The government requires hedge funds and wealthy investors that crossed the $100 million equity holdings threshold are required to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on March 31. We at Insider Monkey have made an extensive database of nearly 750 of those elite funds and famous investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Starwood Property Trust, Inc. (NYSE:STWD) based on those filings.

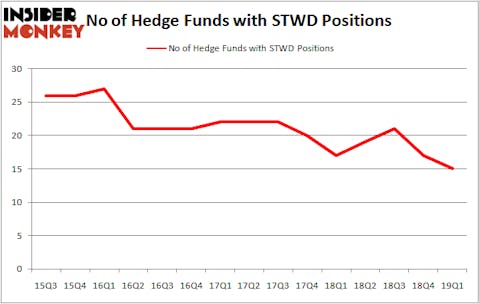

Starwood Property Trust, Inc. (NYSE:STWD) shareholders have witnessed a decrease in support from the world’s most elite money managers lately. STWD was in 15 hedge funds’ portfolios at the end of March. There were 17 hedge funds in our database with STWD positions at the end of the previous quarter. Our calculations also showed that STWD isn’t among the 30 most popular stocks among hedge funds.

In the eyes of most shareholders, hedge funds are perceived as worthless, outdated financial tools of the past. While there are over 8000 funds trading today, Our researchers choose to focus on the masters of this club, approximately 750 funds. These investment experts manage most of all hedge funds’ total capital, and by tracking their first-class stock picks, Insider Monkey has formulated numerous investment strategies that have historically outrun the S&P 500 index. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by around 5 percentage points annually since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

Let’s check out the fresh hedge fund action surrounding Starwood Property Trust, Inc. (NYSE:STWD).

What have hedge funds been doing with Starwood Property Trust, Inc. (NYSE:STWD)?

At Q1’s end, a total of 15 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -12% from one quarter earlier. By comparison, 17 hedge funds held shares or bullish call options in STWD a year ago. With the smart money’s sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

Among these funds, Cardinal Capital held the most valuable stake in Starwood Property Trust, Inc. (NYSE:STWD), which was worth $38.1 million at the end of the first quarter. On the second spot was Clough Capital Partners which amassed $35.9 million worth of shares. Moreover, Two Sigma Advisors, Cobalt Capital Management, and Waterfront Capital Partners were also bullish on Starwood Property Trust, Inc. (NYSE:STWD), allocating a large percentage of their portfolios to this stock.

Judging by the fact that Starwood Property Trust, Inc. (NYSE:STWD) has witnessed bearish sentiment from the smart money, logic holds that there was a specific group of hedge funds that slashed their positions entirely last quarter. It’s worth mentioning that Matthew Drapkin and Steven R. Becker’s Becker Drapkin Management sold off the largest position of the 700 funds monitored by Insider Monkey, comprising an estimated $2.6 million in stock, and Ray Dalio’s Bridgewater Associates was right behind this move, as the fund said goodbye to about $2.1 million worth. These transactions are interesting, as total hedge fund interest fell by 2 funds last quarter.

Let’s go over hedge fund activity in other stocks similar to Starwood Property Trust, Inc. (NYSE:STWD). We will take a look at New Residential Investment Corp (NYSE:NRZ), EnLink Midstream LLC (NYSE:ENLC), The Carlyle Group LP (NASDAQ:CG), and People’s United Financial, Inc. (NASDAQ:PBCT). This group of stocks’ market values are similar to STWD’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NRZ | 18 | 187262 | -7 |

| ENLC | 10 | 39338 | -5 |

| CG | 7 | 122872 | -3 |

| PBCT | 20 | 176840 | -2 |

| Average | 13.75 | 131578 | -4.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.75 hedge funds with bullish positions and the average amount invested in these stocks was $132 million. That figure was $144 million in STWD’s case. People’s United Financial, Inc. (NASDAQ:PBCT) is the most popular stock in this table. On the other hand The Carlyle Group LP (NASDAQ:CG) is the least popular one with only 7 bullish hedge fund positions. Starwood Property Trust, Inc. (NYSE:STWD) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately STWD wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on STWD were disappointed as the stock returned 3.4% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.