Before putting in our own effort and resources into finding a good investment, we can quickly utilize hedge fund expertise to give us a quick glimpse of whether that stock could make for a good addition to our portfolios. The odds are not exactly stacked in investors’ favor when it comes to beating the market, as evidenced by the fact that less than 49% of the stocks in the S&P 500 did so during the second quarter. The stats were even worse in recent years when most of the advances in the market were due to large gains by FAANG stocks. However, one bright side for individual investors was the strong performance of hedge funds’ top consensus picks. This year hedge funds’ top 20 stock picks outperformed the S&P 500 Index by 6.6 percentage points through May 30th. Thus, we can see that the tireless research and efforts of hedge funds to identify winning stocks can work to our advantage when we know how to use the data. While not all of their picks will be winners, our odds are much better following their best stock picks than trying to go it alone.

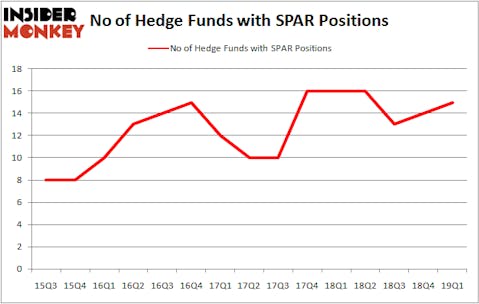

Is Spartan Motors Inc (NASDAQ:SPAR) ready to rally soon? Investors who are in the know are taking a bullish view. The number of long hedge fund bets inched up by 1 in recent months. Our calculations also showed that SPAR isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are many indicators stock market investors have at their disposal to evaluate publicly traded companies. Some of the less utilized indicators are hedge fund and insider trading activity. We have shown that, historically, those who follow the top picks of the elite hedge fund managers can outpace the market by a solid margin (see the details here).

We’re going to check out the latest hedge fund action regarding Spartan Motors Inc (NASDAQ:SPAR).

How have hedgies been trading Spartan Motors Inc (NASDAQ:SPAR)?

At Q1’s end, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a change of 7% from one quarter earlier. On the other hand, there were a total of 16 hedge funds with a bullish position in SPAR a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Spartan Motors Inc (NASDAQ:SPAR) was held by Royce & Associates, which reported holding $11.5 million worth of stock at the end of March. It was followed by D E Shaw with a $5.7 million position. Other investors bullish on the company included Renaissance Technologies, Prescott Group Capital Management, and GAMCO Investors.

Now, specific money managers have been driving this bullishness. Manatuck Hill Partners, managed by Mark Broach, assembled the most outsized position in Spartan Motors Inc (NASDAQ:SPAR). Manatuck Hill Partners had $1 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also made a $0.4 million investment in the stock during the quarter. The other funds with brand new SPAR positions are Roger Ibbotson’s Zebra Capital Management and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s go over hedge fund activity in other stocks similar to Spartan Motors Inc (NASDAQ:SPAR). These stocks are Spark Energy, Inc. (NASDAQ:SPKE), Genco Shipping & Trading Limited (NYSE:GNK), Bel Fuse, Inc. (NASDAQ:BELFB), and Source Capital, Inc. (NYSE:SOR). This group of stocks’ market valuations match SPAR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SPKE | 11 | 15596 | -1 |

| GNK | 12 | 171868 | 0 |

| BELFB | 8 | 23311 | -1 |

| SOR | 2 | 6340 | 0 |

| Average | 8.25 | 54279 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.25 hedge funds with bullish positions and the average amount invested in these stocks was $54 million. That figure was $34 million in SPAR’s case. Genco Shipping & Trading Limited (NYSE:GNK) is the most popular stock in this table. On the other hand Source Capital, Inc. (NYSE:SOR) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Spartan Motors Inc (NASDAQ:SPAR) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on SPAR as the stock returned 13.4% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.