fund sentiment recently. Our calculations also showed that syf isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a look at the new hedge fund action encompassing Synchrony Financial (NYSE:SYF).

How are hedge funds trading Synchrony Financial (NYSE:SYF)?

Heading into the second quarter of 2019, a total of 45 of the hedge funds tracked by Insider Monkey were long this stock, a change of 13% from one quarter earlier. On the other hand, there were a total of 39 hedge funds with a bullish position in SYF a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Berkshire Hathaway was the largest shareholder of Synchrony Financial (NYSE:SYF), with a stake worth $663.6 million reported as of the end of March. Trailing Berkshire Hathaway was Baupost Group, which amassed a stake valued at $454.9 million. AQR Capital Management, Southpoint Capital Advisors, and Citadel Investment Group were also very fond of the stock, giving the stock large weights in their portfolios.

As industrywide interest jumped, specific money managers were leading the bulls’ herd. Southpoint Capital Advisors, managed by John Smith Clark, initiated the most valuable position in Synchrony Financial (NYSE:SYF). Southpoint Capital Advisors had $158 million invested in the company at the end of the quarter. Louis Bacon’s Moore Global Investments also initiated a $55.8 million position during the quarter. The other funds with new positions in the stock are Robert Pohly’s Samlyn Capital, Bain Capital’s Brookside Capital, and Principal Global Investors’s Columbus Circle Investors.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Synchrony Financial (NYSE:SYF) but similarly valued. We will take a look at Fox Corporation (NASDAQ:FOXA), Fox Corporation (NASDAQ:FOX), Eversource Energy (NYSE:ES), and SBA Communications Corporation (NASDAQ:SBAC). All of these stocks’ market caps resemble SYF’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FOXA | 71 | 4255471 | 1 |

| FOX | 40 | 1343889 | -4 |

| ES | 16 | 403030 | -4 |

| SBAC | 29 | 1658761 | -3 |

| Average | 39 | 1915288 | -2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 39 hedge funds with bullish positions and the average amount invested in these stocks was $1915 million. That figure was $2702 million in SYF’s case. Fox Corporation (NASDAQ:FOXA) is the most popular stock in this table. On the other hand Eversource Energy (NYSE:ES) is the least popular one with only 16 bullish hedge fund positions. Synchrony Financial (NYSE:SYF) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on SYF as the stock returned 8% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.