We can judge whether Spotify Technology S.A. (NYSE:SPOT) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, our research shows that these picks historically outperformed the market when we factor in known risk factors.

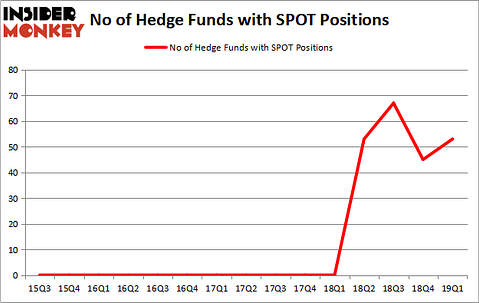

Is Spotify Technology S.A. (NYSE:SPOT) a first-rate investment today? The best stock pickers are getting more optimistic. The number of bullish hedge fund bets increased by 8 in recent months. Our calculations also showed that SPOT isn’t among the 30 most popular stocks among hedge funds.

At the moment there are plenty of signals stock traders can use to analyze publicly traded companies. Some of the most under-the-radar signals are hedge fund and insider trading indicators. We have shown that, historically, those who follow the best picks of the best investment managers can outpace the market by a solid amount (see the details here).

We’re going to review the key hedge fund action regarding Spotify Technology S.A. (NYSE:SPOT).

How are hedge funds trading Spotify Technology S.A. (NYSE:SPOT)?

At Q1’s end, a total of 53 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 18% from one quarter earlier. On the other hand, there were a total of 0 hedge funds with a bullish position in SPOT a year ago. With hedge funds’ capital changing hands, there exists a select group of key hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

More specifically, Tiger Global Management was the largest shareholder of Spotify Technology S.A. (NYSE:SPOT), with a stake worth $1138.6 million reported as of the end of March. Trailing Tiger Global Management was Steadfast Capital Management, which amassed a stake valued at $201.6 million. Cadian Capital, Tremblant Capital, and Honeycomb Asset Management were also very fond of the stock, giving the stock large weights in their portfolios.

Consequently, some big names were breaking ground themselves. Hitchwood Capital Management, managed by James Crichton, created the largest position in Spotify Technology S.A. (NYSE:SPOT). Hitchwood Capital Management had $43.7 million invested in the company at the end of the quarter. Zach Schreiber’s Point State Capital also initiated a $43.5 million position during the quarter. The other funds with new positions in the stock are Amish Mehta’s SQN Investors, Robert Karr’s Joho Capital, and Phill Gross and Robert Atchinson’s Adage Capital Management.

Let’s now take a look at hedge fund activity in other stocks similar to Spotify Technology S.A. (NYSE:SPOT). We will take a look at CRH PLC (NYSE:CRH), Dollar Tree, Inc. (NASDAQ:DLTR), Brown-Forman Corporation (NYSE:BF), and WEC Energy Group, Inc. (NYSE:WEC). This group of stocks’ market valuations are similar to SPOT’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CRH | 5 | 60693 | -3 |

| DLTR | 48 | 2546741 | -5 |

| BF | 24 | 646634 | 3 |

| WEC | 15 | 437674 | 2 |

| Average | 23 | 922936 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $923 million. That figure was $2210 million in SPOT’s case. Dollar Tree, Inc. (NASDAQ:DLTR) is the most popular stock in this table. On the other hand CRH PLC (NYSE:CRH) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks Spotify Technology S.A. (NYSE:SPOT) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately SPOT wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on SPOT were disappointed as the stock returned -8.1% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market in Q2.

Disclosure: None. This article was originally published at Insider Monkey.